Berkshire Hathaway

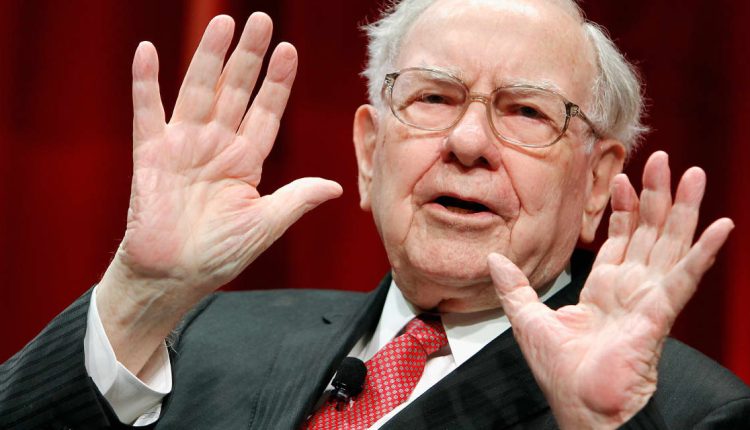

investors will have plenty to digest Saturday when the company releases its fourth-quarter profits, CEO Warren Buffett’s yearly shareholder letter, and its 2023 annual report.

The news will come after a strong start for the year to Berkshire stock. The Class B shares are up more than 14% after hitting several records, including one Tuesday, putting them about 10 percentage points ahead of the

S&P 500

index so far in 2024.

The points of interest are varied, ranging from the format of the 2024 annual meeting to the investment performance of the two men who are expected to run the conglomerate’s vast equity portfolio in the post-Buffett area. Here is a rundown of the key areas.

How the Businesses Are Doing

Investors will be focused on the company’s big property and casualty insurance business, which like the rest of the industry has benefited from higher premiums in auto coverage and other lines of business. Also of interest will be the performance of Berkshire’s vast industrial and housing-related businesses, including the Burlington Northern Santa Fe railroad.

Berkshire likely scored with a big Florida catastrophe insurance policy that it wrote for the 2023 hurricane season. The state had relatively little storm damage, so Berkshire may book as profits much of a premium that Ajit Jain, the head of Berkshire’s insurance business, has put at several billion dollars.

What Comes Next

While Buffett is likely to devote part of the shareholder letter to Charlie Munger, his longtime partner and friend, who died in late 2023 at 99, investors will also be watching for comments on Berkshire stock, financial markets, the economy and any new thoughts on succession and a post-Buffett Berkshire. Berkshire vice chairman Greg Abel, who oversees the company’s noninsurance businesses, has been designated as the likely successor to Buffett, 93.

Todd Combs and Ted Wechsler, who run about 10% of the Berkshire equity portfolio of some $350 billion, are expected to oversee the entire amount, but Buffett has said and written little about them in recent years. One particular area of interest is how they are performing relative to the S&P 500 index.

Many Berkshire holders would like to hear about their investment approach and equity holdings, which are believed to include Berkshire investments

Amazon.com,

Snowflake,

Charter Communications,

Liberty SiriusXM, and

DaVita.

Buffett may also talk about the format for the annual meeting in May. In the past, he and Munger have fielded questions for over five hours. It will be interesting to see if Buffett will continue that marathon and how much he integrates Abel and Jain into the format and whether Weschler and Combs get a billing this year.

Stock Buybacks and Cash

Another point to watch is the pace of Berkshire’s stock repurchases in the fourth quarter and through the first five or six weeks of 2024. Buyback activity slowed in 2022 and the first three quarters of 2023 relative to the heavy pace of 2020 and 2021.

Repurchases totaled just $1.1 billion in the third quarter but picked up somewhat early in the fourth quarter, with an estimated $800 million in the first few weeks of October. Buybacks through the third quarter were about $7 billion. The total for 2023 could be around $10 billion, less than half the $27 billion in 2021.

Investors also will be interested to see whether Berkshire’s cash holdings, which hit a record $157 billion on Sept. 30, further increased in the fourth quarter. That is a possibility given the impact of the company’s earnings and what could have been another quarter of net sales of stocks from the company’s equity portfolio.

The Earnings

Berkshire Hathaway stock has rallied nicely this year with a string of record highs and its investor base is likely hoping that the earnings report and any comments from Buffett in the letter will maintain the momentum. There has been no corporate news to account for the strength in Berkshire stock this year other than healthy results for other P&C insurers like

Chubb.

Apple

stock, the largest Berkshire equity holding, is down so far this year.

Berkshire’s operating earnings are expected to have risen 26% in the fourth quarter to $5,717 per Class A share, according to FactSet. Overall earnings likely will be much higher due to the stock market rally and a surge in Apple shares in the fourth quarter. Apple accounts for nearly half of Berkshire’s equity portfolio.

Berkshire’s Class B stock was up 0.5% Wednesday to $409.25. The A shares gained 0.6% to $617,011.

Details on Deals

Berkshire may also reveal what it paid for the remaining 20% of Pilot Travel Centers after it agreed in January to settle its dispute with the Haslam family, which had sold it 80% of the truck-stop operator in two stages in 2017 and 2023. Barron’s best guess is a price of about $3 billion, in line with the valuation that Berkshire assigned to that stake last year.

Berkshire’s cash-flow statement could give some clue about the size of the “mystery” stock purchase that the company has kept secret in the third and fourth quarters.

Gains at Geico

An investor focus will be the continuing turnaround at Berkshire’s auto insurance unit, Geico. It had a healthy third quarter with underwriting profit of $1 billion after a loss of about $2 billion in 2022.

Geico has raised rates sharply like other auto insurers, with a 17% rise in average premiums in the year ended Sept. 30. Investors will be interested to see whether Geico had another quarter of good underwriting results and whether its policy count has bottomed after a marked decline during 2023. Geico has invested less in technology than Progressive, its archrival.

Book Value

Investors also will want to see the company’s book value, a widely followed metric for valuing Berkshire. Edward Jones analyst Jim Shanahan has estimated year-end book value for 2023 at $388,000 per Class A share.

Barron’s estimates that current book value is slightly higher than that figure because operating earnings have offset what could be a modest decline in the equity portfolio. Berkshire is now trading at the upper end of its price/book ratio history in recent years at 1.6 times estimated year-end 2023 book. The stock generally has traded closer to 1.4 to 1.5 times book. The shares also trade for around 23 times projected 2024 earnings.

Corrections & Amplifications: The Haslam family sold Pilot Travel Centers to Berkshire Hathaway. An earlier version of this article misspelled their name.

Write to Andrew Bary at [email protected]

Read the full article here