ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis TradingLounge (1D Chart).

Greetings,

Today’s Elliott Wave analysis provides an update on the Australian Stock Exchange (ASX) SOUTH32 LIMITED – S32. We observe S32 continuing to decline within the (Y)-orange wave.

ASX: SOUTH32 LIMITED – S32 Elliott Wave technical analysis

ASX: SOUTH32 LIMITED – S32 1D Chart (Semilog Scale) Analysis.

-

Function: Major trend (Minor degree, grey).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave ((v))-navy of Wave A-grey.

-

Details: The ((v))-navy wave seems to be pushing lower. However, if the price rises above 3.17, it would signal that the ((v))-navy wave concluded earlier than anticipated, completing the five-wave sequence (Wave A-grey). At that point, a larger corrective wave (Wave B-grey) would unfold, pushing prices higher.

-

Invalidation point: 3.17.

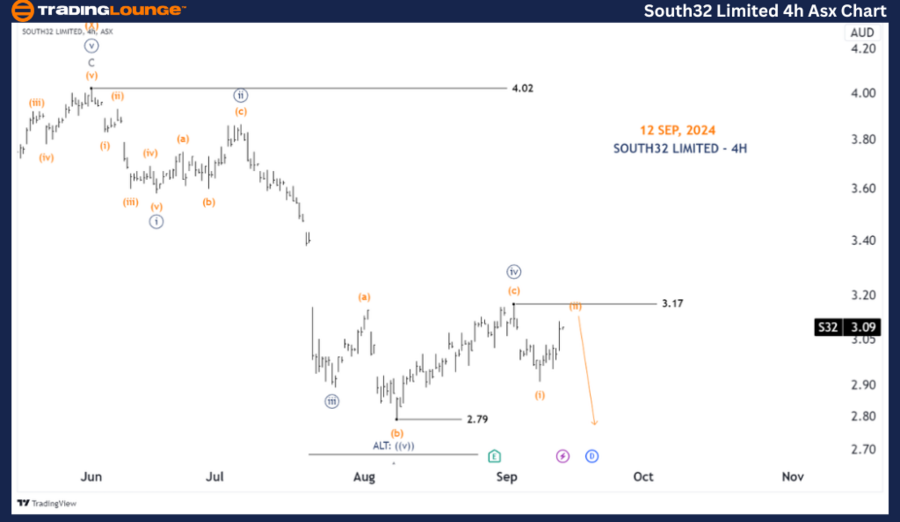

ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: SOUTH32 LIMITED – S32 four-hour chart analysis

-

Function: Major Trend (Minute degree, navy).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave (ii)-orange of Wave ((v))-navy.

-

Details: Wave ((iv))-navy appears to have completed as an Expanded Flat. Now, Wave ((v))-navy seems to be unfolding and pushing lower. However, there is weakness in this count, with recent price action nearing the 3.17 level. Should the price exceed this point, a reassessment of the situation would be necessary.

-

Invalidation point: 3.17.

Conclusion

Our analysis and forecast for ASX: SOUTH32 LIMITED – S32 offer insights into the ongoing market trends, guiding traders on how to capitalize on these movements. We provide clear price points as validation or invalidation signals for our wave counts, strengthening confidence in our analysis. Combining these factors allows us to present an objective and professional perspective on the current market conditions.

Technical analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

ASX: SOUTH32 LIMITED – S32 Elliott Wave technical analysis [Video]

Read the full article here