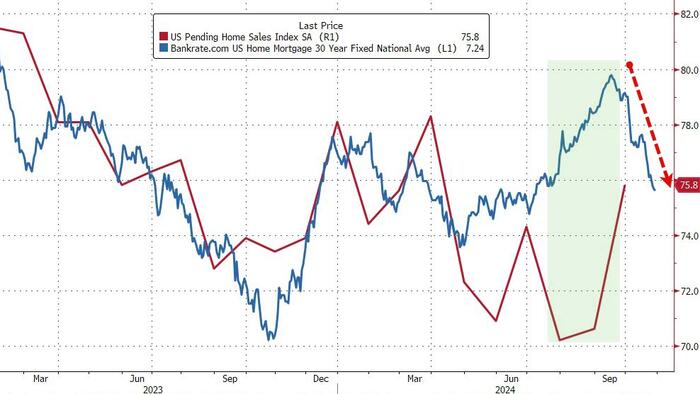

Existing home sales slumped (14 year low), but new home sales surged in September, so today’s Pending Home Sales data is the tiebreaker for just what a shitshow the US housing market is.

And the winner is… Pending home sales surged 7.4% MoM (+1.9% exp) in September – that is the biggest MoM jump since the COVID lockdowns (June 2020)…

Source: Bloomberg

This giant jump sent the YoY sales print up 2.16% YoY – the first annual gain since Nov 2021.

“Contract signings rose across all regions of the country as buyers took advantage of the combination of lower mortgage rates in late summer and more inventory choices,” NAR Chief Economist Lawrence Yun said in a prepared statement.

“Further gains are expected if the economy continues to add jobs, inventory levels grow and mortgage rates hold steady.”

The total pending home sales index rebounded off record lows…

Source: Bloomberg

September saw mortgage rates decline rapidly back below 7.00%, but since then mortgage applications have collapsed as mortgage rates surged back to 7.25% since The Fed cuts rates (that’s not supposed to happen)…

Source: Bloomberg

Pending sales rose in all regions of the US, increasing 9.8% in the West, 7.1% in the Midwest, 6.7% in the South and 6.5% in the Northeast, NAR data show.

Yun expected slower appreciation in home prices to boost sales over the next couple years.

“After two years of sluggish home sales in 2023 and 2024, existing-home sales are forecasted to rise to 4.47 million in 2025 and more than 5 million in 2026,” Yun said in the release.

“During the next two years, expect a slower rate of growth in home prices that’s roughly in line with the consumer price index because of additional supply reaching the market.”

Finally, as a reminder, pending-homes sales tend to be a leading indicator for previously owned homes, because houses typically go under contract a month or two before they’re sold.

Loading…

Read the full article here