Quite a mixed bag this morning…

On the good side, the final (3rd) read for Q3 GDP, US economic growth was revised up to 3.1% QoQ Annualized (from 2.8%)…

…with personal consumption also revised up to +3.7% (better than the 3.6% exp)…

On the not bad side (sorry to break the analogy), jobless claims tumbled back to earth last week – after spiking the prior week…

New York and Texas saw the largest drop in initial jobless claims…

Continuing claims dipped but holds still around the 1.9 million level (three year highs)…

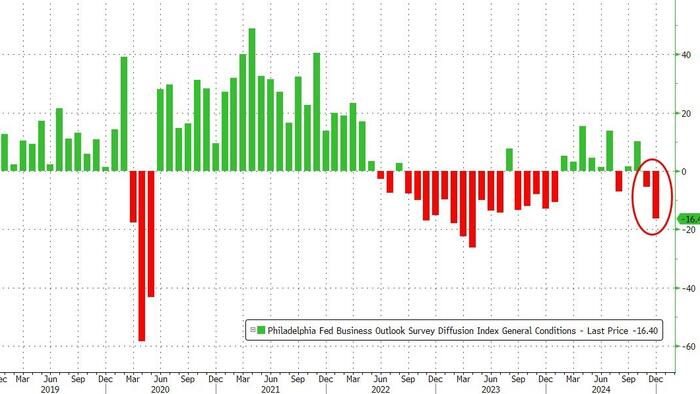

On the bad side, The Philly Fed Manufacturing survey collapsed from -5.5 to -16.4 (dramatically worse than the +2.8 expected and far below even the worst analyst expectation)…

Source: Bloomberg

Future general activity expectations plunged 26 points to 30.7 in December (after jumping higher the previous two months), with future new orders and future shipments indexes both declined

Source: Bloomberg

On the ugly side, Prices Paid are surging while Prices Received are falling… that’s a disaster for corporate margins…

So strong GDP, strong labor force, but manufacturing is shaky….

…what will Powell do next?

Loading…

Read the full article here