Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Healthcare executives, dealmakers and investors will gather in San Francisco this coming week at a tumultuous moment for the industry following the murder of a top executive and Donald Trump’s nomination of a vaccine sceptic as the top US health official.

“We’re entering San Francisco this year with a higher level of uncertainty than we have in the past, largely because some of the policy unknowns,” said John Maraganore, the former chief executive of $30bn biotech Alnylam Pharmaceuticals who now advises boutique bank Jefferies and venture capital firm Arch Venture Partners.

About 8,000 people are expected to attend the JPMorgan healthcare conference in San Francisco’s Union Square. In total more than 60,000 people will travel to the city for the event, which is typically a magnet for biotech deals.

Over the past year, the SPDR S&P Pharmaceuticals ETF, which groups together large-cap pharmaceutical stocks, was flat, while the wider S&P 500 index was up nearly 22 per cent.

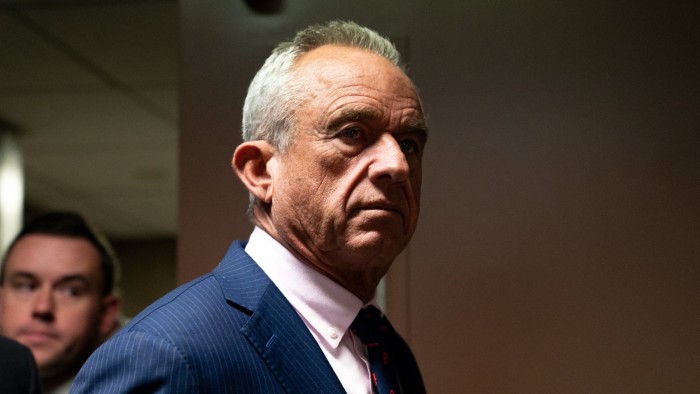

The nomination of Robert F Kennedy Jr, who has spread conspiracy theories about the Covid-19 vaccine and criticised blockbuster weight-loss drugs, to run the health department as well as several of his allies to run its powerful agencies has injected extra uncertainty.

The security presence at the conference has been significantly bolstered following the murder of UnitedHealthcare chief executive Brian Thompson in midtown Manhattan in November in what prosecutors alleged was “an act of terrorism” waged against the healthcare industry by 26-year-old Ivy League graduate Luigi Mangione.

“Everyone’s on higher alert this year, but I’m not going to do anything different than pay more attention to what my security team tells me I can and can’t do,” said Brent Saunders, the chief executive of eyecare company Bausch + Lomb.

Saunders said policy uncertainty had been “like a cold bucket of water on the sector”. But he added that “I’ve lived through several administrative changes as a CEO and you tend to not get too worried about it.”

Several managed care companies will not be in attendance this year, but people close to them stressed that their absence was unrelated to security concerns. UnitedHealth never attends, CVS pulled out after the departure of its chief executive in October and Cigna will also not attend, according to people familiar with the matter.

Local police officers’ leave has been cancelled to ensure the San Francisco Police Department has sufficient resources for the event, according to a person familiar with the plans.

Kosta Kleyman, a healthcare investor at investment manager Columbia Threadneedle, pointed out that the discontent towards health insurers that emerged in the aftermath of Thompson’s killing had created a “negative sentiment” around insurer stocks and a sell-off at the end of last year as investors fretted over policy changes.

Despite the uncertainty, Peter Kolchinsky, managing partner of $10bn biotech venture capital fund RA Capital, said he was bullish about the outlook for the sector. “I think that medicine in America operates with a lot of checks and balances and can handle ideological shifts.”

“All people want medicines that really work,” added Kolchinsky. “For example, outbreaks among the unvaccinated remind the rest of us that life is better with vaccines. Ideology isn’t everything.”

Fred Hassan, the former chief executive of Schering-Plough who now advises private equity group Warburg Pincus, said: “There’s a lot of good science that got started in the 2021-22 period and is struggling to get funded, so hopefully at JPMorgan, we are going to hear some good news about the sector loosening up.”

In a sign that brighter days may be ahead, there were already glimmers of hope over the weekend that big drugmakers were beginning to spend on mergers and acquisitions, either to resolve patent cliffs or to diversify their pipeline. Both GSK and Eli Lilly were in late-stage talks to acquire cancer-focused biotechs, the Financial Times reported, while Biogen made a nearly $500mn unsolicited bid for depression drugmaker Sage Therapeutics.

Read the full article here