In Parting Gift To Trump, Biden Sends Oil Prices Soaring With Russian Sanctions Days Before Inauguration

For the duration of his fake, first and only presidential term, Joe Biden did everything in his power to avoid a rise in oil prices, knowing nothing would seal his fate as America’s worst president than a gas price spike in the twilight days of his life and career. He would court dictators (from a persona non grata, Venezuela’s Nicolas Maduro quietly became one of Biden’s BFFs), he would prevent sanctions against Iran from being fully enforced (allowing China to buy up Iranian oil at pennies on the dollar and keep overall oil prices subdued), and most importantly, he would water down sanctions against Russian oil for the past two years, realizing that crippling Russian oil exports would be a mutually assured destruction move, crushing both Putin and his own administration by sharply reducing oil output and sending oil prices sharply higher, even as it was those oil exports that kept Russia war machine humming and enabling the Kremlin to play cat and mouse with Zelensky, now that the Russian army is in full advance across Ukraine.

But now that Biden is out of the White House (having easily won the “worst US president” designation many times over), the Democrats are in disarray, and the world looking with some semblance of hope toward Trump’s second term, Biden has decided that it is finally time to do the “right thing” and send oil prices surging by announcing the most sweeping and aggressive sanctions yet on Russia’s oil trade, making life for his successor hell as gas prices are about to soar following closely the spike in oil.

Indeed, it was last Friday, with less than 2 weeks to go until Biden is kicked to the curb, when we got the shocking news that the US Treasury would enforce sanctions against Russian oil giants, Surgutneftgas and Gazprom Neft, while also dramatically expanding a highly effective program of targeting individual oil tankers expanding the list to some 270 total tankers sanctioned for carrying Russian oil, listing traders organizing hundreds of illicit shipments, naming pivotal insurance companies, and telling two US oil service providers to exit.

In short, an unprecedented crackdown on Russian oil exports, one which should have taken place the day after the Ukraine war, but didn’t because Biden knew it would send oil prices surging.

US TREASURY SANCTIONS SOME RUSSIA OIL TANKERS

Biden waited until he is out of the White House to finally activate Russia sanctions because surging gas prices are now Trump’s problem

— zerohedge (@zerohedge) January 10, 2025

Biden’s surprise move, could reduce what the International Energy Agency predicts will be a supply surplus of almost 1 million barrels a day this year to zero (between them, Surgutneftgas and Gazprom Neft shipped about 970,000 barrels a day of oil by sea in 2024 and they are main source of commodity product for refiners in China and India) if not push it negative for another year, only this time Cushing is at “tank bottoms” meaning commercial inventory levels are at record low and the US Strategic Petroleum Reserve is… well, everyone knows where that is.

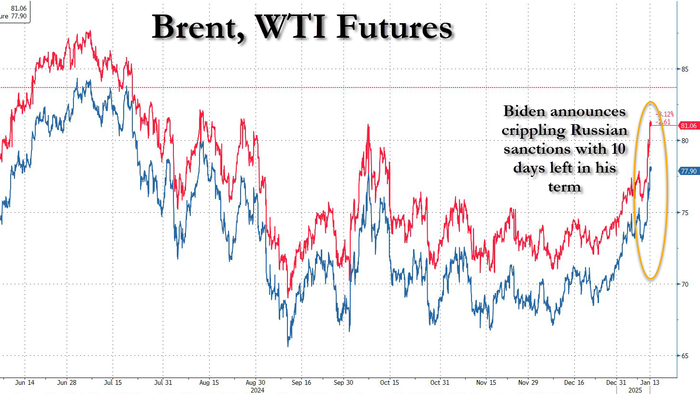

And lo and behold, with everyone on Wall Street beared up on oil to unprecedented levels – not just the cartoonish analysts at Citi who think $0 would be too high a price for a barrel of Brent but literally everyone – oil has surged to a four-month high with Brent oil futures, which ended 2024 below $75 a barrel, rising above $81, and WTI trading at $78, up $10 in a month and the highest price since August.

The news of Biden’s farewell gift to Trump spread like a shockwave around the world, as crude oil futures on the Shanghai International Energy Exchange surged by their daily limit, and helped send India’s rupee to a record low against the dollar.

The Biden sanctions prompted a cascade of frenzied headline reports, such as these…

… which did nothing to ease the market’s sudden panic that everyone – literally everyone – is positioned incorrectly (short) in oil, and as a result of the coming squeeze we may see triple digit oil again. Wall Street analysts, who also had been remarkably bearish on oil, are now scrambling to undo their positioning

But has Biden truly succeeded in laying the biggest Easter Egg possible for Trump? That is the topic of a note published overnight by Goldman’s commodity analyst Daan Struyen titled “Risks from Russia Sanctions” (available to pro subscribers), in which he writes that while the uncertainty from the Russia sanctions is very high, Godlman has not changed its base case for Russia production and oil prices for three reasons:

- First, Russian oil can discount to incentivize continued shipping by a dynamic shadow fleet and continued purchases by price-sensitive buyers.

- Second, Goldman assumes that the incoming US administration will likely want to avoid large and persistent drops in Russian volumes given its goal of lower US energy prices and its commentary signaling a greater focus on reducing oil revenues from Iran than from Russia.

- Third, higher Russian refinery runs and higher refined products exports can help ease constraints on crude oil exports.

That said, Friday’s announcement strengthens Goldman’s view that “the risks to our $70-85 Brent range forecast are skewed to the upside in the short term” and the bank now estimates that Brent could rise just above the top of our range if Russian production briefly falls by 1mb/d and to $90/bbl in a combined scenario where Iran supply also falls 1mb/d but in a persistent way.

Furthermore, Struyven writes that while a close call as sanctions may push up prices significantly further, Goldman is closing its ‘Well-Timed’ trade recommendation (long May-June 2025 vs. short May-June 2026 Brent timespreads) “because it has achieved its goal to capture US policy-driven short-term gains. We recommend oil producers take advantage of the increase in prices and in call skew to hedge downside risks with producer three-ways.”

Across scenarios, the long-term price impact of lower sanctioned supply is limited because Goldman also assumes that OPEC+ would stabilize the market by deploying its high spare capacity and by raising production for longer than in our base case.

Below we excerpt from the Goldman Q&A in the note to clients (the full report is available to professional subscribers in the usual place).

Q1. What drove the oil price rally through Thursday ahead of the latest sanctions announcement?

In addition to algorithmic buying, we think three factors have driven the rally to $77/bbl through Thursday.

- First, cold winter weather is modestly tightening the oil balance and could tighten it further. On the demand side, we estimate a 0.1mb/d boost to global oil heating demand from cold US weather (Exhibit 1, left panel). Cold weather in Europe or Asia can also indirectly and more persistently boost oil demand via gas-to-oil switching by boosting natural gas prices more than oil prices.1 On the supply side, freeze-offs may reduce oil production.

- Second, market perception around the 2025 balance has changed as salient US crude inventories have declined for 7 weeks. Effective OPEC+ market stabilization, and rising compliance drove a 0.6mb/d deficit in 2024Q4, and we continue to disagree with the consensus narrative that a large 2025 surplus is a done deal given the uncertainty around non-OPEC and sanctioned supply.

- Third, the market now appears to price in some premium compensating for the risk of a decline in Iran exports, where we see some signs of early frictions and an increase in the relative price of medium sour barrels (e.g. Dubai) similar to those that Iran produces (Exhibit 1, right panel).

Q2. What sanctions did the US Treasury announce on Friday?

The US imposed its broadest and strictest package of sanctions on Russia oil production and exports yet. The UK joined the US Treasury in sanctioning two Russia oil majors, which together accounted for nearly 1mb/d of oil seaborne exports in 2024. The US has also sanctioned 183 Russian vessels (mostly oil tankers) to increase pressure on Russia’s “shadow fleet”. Following the announcement, the number of Russian oil tankers sanctioned by the US, UK, and EU has doubled to 270 vessels.

We estimate that the vessels targeted by the new sanctions transported 1.7mb/d of crude and products in 2024 or 25% of Russia’s export volumes (Exhibit 3), with the vast majority being crude oil.

The latest measure also targets “opaque traders willing to ship and sell” Russia’s oil and the two largest Russian insurance providers for oil tankers, pushing Russia’s fleet further outside of credible insurance markets. The White House highlighted three key reasons for imposing sanctions only now, 10 days before inauguration: 1) higher spare capacity, 2) forecasts of a 2025 surplus, and 3) currently lower prices.

Q3. Have you changed your oil price forecast?

While the uncertainty is elevated, we have not changed our base case for Russian production (total liquids 2025 average of 10.6mb/d) and oil prices (Brent in the $70-85 range, averaging $76/bbl in 2025) for three reasons.

First, Russian oil can discount to incentivize continued shipping by a dynamic shadow fleet and continued purchases by price-sensitive buyers in new or existing destination countries, with both the ships and buyers being less sensitive to Western sanctions. We recently showed that sanctioned vessels often keep shipping Iranian oil in some capacity, that new entrants tend to join the shadow fleet, and that most Iranian exports head to independent Chinese refiners that are less exposed to sanctions.3 Turning to the price-sensitive buyers, Exhibit 5 shows that India, China, and Turkey became the largest importers of Russian crude since the West imposed sanctions since 2022.

Second, we assume that the incoming US administration will likely want to avoid large and persistent drops in Russian oil volumes given its policy goal of lower US energy prices and commentary from several key incoming energy and foreign policy US officials signaling a greater focus on reducing oil revenues from Iran than from Russia. That said, President-elect Trump may not ease sanctions once he takes office but could tie their removal to the negotiation and/or successful implementation of a potential Ukraine-Russia peace deal. Third, higher Russian refinery runs and higher refined products exports can help ease constraints on crude oil exports.

Q4. How do you now see the risks to your oil forecast?

Friday’s announcement strengthens our view that the risks to our $70-85 Brent range forecast are skewed to the upside in the short term, although we still see the medium-term risks to our range as skewed to the downside given high spare capacity. Exhibit 6 plots Brent oil prices in our base case and in four disruption scenarios. Our base case assumes that OPEC8+ raises production for four months starting in July with a cumulative contribution from reversing the extra voluntary cuts to production of +450kb/d. Across scenarios, the long-term price impact of lower sanctioned supply is limited because we assume that OPEC8+ would stabilize the market by deploying its high spare capacity and by raising production for longer than in our base case. The first scenario (dark blue) assumes that Russian production falls by 1mb/d in February and then recovers in April and May, and that OPEC8+ starts raising production in April, consistent with its data-dependent announcement, but only for four months (as in our base case). In this scenario, we estimate that Brent peaks at $86/bbl in March before gradually normalizing.

In a second scenario (red) where Russia supply falls persistently by 0.5mb/d, reflecting for instance that the Trump administration maintains Russia sanctions during the bargaining and/or the implementation of a potential Ukraine-Russia peace deal, we estimate that Brent rises to $83/bbl by mid-2025. We also assume OPEC8+ production increases in April-December at the announced pace (vs. July-October in our base case). In a third scenario (green) where only Iran supply drops by 1mb/d, reflecting tighter sanctions enforcement in a ‘maximum pressure’ campaign, we estimate that Brent rises to $83/bbl by mid-2025. We assume OPEC8+ production increases in

April-February 2026.

In a fourth combined scenario (grey) where Russian production briefly falls by 1mb/d (as in scenario 1) and Iran supply also falls 1mb/d but in a persistent way (as in scenario 3), we estimate that Brent rises to a peak of $90/bbl in March. We again assume OPEC8+ production increases in April-February 2026.

Q5. What Russia supply risks is the market pricing? Are you changing your recommendations to investors and oil producers?

Brent (1/36m) timespreads strengthened by $3/bbl from Friday’s open to close. Leveraging our pricing model, we estimate this is equivalent to a 0.5mb/d downgrade to Russian supply over the next six months, or a 25pp increase in the chance of a large 2mb/d disruption over this time period. Actual timespreads have now essentially caught up with our fair value estimate (which uses our baseline path for inventories assuming no Russia disruptions), implying a significantly faster closure in the undervaluation gap than we had assumed.

Ultimately, given our assumption that the US administration likely does not want to meaningfully disrupt the oil market, we view this as a significant repricing of supply risks. While a close call, we thus close our ‘Well-Timed’ trade recommendation (long May-June 2025 vs. short May-June 2026 Brent timespreads), which has, in our view, achieved its goal of capturing exposure to US policy-driven short-term gains.

Closing this recommendation is a close call because Russia or Iran sanctions may push up prices significantly further. After all, after Russia’s invasion of Ukraine, prices sharply overshot the impact implied by actual Russia disruptions. Because this rally was large relative to the actual 0.7mb/d peak drop in liquids supply, the Brent 1M/36M timespread remained 10-15pp above its fair value for the rest of 2022, consistent with a persistent risk premium of around $10/bbl

We also reiterate our recommendation that oil producers take advantage of the increase in prices and call skew to hedge downside risks with producer three-ways (e.g. sell 80 WTI call, buy WTI 65/55 put spread).

More in the full Goldman note available to pro subscribers.

Loading…

Read the full article here