Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

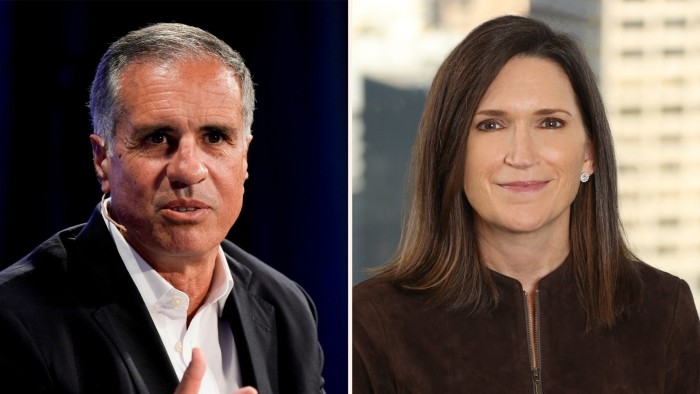

JPMorgan Chase has said Jenn Piepszak will replace Daniel Pinto as chief operating officer but will not seek the job of chief executive, complicating the race to one day succeed Jamie Dimon at the top of the US’s biggest bank.

Pinto, JPMorgan’s president and COO, will relinquish his responsibilities at the end of June and retire by the end of next year, the bank said on Tuesday.

Piepszak was named COO with immediate effect.

The moves come a year after JPMorgan chief executive Jamie Dimon’s previous reshuffle of senior leaders at the bank, which sparked the high-profile departures of several executives close to Pinto.

In a series of moves in January 2024, Piepszak and Troy Rohrbaugh took over responsibility for JPMorgan’s expanded commercial and investment banking division from Pinto, serving as co-heads.

Those changes had prompted speculation that Piepszak was the frontrunner among the contenders to eventually succeed Dimon, one of the most powerful figures on Wall Street.

However, JPMorgan told the Financial Times on Tuesday that Piepszak was not seeking the top job, citing her “preference for a senior operating role working closely with Jamie”.

JPMorgan also elevated Doug Petno on Tuesday to replace Piepszak as co-head of the commercial and investment bank, alongside Rohrbaugh.

The promotion bumps Petno up the list of potential replacements for Dimon, 68. Other contenders are considered to be Rohrbaugh; Marianne Lake, head of JPMorgan’s sprawling consumer bank; and Mary Erdoes, asset and wealth management chief.

Lake and Erdoes will continue in their current roles, the bank said.

Who will succeed Dimon has long been speculated upon, with Pinto himself once considered a candidate for the top job.

While no timeline has been set for Dimon’s departure, the bank in 2021 awarded Dimon a retention bonus that would tie him to the bank until at least the middle of 2026.

Last May, Dimon told investors that the search for his eventual successor was “on the way”, and that the timetable for him to step down as chief executive was less than the five-year period he had previously touted.

Dimon may stay on as chair, however, even after he relinquishes his executive responsibilities.

A senior Wall Street executive said it would be a mistake to view Tuesday’s moves as the elevation of any particular candidate. “Is Jamie clearing the decks to make Marianne the next CEO? I don’t think so. He doesn’t want to leave.”

JPMorgan pointed to Dimon’s comments at investor day that the choice of his successor was “up to the board . . . When I can’t put the jersey on and give it the fullest thing, I should leave, basically.”

The latest reshuffle comes just a day before JPMorgan reports its fourth-quarter earnings.

The bank’s net profits are expected to have risen by almost a third to $11.7bn in the final three months of 2024 from the same period in the previous year.

The figure is forecast to be boosted by strength in investment banking and markets revenues, but also flattered by a big hit in late 2023 when banks had to make payments to the federal deposit insurance fund to cover the costs of that year’s regional bank failures.

Reporting by Peter Wells, Adam Samson, Joshua Franklin and Brooke Masters in New York and Ortenca Aliaj in London

Read the full article here