- The Euro looks markedly offered against the US Dollar.

- Stocks in Europe trade mostly on the defensive on Monday.

- EUR/USD retreats to the 1.0520 zone amidst USD buying.

- The USD Index (DXY) extends the rebound to the 106.50 zone.

- Industrial Production in Germany surprised to the downside.

The Euro (EUR) is displaying signs of renewed weakness against the US Dollar (USD), leading EUR/USD to drop to the 1.0520 zone following three consecutive sessions of gains on Monday.

In contrast, the Greenback is reclaiming ground lost and revisiting the 106.50 region when gauged by the USD Index (DXY) in response to the prevailing risk-off sentiment in the global markets at the beginning of the week.

Regarding monetary policy, investors anticipate that the Federal Reserve (Fed) will maintain its interest rates at their current levels for the remainder of the year. Simultaneously, there is speculation in the market about the possibility of the European Central Bank (ECB) pausing its policy, despite inflation levels surpassing the bank’s target and mounting concerns about the potential for a future recession or stagflation in the European region.

A look at the speculative community notes that speculators trimmed further their EUR net longs positions to levels last seen in late October 2022 in the week to October 3, as per the latest CFTC Positioning report.

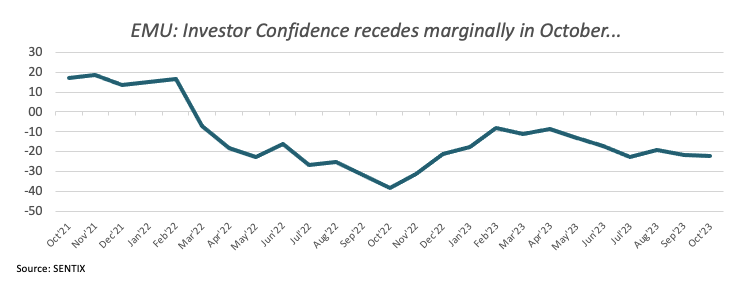

On the domestic calendar, Industrial Production in Germany contracted at a monthly 0.2% in August, while the Investor Confidence eased a tad to -21.9 when tracked by the Sentix Index for the current month.

The US docket will be empty on Columbus Day holiday, while investors’ attention is expected to be on speeches by Dallas Fed President Lorie Logan (voter, hawk), FOMC Governor Michael Barr (permanent voter, centrist) and FOMC Governor Philip Jefferson (permanent voter, centrist).

Daily digest market movers: Euro gives away gains on USD-buying

- The EUR abandons the area of recent peaks against the USD.

- German 10-year bund yields drop to monthly lows.

- Investors see the Fed refraining from moving on rates in the next months.

- Markets believe the ECB will pause its rate hike campaign.

- ECB policy maker Martins Kazaks favoured an impasse at the bank’s hiking cycle.

- German Industrial Production adds to recession fears.

- Speculation on FX intervention in USD/JPY remains firm.

- Oil jumps on Israel-Hamas conflict.

Technical Analysis: Euro faces the next support of note at 1.0448

EUR/USD resumes the downside and corrects lower from peaks around 1.0600.

The continuation of selling pressure on EUR/USD might result in a review of the 2023 low at 1.0448 seen on October 3, with a challenge of the crucial round mark of 1.0400. If this level is breached, it may pave the way for a retest of the lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

If the pair gains momentum, it may aim for the next upward hurdle at 1.0617 from September 29, followed by the important 200-day SMA at 1.0823. If this level is breached, the August 30 high at 1.0945 and the psychological hurdle of 1.1000 may be tested. If the pair breaks beyond the August 10 peak of 1.1064, it might reach the July 27 high of 1.1149 and perhaps the 2023 peak of 1.1275 from July 18.

As long as the EUR/USD remains below the 200-day SMA, additional negative pressure is possible.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany’s economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany’s economy strengthens, it can bolster the Euro’s value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro’s strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact’ following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond’s price, and it is therefore considered a more accurate reflection of return. A decline in the bund’s price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

Read the full article here