Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

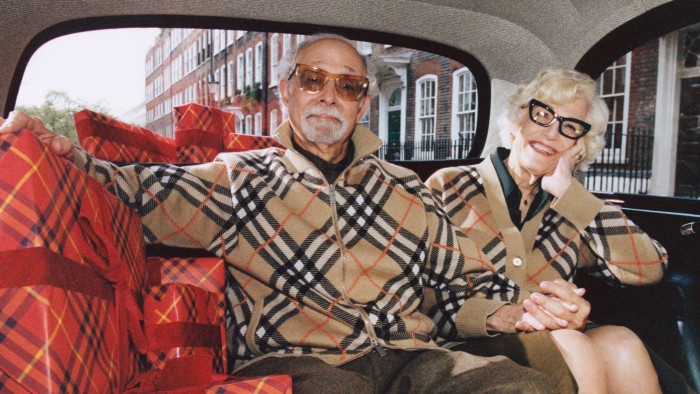

Burberry’s shares jumped as much as 15 per cent on Friday after the British luxury group reported a lower than expected fall in sales over the festive period, boosted by US shoppers splashing out on high-end fashion.

Burberry, which is in the middle of a turnaround, reported on Friday that comparable store sales fell 4 per cent in the 13 weeks to December 28, beating analysts’ expectations of a 12 per cent decline.

Chief executive Joshua Schulman, who is aiming to refocus the brand on classic outerwear products such as its staple trenchcoats and scarves, said: “We recognise that it is still very early in our transformation and there remains much to do.”

Burberry said it was now more likely that it would avoid a full-year operating loss for the 12 months to March.

Sales in the US rose 4 per cent in the third quarter, driven by a strong performance in New York, mirroring a similar pattern at Swiss luxury group Richemont, whose quarterly trading was also boosted by demand in the US.

James Grzinic, an analyst at Jefferies, said Burberry had benefited from an improvement in the wider industry which was being “driven by a pullback in US sales turning into a catch-up post elections”.

But sales in Europe, the Middle East and Africa fell 2 per cent. Revenues in the Asia-Pacific region were 9 per cent lower, dragged down by a 7 per cent decline in mainland China — once a key driver of growth for the luxury sector.

Retail revenue fell to £659mn compared with £706mn in the same quarter in 2023.

Schulman joined Burberry in July to arrest a decline in sales after a botched strategy to move upmarket.

In November he vowed to “act with urgency” to stabilise the brand as it swung to a half-year loss.

He set out a £40mn cost-savings plan and a £3bn annual revenue target, without setting an explicit timeline to achieve the latter goal. He said he wanted Burberry to have a broader range of price points, including lower ones in certain categories such as leather handbags, and to sell more staples such as trenchcoats.

Schulman has insisted, however, that Burberry would continue to be a luxury brand and that he has “no plans to [turn] Burberry into an accessible luxury brand”.

Shares have risen about 20 per cent since he unveiled his strategy, but are still down 8 per cent over 12 months.

Read the full article here