Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

First Brands Group filed for bankruptcy protection in the Southern District of Texas as the minute hand began to near midnight on Sunday evening.

Anyone who has followed mainFT’s coverage over the past month — which began on September 1 with this examination of the group’s more opaque invoice financing — will know that things are about to get messy.

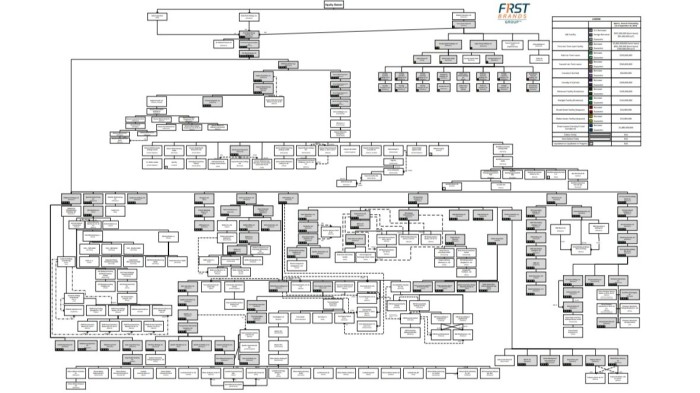

How messy? The baroque org-chart that serves as this piece’s cover image is instructive. As you need a magnifying glass to have a hope of making sense of it, you can access the full petition and zoom in on all the little boxes here.

The petition also breaks down some of First Brands and its wider affiliates’ secured debt in a handy table:

A chunk of this debt relates to the special purpose entities providing inventory finance that FTAV broke down last week. Many of those entities previously filed for bankruptcy protection, which MainFT broke news of.

The debt in this new table sums to just over $8bn, including a euro conversion of one of the facilities at present rates. That figure is in excess of the $5.9bn of secured debt that First Brands disclosed to loan investors last month (albeit that snapshot was of end-March).

Even that $8bn sum does not appear to include financing arrangements linked to customer and supplier invoices, with some providers named as unsecured creditors. And there could be billions of dollars more in factoring and reverse factoring arrangements at play here.

FTAV readers will have noticed that specialist credit investment firms Evolution Credit Partners, AB CarVal and Aequum Capital are named in relation to the inventory debt in Sunday’s bankruptcy petition.

CarVal we mentioned here last week. Boston-based Evolution is also separately listed as having factoring exposure in the petition. We have gone to all three firms for comment and will update if we hear back.

While the petition offers a window into the financing antics that preceded First Brands’ lightning-fast collapse, full details of its finances could take time to emerge, given the chaotic nature of this descent into bankruptcy.

In the meantime, tell us if you see anything interesting, either below the line or on email.

Read the full article here