The NCAA wants the CFTC to tighten rules on college sport prediction markets, including age and advertising restrictions and anti-harassment measures.

The National Collegiate Athletic Association (NCAA) has called on the Commodity Futures Trading Commission to suspend college sports prediction markets until rules are implemented to protect student athletes.

NCAA President Charlie Baker asked CFTC Chair Michael Selig in a letter on Wednesday to “suspend collegiate sport prediction markets until a more robust system with appropriate safeguards is in place.”

Baker said that the “growth and haphazard nature” of sports prediction markets has contributed to more harassment directed at student athletes by bettors, negatively affecting their well-being.

He added that most states restrict sports gambling to those aged 21, while prediction markets allow users as young as 18, which could “heavily entice college students — and even high school students — into engaging in these markets in a harmful way.”

Baker asked for age and advertising restrictions, a more robust integrity monitoring system, anti-harassment measures, and harm reduction resources.

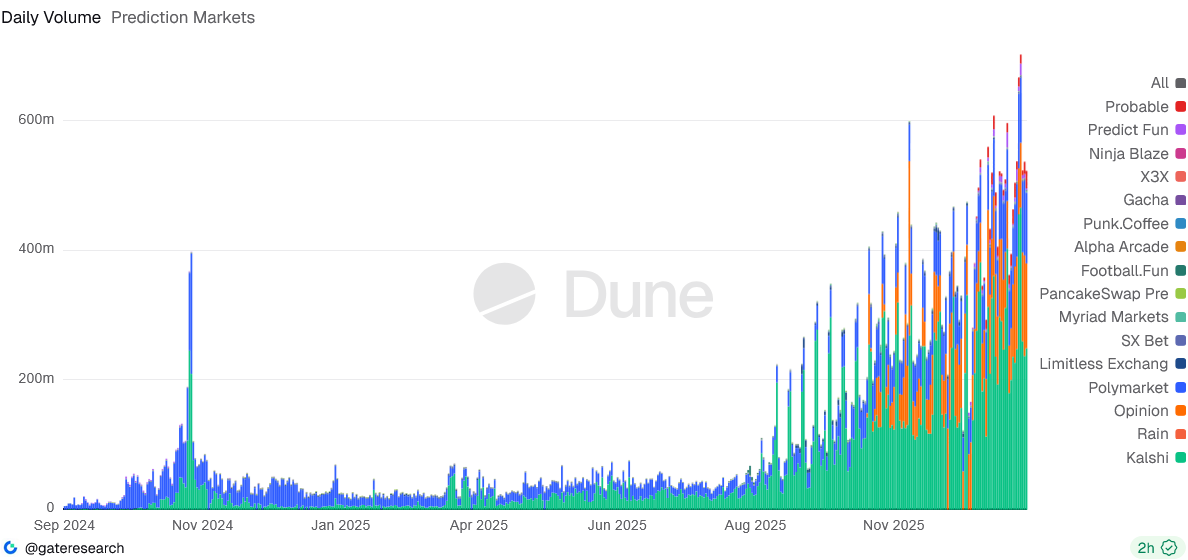

Prediction markets such as Kalshi and Polymarket have exploded in popularity and usage in recent months, with bets on sports event contracts a large portion of their volumes.

Lawmakers and regulators in Connecticut, New York, Nevada, New Jersey and other states have sought to ban or block prediction markets tied to sports, with multiple state regulators taking action against prediction market platforms.

Prediction market volumes at record highs

Despite the legal threats, prediction markets continue to boom, with trading volumes hitting a record $701.7 million on Monday.

Related: Coinbase CEO expects market structure bill markup ‘in a few weeks’

The $701.7 million tally beat the previous record of $666.6 million set a day earlier, with Kalshi accounting for around two-thirds of trading volumes on both days.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Read the full article here