By Bas van Geffen, Senior Market Strategist at Rabobank

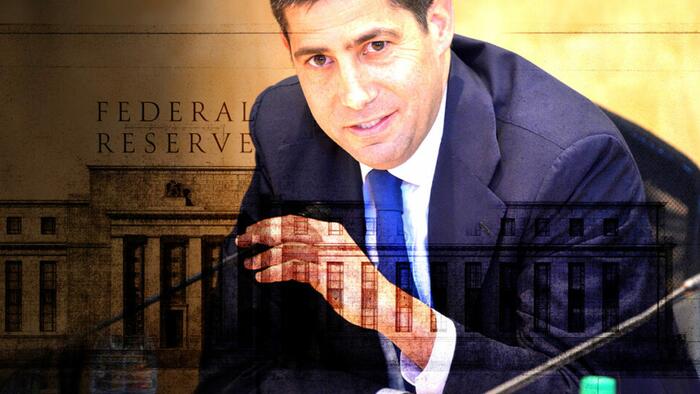

When the Fed decided to hold rates unchanged last Wednesday, Waller was one of the two dissenters in favour of another rate cut. Waller’s dissenting vote may have kept him on President Trump’s list of potential Fed chairs, but it now seems that it did not get him to the top of that list. Reportedly, Trump is ready to announce Kevin Warsh as his nominee (ZH: Trump officially nominated him this morning)..

The dollar has regained some strength. Perhaps that’s thanks to Warsh’ credentials as a former monetary policy hawk – prioritizing inflation control and favouring a smaller Fed balance sheet. However, let’s not forget that President Trump’s first selection criterion is whether the candidates are willing to pursue lower interest rates. So, if he does nominate Warsh later today, he is unlikely to be as hawkish as he once was – unless he has hidden that very well in his interviews with the president. Indeed, Warsh has recently also called for rate cuts.

Nonetheless, compared to the other candidates, Warsh is certainly more on the hawkish side of the spectrum. And so, most asset classes wavered. Treasury yields opened the day higher, and equities slid, with Chinese markets down 1% on the day. The record-breaking streaks in gold and silver have also ended – at least for now. The precious metals are currently down about 8% and 12% from their peaks, respectively. And that is despite concerns over a potential escalation in the Persian Gulf.

The retracements are notable, but we wouldn’t say that the debasement trade or diversification from the US have now stopped. The market may respond optimistically to the prospect of Warsh’ nomination, but broader US policy uncertainty is still not doing the dollar any favours.

Likewise, the US’ attitude towards other countries, is even starting to drive traditional allies away from the US. The European Union has accelerated trade deals with various other economies, and the signing of an accord with India earlier this week is a key step in the EU’s effort to diversify away its economic and geopolitical dependencies.

With a 99.5% reduction of tariffs on imports from India, it creates significant opportunities for India’s (labor) intensive export sectors. That may also help Europe, as it is facing a major acceleration in ageing in the coming decades. But it will also create more opportunities for European businesses to diversify their operations out of China and into India. That is the strategic value in that deal.

And the United Kingdom is pursuing closer ties with China. This week, Starmer became the first prime minister to visit China in eight years, where he met with president Xi. The visit thawed some of the relations between the two countries. China agreed to waive visa requirements for UK visitors. Amongst the results is a “services partnership” that should give the UK better access to the Chinese market. It’s a first step towards a potential bilateral trade deal on services, which both sides have agreed to explore.

The UK’s rapprochement to China drew criticism from Trump. The US president said it is “very dangerous” that the UK government is trying to get closer to China. The UK could therefore come into Trump’s crosshairs again, just like the US president threatened new tariffs on Canada over its recent trade deal with China. However, as we noted above, its precisely these kinds of threats that have encouraged the UK and Canada to seek alternatives to the US.

Loading recommendations…

Read the full article here