Bitcoin (BTC) gained sub-$50,000 ahead of Sunday’s weekly close as bulls failed to recover from ten-month lows.

Key points:

-

BTC price targets stay bearish as Bitcoin bulls lick their wounds at ten-month lows.

-

CME futures gaps may provide some temporary relief into the new week.

-

Bitcoin is still following the path from earlier bear markets by losing realized price support, says research.

BTC price: “So far, history is repeating”

Data from TradingView showed BTC price action staying below $80,000 after BTC/USD fell more than 6% the day prior.

After losing significant bull market support levels, including the true market mean at $80,700, Bitcoin left many traders bearish on the period ahead.

“$74,400 and $49,180 are the two major downside liquidity targets for this bear market,” X account Cmt_trader forecast.

Trader CryptoBullet drew particular attention to the loss of the 21-week exponential moving average (EMA) — an event that preceded previous bear markets.

$BTC has lost the 21-Month EMA 🥶

It’s so over you can’t even imagine pic.twitter.com/UFJnoFZmkv

— CryptoBullet (@CryptoBullet1) February 1, 2026

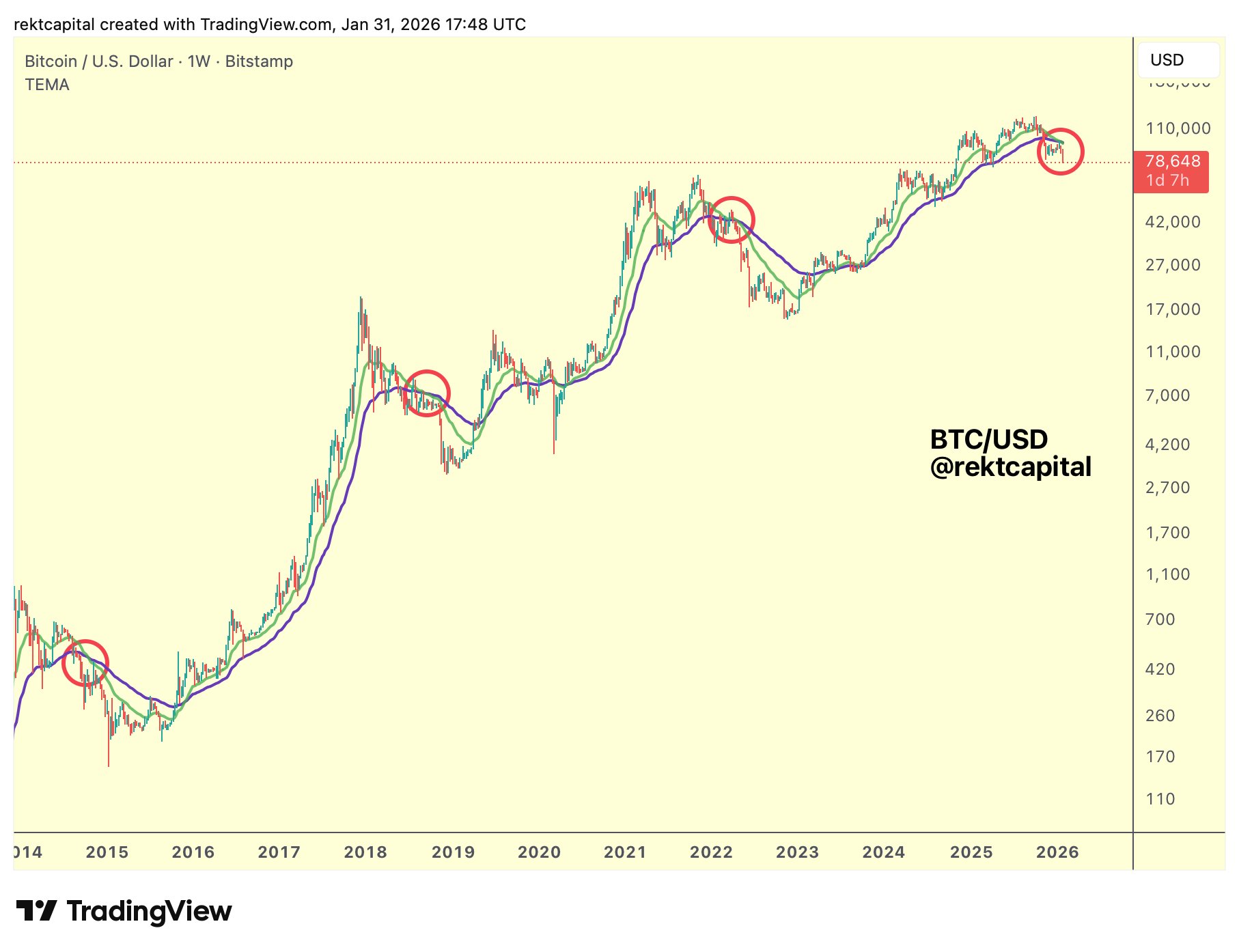

Following up on last week’s bull market EMA crossover, trader and analyst Rekt Capital agreed that history was on the side of “additional downside continuation.”

“So far, history is repeating, with downside occurring after the Bull Market EMA crossover,” he told X followers.

“Bitcoin has dropped -17% from $90,000 to $78,000 since the crossover took place.”

The crossover involves the 21-week and 50-week EMAs, and last triggered in April 2022.

Hopes of a short-term rebound, meanwhile, hung on newly opened “gaps” in CME Group’s Bitcoin futures market.

Often acting as low-time frame price “magnets,” the nearest gap was now waiting near $84,000.

Trader Killa thus predicted that $84,000 would be filled “over the next few weeks.”

Closed 50% of the short position. Remaining 50% left open toward the final target.

Expecting us to fill the CME gap at 84K over the next few weeks. Ideally you want to see BTC reclaim the range low. If no reclaims = no safe trigger.

Thanks for playing 💸💸 https://t.co/lmj9mKa52j pic.twitter.com/wrKVJUTBht

— Killa (@KillaXBT) January 31, 2026

Bitcoin risks new “extended bearish phase”

Zooming out, the latest onchain research remained firmly risk-off on longer time frames.

Related: Bitcoin bear market nearly over? Key BTC metric undercuts 2022 low

For onchain analytics platform CryptoQuant, spot price trading below the realized price of investors holding BTC between 12 and 18 months was the writing on the wall.

Realized price refers to the aggregate cost basis at which their BTC last moved.

“Historically, when price breaks and sustains below this cost basis, market behavior transitions from normal corrections into structural bearish regimes, not short-term pullbacks,” contributor Crazzyblockk warned in a “Quicktake” blog post.

Realized price itself, the research noted, was stable — something “reinforcing its role as overhead resistance.”

“When spot price remains below a flat or rising realized cost, rallies tend to fail as supply seeks breakeven exits,” Crazzyblockk added.

“From a cycle perspective, the combination of price below realized cost, negative unrealized profitability, and slowing balance growth has historically aligned with extended bearish phases.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here