Bitcoin (BTC) fell below $70,000 on Thursday as suspicions over coordinated selling boiled over.

Key points:

-

Bitcoin tumbles below 2021 highs for the first time since November 2024.

-

Gold and silver volatility spark copycat BTC price maneuvers as lower targets stay in play.

-

Market participants believe that large entities are selling BTC on a schedule.

Bitcoin collapses to $69,000 in fresh cascade

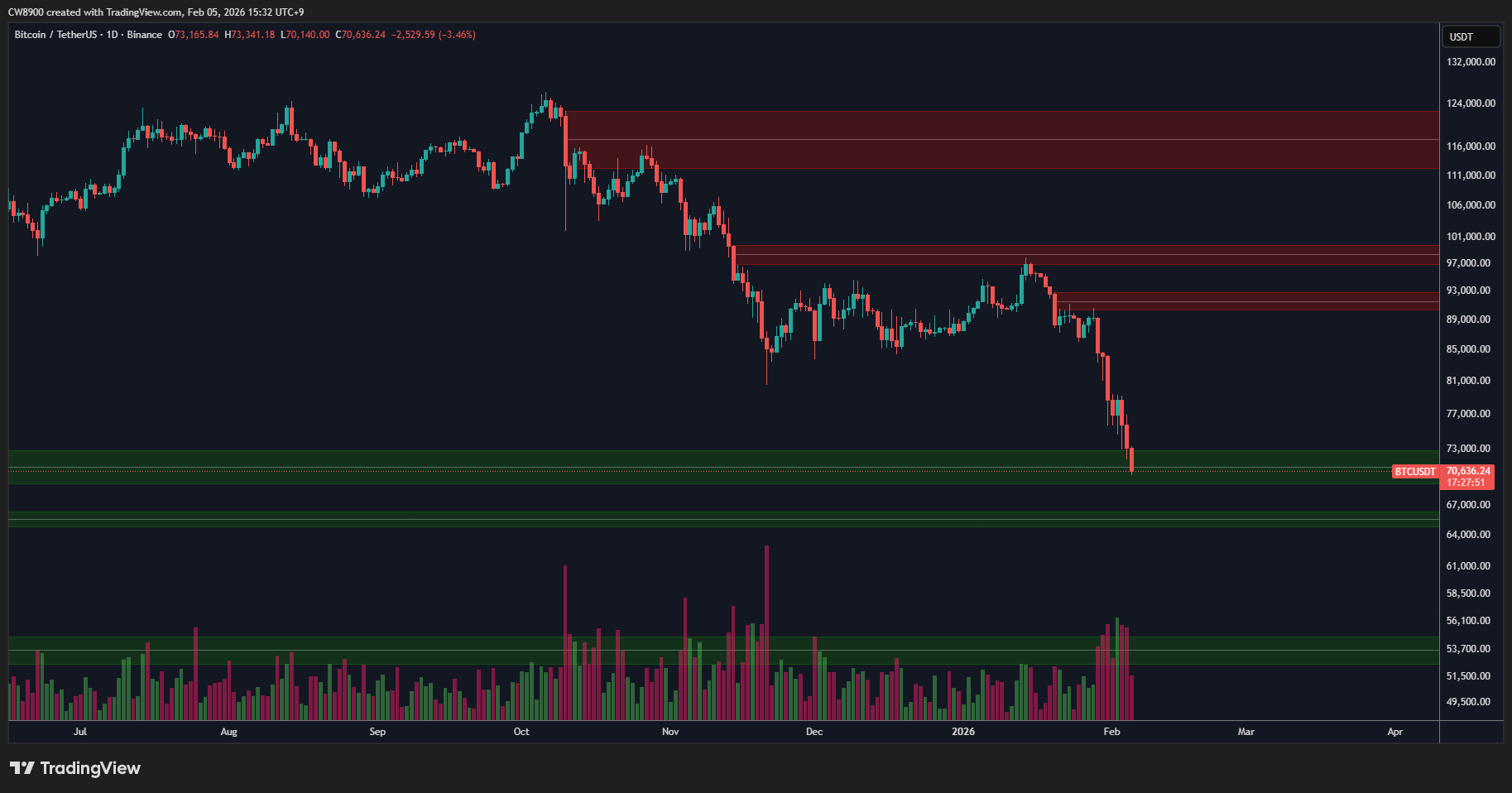

Data from TradingView captured new 15-month BTC price lows of $69,100 on Bitstamp during the Asia trading session.

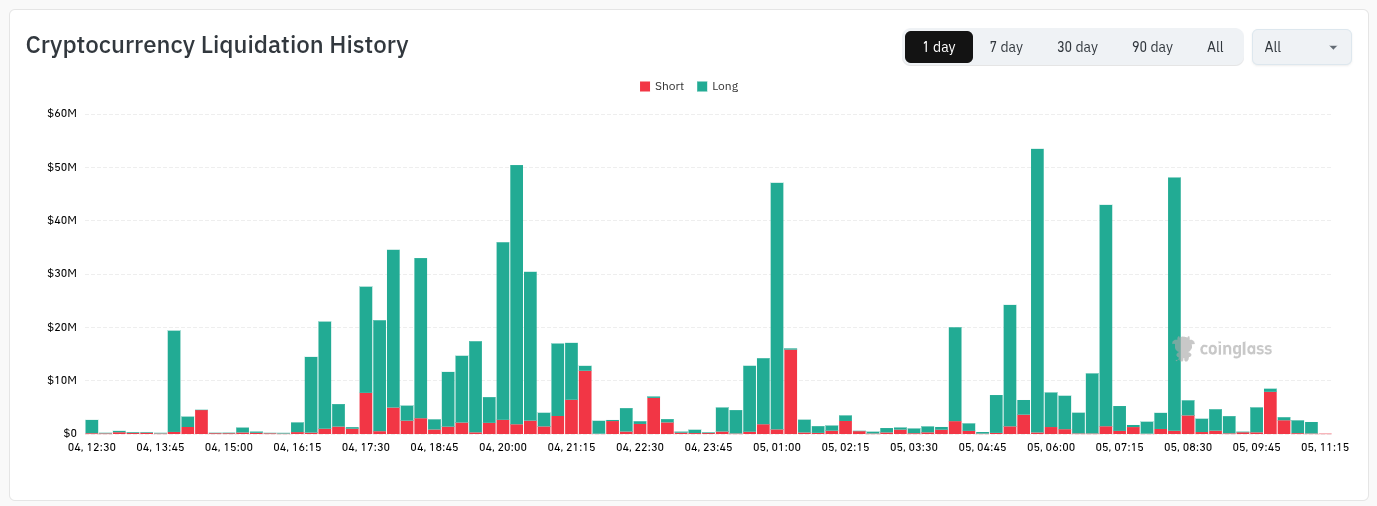

The latest plunge marked Bitcoin’s first trip to the $60,000 range since early November 2024. In doing so, it sparked $130 million of crypto long liquidations over four hours, per data from monitoring resource CoinGlass.

Bitcoin moved in step with a flash reversal on precious metals.

Gold, which the day prior had seen a relief bounce to $5,100 per ounce, fell as low as $4,789 Thursday before again targeting the $5,000 mark.

Silver, meanwhile, gyrated between $90 and $73 per ounce as volatility stayed in control.

“$BTC has entered a key support zone,” trader CW warned in a post on X.

“If it fails to support the 69k level, another significant decline could occur.”

Earlier, traders gave various BTC price bottom targets of interest, with these including the area around $50,000. Directly below $69,000, meanwhile, lies the key 200-week exponential moving average (EMA) support trend line.

Reacting, crypto entrepreneur Alistair Milne agreed with observations from longtime trader Peter Brandt. Bitcoin, the latter argued, was the victim of “campaign selling.”

“Agree with this take. Someone enormous is unloading to a deadline,” Milne responded on X.

The post likened the current sell-side pressure to when the government of Germany distributed its BTC holdings to the market, suggesting that coins were being “handed over to OTC desks who simply execute.”

“For me it started 14th Jan,” he added.

Coinbase Premium undercuts Liberation Day low

Nic Puckrin, CEO of crypto education resource Coin Bureau, likewise flagged “large selling” by whales during US hours.

Related: Bitcoin, crypto ‘winter’ soon over, says Bitwise exec as gold retargets $5K

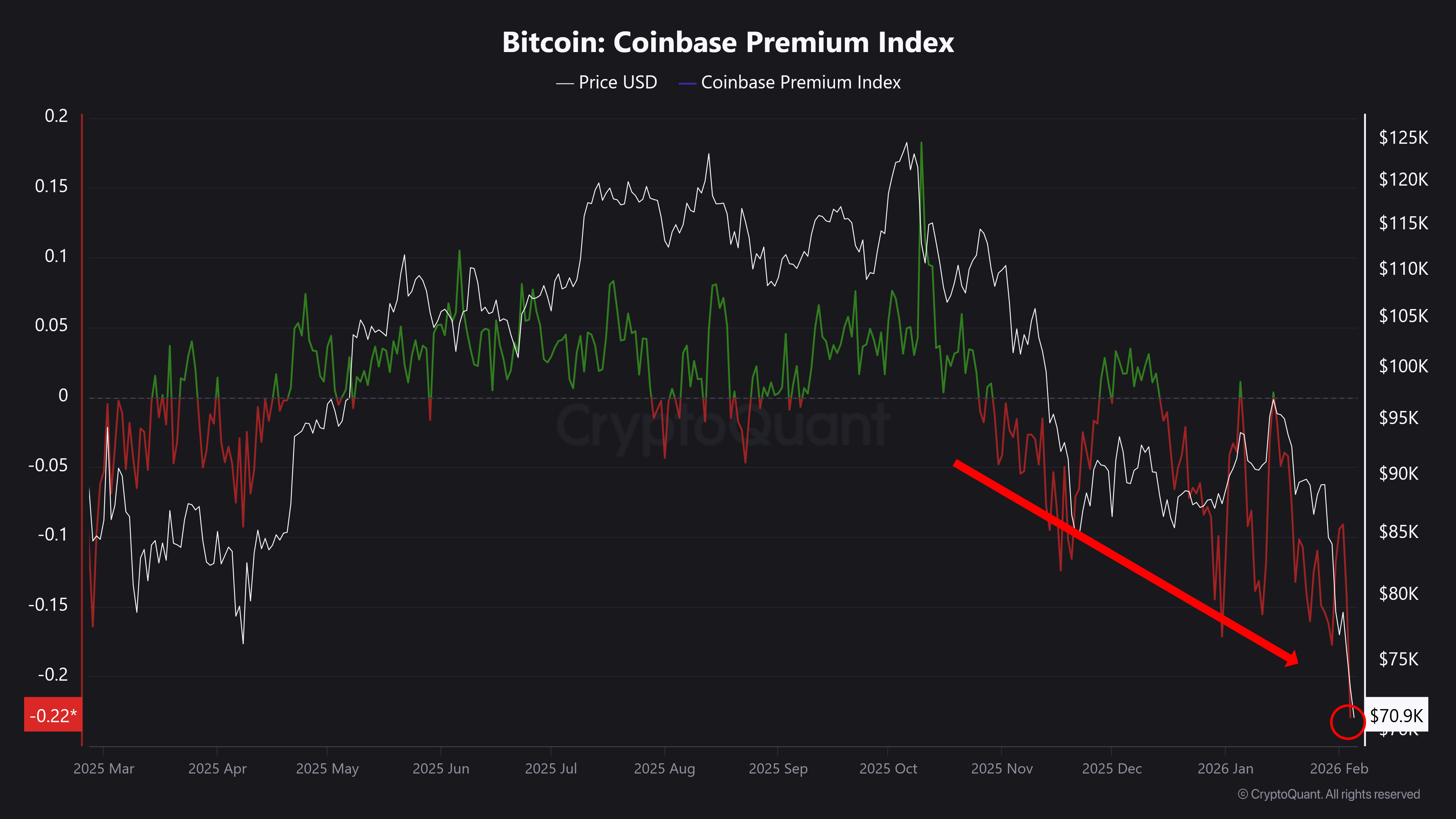

As Cointelegraph reported, the negative Coinbase Premium, which measures the difference in price between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, highlighted the lack of overall US Bitcoin demand.

“The Coinbase Premium is the lowest it has been in over a year. It’s even lower than post liberation day tariffs,” Puckrin noted.

He added that selling pressure would continue until the Premium changed course.

Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, said that “OG” whales were behaving as if BTC/USD were at all-time highs.

Bitcoin’s at $72K and the OG whales continue to dump like we’re still at $125K pic.twitter.com/prL68L8Lhi

— Charles Edwards (@caprioleio) February 5, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here