Bitcoin (BTC) rebounding is now “highly probable” as BTC price action sets another bearish record.

Key points:

-

Bitcoin has never traded so far below its 200-day moving average, data shows.

-

BTC price action is due “mean reversion” as a result.

-

Analysis describes a “macro-driven” Bitcoin bear market now in progress.

Bitcoin sees one of its fastest price drawdowns

New analysis from Martin Leinweber, director of digital asset research and strategy at European index provider MarketVector Indexes, says that Bitcoin’s long-term investment thesis is “intact.”

BTC price action has never strayed so far from its 200-day simple moving average (SMA) — and Leinweber thinks that the dip below $60,000 was anything but “normal.”

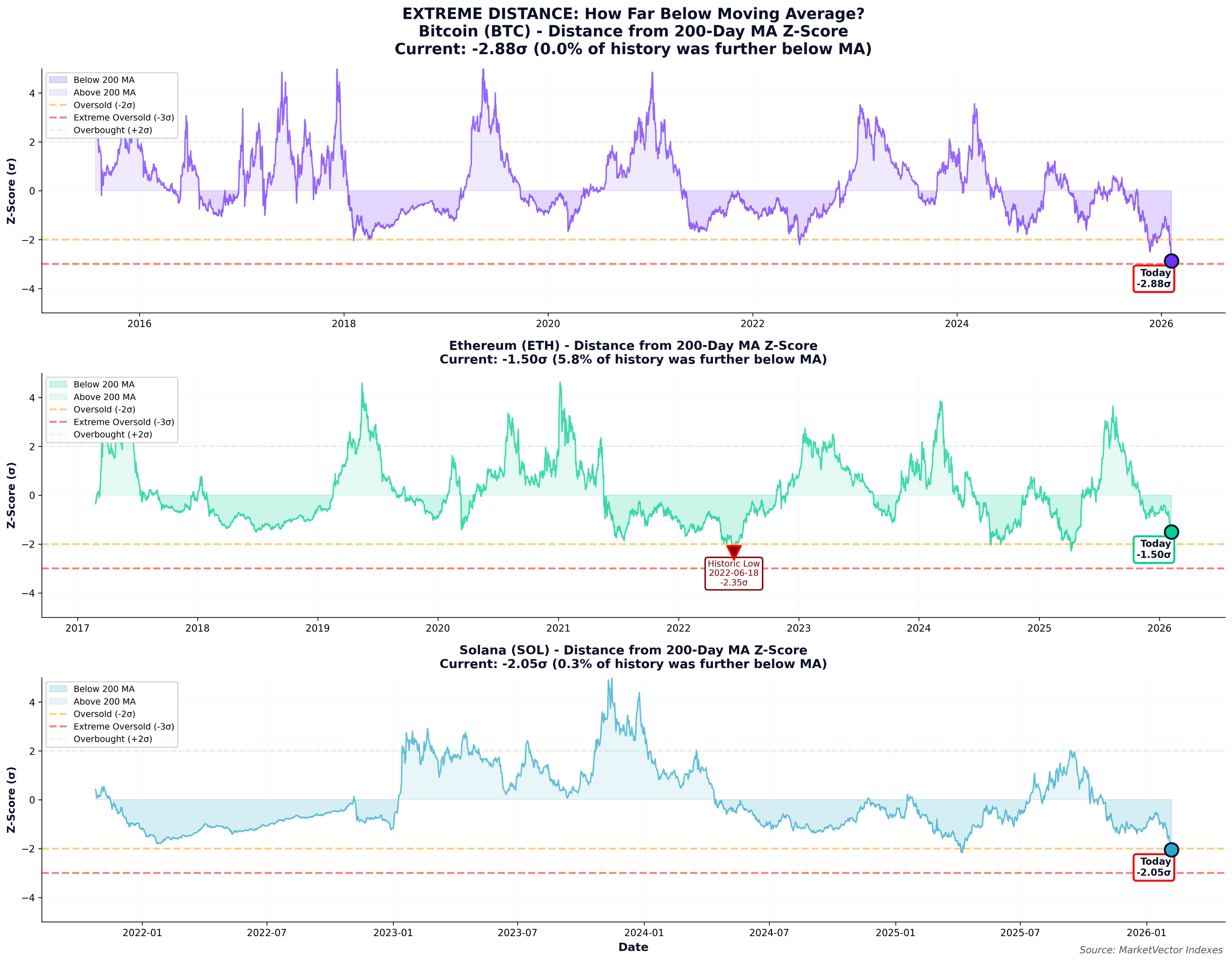

“Bitcoin is -2.88σ below its 200-day moving average. In 10 years of data, this has literally NEVER happened before. Not during COVID. Not during FTX. Never,” he summarized in an X thread on Friday.

The analysis places this week’s crash among Bitcoin’s 15 fastest, with BTC/USD dropping by more than 22% in a single week — a worse rate than in 98.9% of its history.

“When you’re in the 99th percentile of bad outcomes, mean reversion becomes highly probable,” Leinweber continued.

2.88 standard deviations below the 200-day SMA, however, has never happened before, and sees Bitcoin beat the drawdowns for major altcoins Ether (ETH) and Solana (SOL).

“We’re not at generational lows yet. But we ARE at statistical extremes across multiple indicators,” the analysis confirmed.

Despite that, Leinweber is not in a hurry to predict a long-term BTC price bottom, arguing that the current floor may only be a “local” one.

Zooming out, meanwhile, there remains reason to believe in the Bitcoin bull case.

“Bear market = macro driven, not tech failure. Long-term thesis intact,” the X thread concluded.

Bitcoin dip-buying needs “patience”

Earlier, Cointelegraph reported on the record-breaking nature of recent BTC price losses.

Related: BTC price heads back to 2021: Five things to know in Bitcoin this week

Thursday saw Bitcoin’s first-ever $10,000 red daily candle, with liquidations beating significant bearish events in the past, including the COVID-19 crash and implosion of exchange FTX.

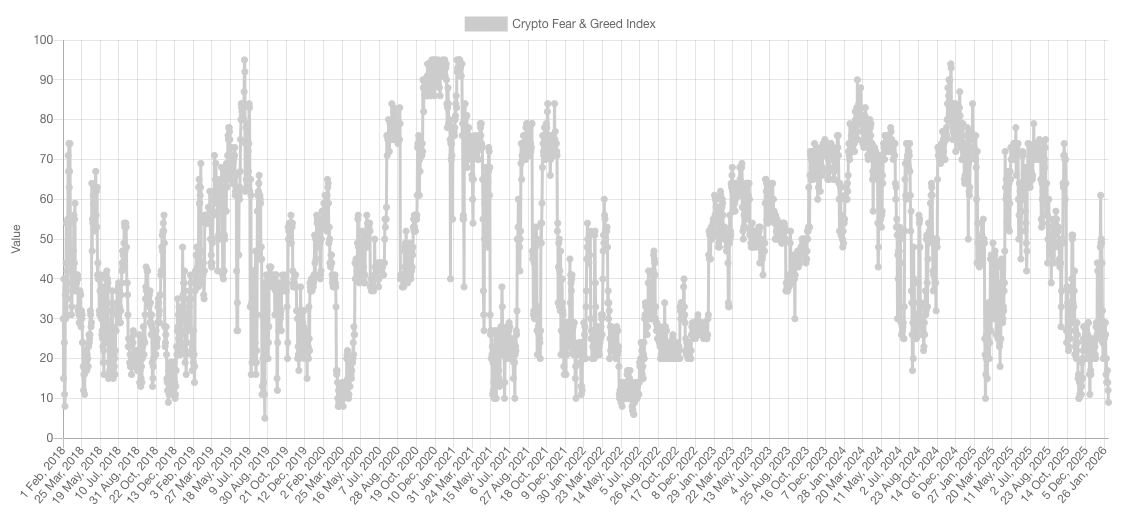

Sentiment dropped to extreme lows, as measured via the Crypto Fear & Greed Index’s 9/100 score.

At the same time, signs that large-volume investors were buying the dip quickly emerged, with the focus on hedge funds and Binance.

Analyzing the wave of liquidations in recent weeks, trader Daan Crypto Trades was among those eyeing a potentially lucrative buying opportunity.

“$BTC Bouncing from the middle of the 2024 range. Price sold off -38% in just a few weeks and a lot of large leveraged positions have been wiped out,” he told X followers.

“Great time if you are more cash heavy and have the patience to accumulate or profit from the volatility.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here