Fierce winter weather across the eastern half of the U.S. put the power grid, data centers, and electricity prices back in focus, especially in the Mid-Atlantic, where Washington, D.C., logged its longest freezing streak since 1989.

Our review of Facebook, X, media coverage, and local officials’ comments suggests that the cold snap across the Mid-Atlantic has put data centers and power bills in the spotlight, especially given that PJM Interconnection is already operating in a very tight grid environment.

Even as residents in Mid-Atlantic states increasingly push back against data centers while watching their monthly power bills soar, local officials, some of whom are partly responsible for tightening grid spare capacity with backfiring “green” policies, are scrambling as public anger grows.

However, Goldman analysts led by Hongcen Wei have some disappointing news for residents in the Mid-Atlantic, and frankly elsewhere, who are trying to slow data center development: “U.S. Local Regulatory Pushbacks Against Data Centers Are Not Slowing Development.”

Wei, Daan Struyven, and Samantha Dart explained:

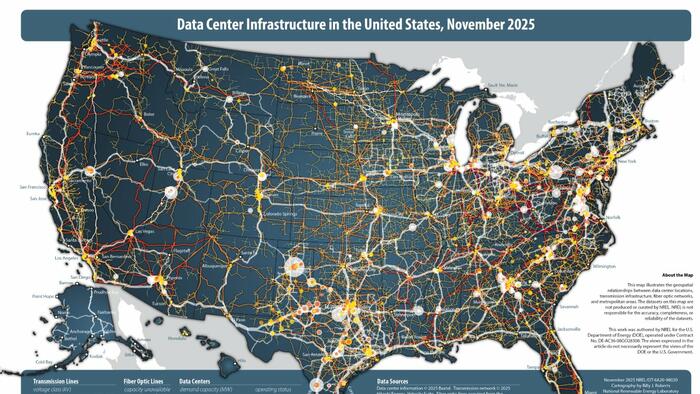

Media coverage highlights growing local community pushbacks against data center developments, posing a slow-down risk to data center power demand growth, along with US power market tightness. While local regulatory reviews could pause data center approvals temporarily, we believe resulting regulations could lead to fewer pushbacks and streamlined development processes by enhancing power reliability and affordability and establishing clear requirements. Ultimately, we believe power tightness remains the primary risk that could slow the US in the AI race with China.

We note that these pushbacks mostly originated from local communities with little exposure to data centers. In such cases, we expect proposed data centers to relocate rather than be canceled in the extreme scenario of a ban, given elevated demand for data centers and AI. This suggests no significant impact on overall future data center power demand growth at the state or national level.

- We take Georgia as an example, where we estimate the power market is not tightening and power price increases were below the national average in 2025. There was wave of moratoriums enacted by at least six counties in the past year, putting a pause on new data centers for at least a few months (for example, in Coweta and DeKalb counties). However, most of these counties have no existing data centers, only proposed projects to start in a few years, so we do not expect these moratoriums to impact data center developments in the near future. Going forward, with no clustering advantage within these counties (to stay close to another data center with established data highways), we believe even permanent bans would only result in project relocation to a more welcoming area (potentially the neighboring county) rather than cancellations

In other communities with both regulatory actions and existing data centers, regulatory reviews are often followed by continued and even accelerated growth. Rather than creating red tape, we believe updated regulations could streamline development processes by clearly defining specific requirements for data centers which are easier to follow than addressing diverse local community concerns.

- Douglas County, the only one of the six Georgian counties with existing data centers (a top-10% county in the US), activated multiple new data centers in 2H2025 and more are scheduled for later following its 90-day moratorium on data centers starting from March 2025 (Exhibit 1).

- Nationally, Loudoun County, Virginia, the world’s capital of data centers, started reviewing and updating its data center regulations in 2024 and approved them in 2025, with further regulations under consideration. However, the county continues to lead in data center capacity, with additions in the past year surpassing any other US county and its own previous records

Beyond local ordinances, we also see state-level legislation increasingly focusing on power affordability and reliability, which we do not expect to slow down data center developments. Specifically, we expect more regulations in the next few years aiming to shift more power costs from the public to data centers to incentivize additional power supply and to mitigate power bill increases. These regulations could take various formats, such as the President and several governors’ plan for the PJM (Mid-Atlantic) power market, or reductions in data center tax exemption (as seen in bills introduced in Arizona and Maryland). Nevertheless, we expect higher power costs to have limited impact on future data center power demand growth, as power costs are not a primary driver for data center expansion

Conversely, we believe state-level regulations that enhance power affordability and reliability could lead to a more favorable environment for accelerated data center developments, as Texas has started to demonstrate (Exhibit 2).

- In June 2025, Texas passed its Senate Bill 6 (SB6) to regulate large electricity consumers, including data centers and cryptocurrency miners. The bill could be a bellwether for other states, with its new requirements for large-load customers to ensure power reliability, including backup generation and potential curtailments during emergencies. We do not expect these requirements to be a dealbreaker for new data centers, given our estimate that the Texas (mainly ERCOT) power market will be softer than other key regional power markets, resulting in a lower probability of curtailments, a key factor for data centers when choosing their location, while backup generation is always a standard component of data centers. In fact, Texas/ERCOT ranked second only to Virginia/PJM in data center capacity and additions across US states/power markets in 2025 (Exhibit 3). Going forward, we continue to consider Texas as one of the most competitive states for new data centers, with both high power availability and low time to client.

Professional subscribers can learn more about the data centers and power grids on our new Marketdesk.ai portal.

Loading recommendations…

Read the full article here