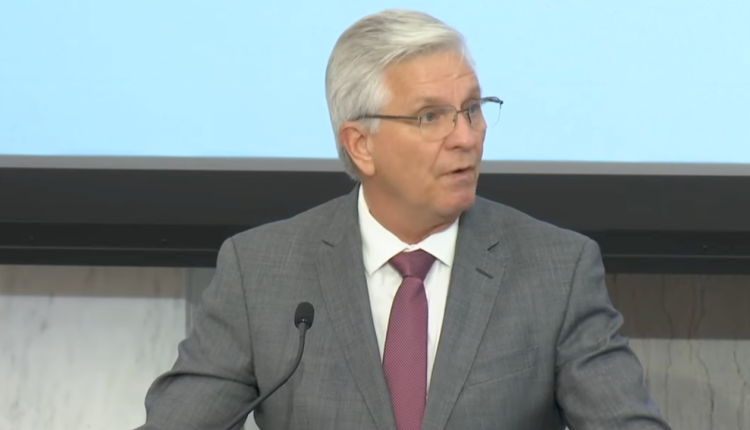

Federal Reserve Governor Chris Waller says the crypto hype that came with US President Donald Trump’s election victory has begun to wane as the market has become more entangled with traditional finance.

“I think some of the euphoria that came into the crypto world with the current administration, some of that’s kind of fading,” Waller said at a conference on Monday.

“A lot of it has been brought into the mainstream finance,” Waller said. “Then, you know, things have to happen there, so I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions.”

More traditional finance players have started to increase their exposure to crypto under the Trump administration, which has helped to elevate the market, but Waller argued that Congress’ failure to quickly pass the crypto market structure bill had also “put people off” as it leaves much uncertainty about how the products are regulated.

He also brushed off the recent market drop as “part of the game” with crypto. “You get in, you make some money, you might lose some money — that’s the nature of the beast.”

“Look, prices go up, prices go down — it’s just the nature of the business,” Waller said. “If you don’t like it, don’t get in it, that’s my advice to everybody.”

Bitcoin (BTC) has fallen 45% from its peak of $125,000 in October and is currently trading around $69,500 after a brief crash to under $60,000 on Friday.

Fed “skinny master accounts” to come this year: Waller

Waller said that the Fed would roll out its proposed “payment accounts” this year, which aims to give fintech and crypto firms limited access to the central banking system.

The Fed fielded feedback on the accounts, dubbed “skinny master accounts,” up until Friday, with crypto companies backing the plan while banking associations urged caution over the proposal.

Related: Bessent suggests Warsh nomination hearings alongside Powell probe

“We got a ton of stuff, and we’ll have to kind of work through that,” Waller said. “If we can get that done reasonably well, I’d like to try to have this done by the end of the year, if possible.”

The Fed’s proposal would see payment accounts given fewer privileges compared to master accounts commonly owned by major banks, such as removing the ability to earn interest and imposing balance limits.

Waller has previously said that payment accounts would “support innovation while keeping the payments system safe” and are necessary due to “rapid developments” in payments technology.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Read the full article here