Bitcoin (BTC) charged above $69,000 on Friday as US CPI data showed cooling inflation, leading traders to hope for a short-term BTC price recovery.

Key takeaways:

-

Traders favor a short-term BTC price relief rally, but bulls must first take out the resistance at $68,000 to $70,000.

-

Bitcoin market analysis forecasts a short squeeze toward $80,000 if bulls succeed in confirming the $65,000 level as support.

Bitcoin price must take out resistance at $68,000

Bitcoin attempted a breakout on Thursday but “got slammed back down at the $68K level,” said analyst Daan Crypto Trades in a Friday post on X, adding:

“That’s the area to watch if BTC wants to see another leg up at some point.”

An accompanying chart showed the BTC/USD pair consolidating within a falling wedge in the one-hour time frame.

Related: Bitcoin ETFs bleed $410M as Standard Chartered slashes BTC target

The pattern projected a short-term rally to $72,000 once the price breaks above the wedge’s upper trendline at $68,000.

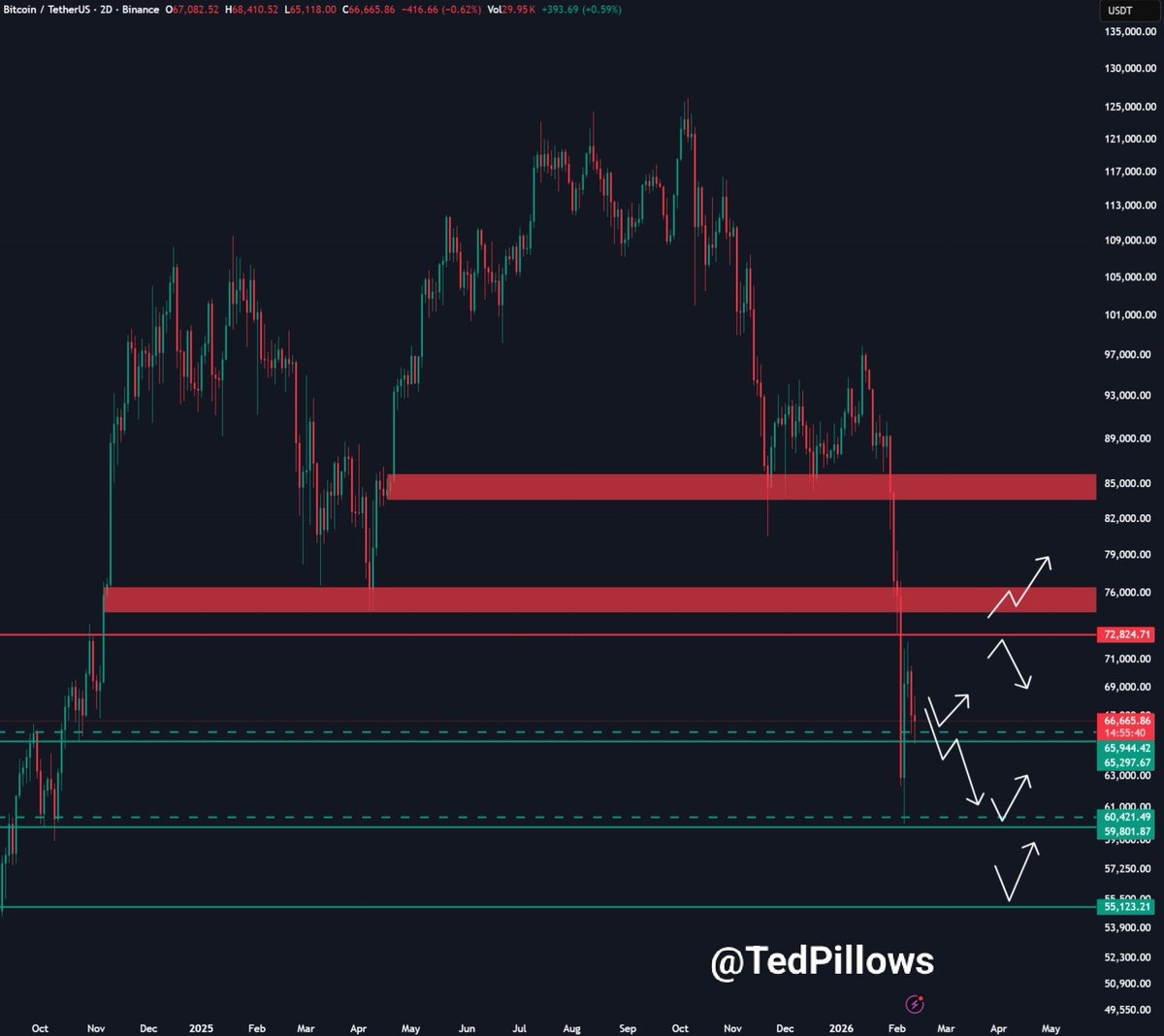

Fellow analyst Ted Pillows said the “chances of a deeper correction would increase” if the $65,000-$66,000 support does not hold.

“To the upside, if Bitcoin reclaims the $70,000 level, it could rally 8%-10% really quickly.”

From a technical perspective, BTC’s price action has been forming a V-shaped recovery chart pattern on the four-hour chart, as shown below.

The BTC/USD pair is retesting a key area of resistance defined by the 20-period EMA at $67,500 and the 200-week exponential moving average (EMA) at $68,000.

Bulls need to push the price above this level to increase the chance of a rally to the pattern’s neckline at $72,000.

As Cointelegraph reported, if Bitcoin breaks $72,000, it will revive the hopes of a recovery toward the 20-day EMA at $76,000 and eventually, the 50-day simple moving average (SMA) above $85,000, bringing the total gains to 26%.

Liquidation risk builds near $80,000

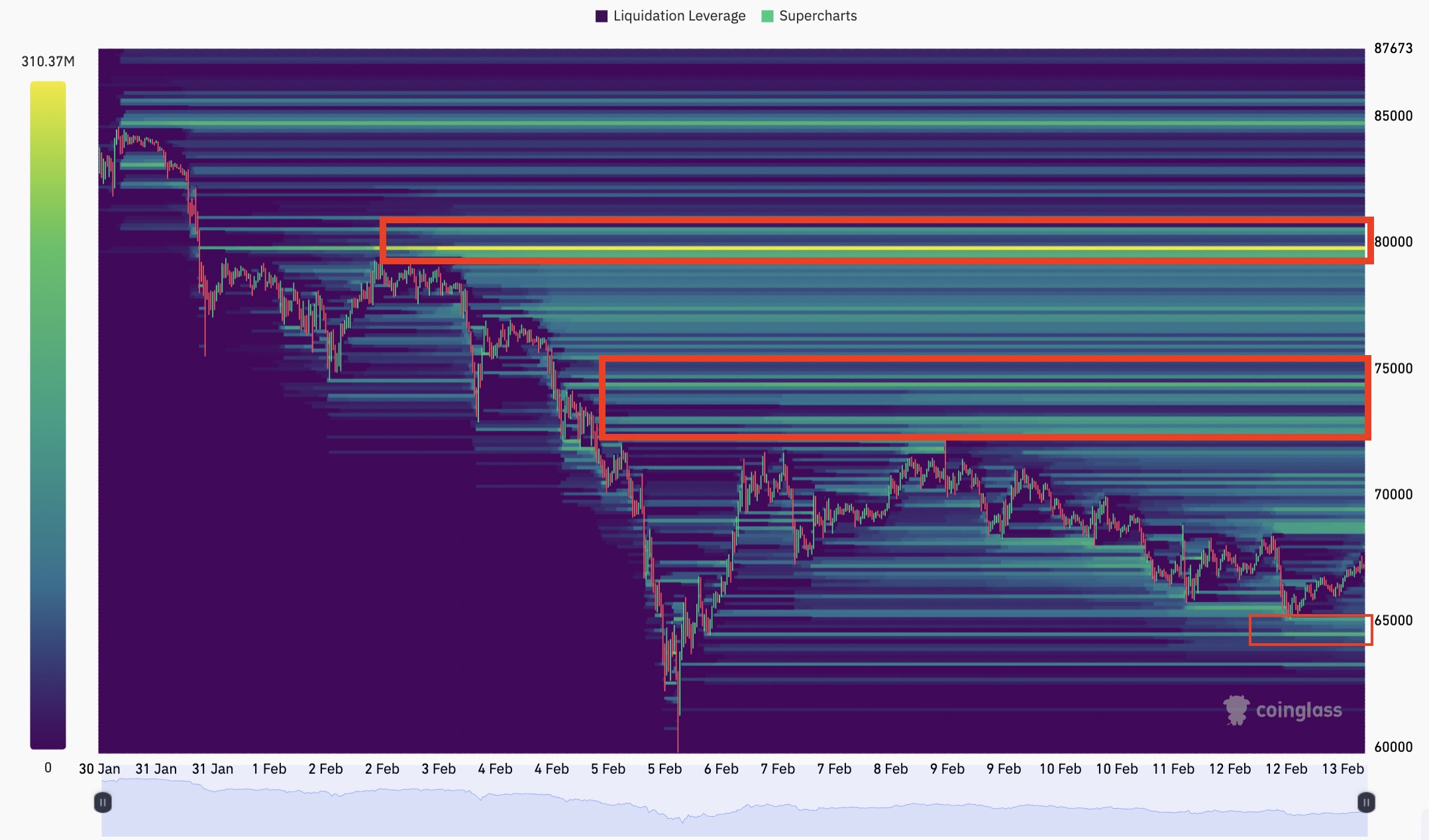

Exchange order-book liquidity data from CoinGlass showed Bitcoin’s price pinned below two walls of asks centered just below $75,000 and around $80,000.

“$BTC liquidations are stacking well above $72K, and around the area from $77K to $80K,” Bitcoin analyst ZordXBT said in his latest post on X.

Below the spot price, bid orders were lying down to $64,500, “where I have my limit orders placed,” the analyst said, adding:

“If the market holds itself here, it can very easily eat those liquidity bubbles.”

The chart above suggests that if the $72,000-$75,000 level is broken, it could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $80,000, which is the next major liquidity cluster.

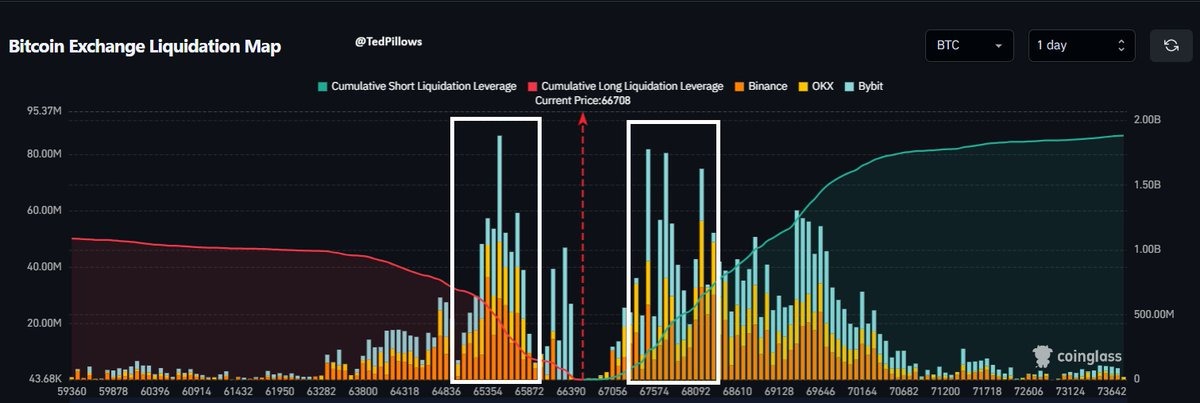

Zooming in, Ted Pillows highlighted significant bid clusters at $65,000 and ask orders around $68,000, saying that the price is likely to revisit these areas to wipe out the liquidity.

“I think a revisit of $65,000 and a pump to $68,000 will both happen soon.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here