Avoid stocks and bonds, and put money in commodities.

That’s the latest advice from JPMorgan’s chief market strategist Marko Kolanovic, who has put himself firmly in the “Year Without a Santa Claus” camp as he repeats his recent warning that the recent equity rally is out of steam.

While others may be holding on to hopes that often traditional end-year gains for stocks are coming, Kolanovic explains why that’s unlikely in a note to clients on Tuesday.

A “significant part” of the stock rally over the past two weeks was down to momentum strategies — betting on recent market winners to keep winning and short covering — investors forced to buy stocks to cover a wrong-way bet that markets were going down, said the strategist.

His pessimism is based largely on higher-for-longer interest rates, rich equity valuations, and a consumer who will be forced to stop spending as interest rates climb for car and other loans, lending standards tighten, and delinquencies start to rise. The resulting demand destruction will make it tougher for corporate earnings growth next year.

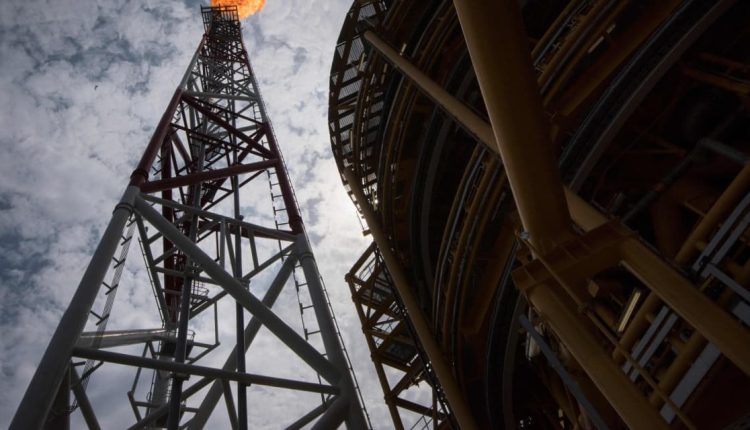

Enter commodities: “Meanwhile, the sharp decline in oil prices over the past month is making us more positive on energy both as a geopolitical hedge and given lighter positioning,” said the strategist.

Kolanovic said they’ve taken profits on their long-duration exposure to government bonds owing to a rally, rising supplies and investor positioning.

“We use the cut in bond allocation to fund an increase in our commodity allocation given still high geopolitical risk, and the significant selloff and weaker positioning in energy, and we incrementally shift our within-commodity allocation into energy.”

Of course, betting on energy is a tough one. On a continuous contract basis, U.S. crude prices

CL.1,

are down 2.% so far this year, after a gain of just 6.7% in 2022.

Some oil bulls firmly believe there is a limited supply of crude, of which the world still needs plenty to keep turning, and given the lack of investment in infrastructure in recent years, greener options are seen as insufficient to make up any shortfall by some.

The commodity has also failed to get much of a hedge-related boost in the latter part of this year amid the conflict in the Middle East between Israel and Gaza, and Russia’s invasion of Ukraine more than two years ago, neither of which has driven prices persistently much higher.

In a note to clients on Tuesday, Citigroup analysts led by Anthony Yuen argued that oil prices will keep dropping from a September spike as “supply should be larger than demand in 2024.” They see Brent crude

BRN00,

currently at $82.33 per barrel, averaging $73/bbl by the second quarter of next year.

That said, they caution that potential weather events, such as polar vortexes and “combustible geopolitical developments” could push prices much higher, or lower this winter.

Read: Here are the biggest clean-energy transition challenges and investment opportunities

One stock bet left?

Note, there are some stocks that appear to squeeze past Kolanovic’s sniff test, as he sees defensives names starting to perk up, notably utilities and staples in the U.S. (Exchange traded fund options here are Vanguard Utilities ETF

VPU

and Consumer Staples Select Sector

XLP

).

Those gains could continue if bond yields are indeed about to peak out, with the relative performance of cyclicals to defensives often strongly correlated to yield direction, he said.

“Even if bond yields ramp up further, the trade might be on as a break in yields above 5% will, in our view, be taken negatively by investors,” he said. And in an overall falling market, defensives might be the least worst place to be parked when it comes to stocks, he explains.

In favor of those stocks, Kolanovic said global purchasing managers index surveys are at risk of contracting further, extending five straight months of weakening. As well, cyclicals earnings are elevated against defensives and “showing signs of a turn,” and cyclicals also had the most profit warnings in the recent earnings period, with utilities the least, he said.

JPMorgan’s mostly bearish view on stocks all year meant clients may have sat out a first-half stock market rally. Kolanovic’s warning of a punishing selloff in June was vindicated by early August, though.

Like JPMorgan, most of Wall Street’s big forecasters have been too hot or too cold with their S&P 500 predictions for 2023 — Kolanovic’s team forecast the index to finish at 4,200 by the end of the year.

They may still have time to get this one right.

Read the full article here