Waning inflation has investors seeing the end of peak interest rates—and buying beaten-up bank stocks.

Yes, those bank stocks. The Federal Reserve’s dramatic campaign of rate hikes to counter inflation led to a generational rout in bonds this year, heaping pressure on the portfolios of lenders and contributing to the failure of Silicon Valley Bank and others, with carnage across financial stocks. The

SPDR S&P Bank

exchange-traded fund (ticker: KBE) has dropped 13% so far this year.

But now the tide is turning, with rapid disinflation causing traders to mostly dismiss the prospect of more rate hikes from the Fed. In fact, markets are predicting as many as four rate cuts next year, with the first coming as soon as March, despite central bankers’ tough talk about the need to make sure inflation is really under control.

Bank stocks are already benefiting. The SPDR Bank ETF is up more than 13% over the first 14 trading days in November, the best start to a month since February 2021. The ETF went on to rally another 4.2% that February before gaining another 9.2% in March, suggesting that the banks could have some momentum behind them.

Not everyone is so sure. Falling inflation is the necessary condition to prompt the Fed to pivot, says Barry Knapp, founder of Ironsides Macroeconomics, but the Fed also needs to start seeing weaker growth and a slowdown in the labor market before slashing rates. While Knapp guesses these conditions will converge in the first quarter of next year—he is, after all, calling for one percentage point of rate cuts in 2024—we may not be quite there yet.

“My conclusion is it’s too early for that trade,” says Knapp, who expects bank stocks to be “at the forefront” of a wider move lower in markets early next year before any rally.

Others are more optimistic. RBC Capital Markets analyst Gerard Cassidy observes that reaching the end of the Fed’s rate hikes has spurred bank stocks higher relative to the

S&P 500.

The hope is the sector can replicate what happened in 1995, when bank stocks gained more than 50% after the Fed’s tightening cycle was followed by a soft landing. It also helps that the stocks, trading at 8.6 times 12-month forward earnings, look cheap. “We continue to believe that if the Fed reaches the terminal rate in the near future, bank stock prices will rise and at these low valuations, investors will be rewarded,” Cassidy writes.

For those who want to bet on a continued rally, smaller names look most attractive. When crisis hit the sector in March, investors bought large institutions in search of stability and safety, notes Piper Sandler analyst Mark Fitzgibbon. “This has left a whole group of well-run, attractively priced, small-cap banks looking like (for lack of a better term) turkeys,” he writes.

To find potential winners, Fitzgibbon screened for Overweight-rated banks with a market capitalization under $1.5 billion, dividend yields above 4.5%, tangible common equity ratios exceeding 8%, and dividend payout ratios below 65%, and found four stocks that stand out:

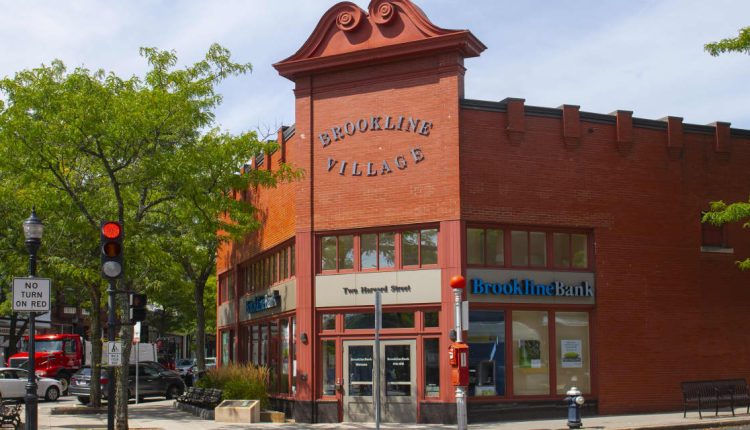

Brookline Bancorp

(BRKL),

Heritage Commerce

(HTBK),

Heritage Financial

(HFWA), and

Provident Financial Services

(PFS).

Of course, these may be some of the riskiest banks out there, especially if the market is wrong about Fed Chairman Jerome Powell’s next move. “If the Fed doesn’t pivot, for whatever reason, then the small banks are gonna get bled,” says Knapp.

Maybe it’s best just to stick with the big guys.

Write to Jack Denton at [email protected]

Read the full article here