The company once called the “most remarkable firm of traders to be involved in the opening up of China” is stepping back from day-to-day business after Jardine Matheson declared it would be an “engaged long-term investor” and not an owner-operator of assets.

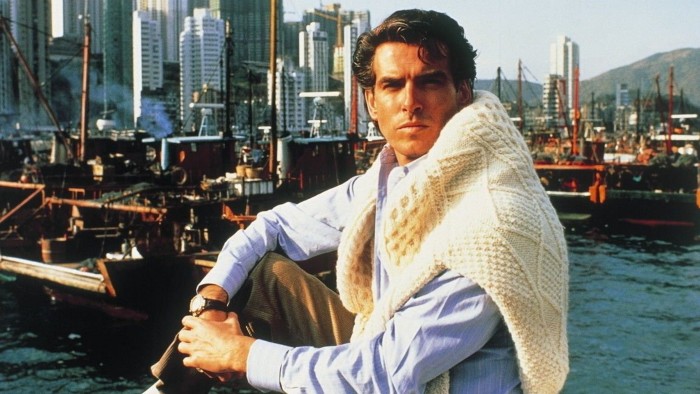

Founded as an opium trader in 1832 and famous as an inspiration for James Clavell’s novels Tai-Pan and Noble House, the shift marks a new incarnation for the storied Anglo-Asian conglomerate — and a focus on higher returns for shareholders.

It shows how pressure to adopt specialised, professional management and make efficient use of capital is reaching all corners of Asian business, but also raises the question of how Hong Kong-based Jardines will maintain its distinctive culture — shaped by the influence of the Keswick family over many years — as it slims down the controlling layer at the top.

“The biggest risk to any family business is complacency,” said Ben Keswick, Jardines’ executive chair and family scion. “With each generation we must evolve to adapt to the environment, now more than ever.”

Jardines declared the strategic shift with its recent 2024 results. Whereas once the company would dispatch its own staff, it has now appointed outsiders to run many of its big listed subsidiaries.

Those include Hongkong Land, which owns much of the territory’s business district; its luxury hotel chain Mandarin Oriental; and DFI Retail, which among other interests, runs Ikea stores in Hong Kong, Taiwan and Indonesia.

The company’s biggest source of profits in recent years has been its controlling stake in Astra, the Indonesian conglomerate. Impairment charges at Hongkong Land hurt profits in 2024, but Jardines generates a lot of cash, producing about $5bn a year in operating cash flow on $53bn of equity in the businesses.

Jardines has revamped the boards of its subsidiaries and the board of the holding company itself, adding directors with private equity experience such as Janine Feng, a managing director at Carlyle, and Ming Lu, senior partner for KKR in Asia.

While by no means becoming a “passive investor”, Jardines is now looking at the financial performance of its subsidiaries “with a certain degree of detachment”, said a person familiar with the recent changes.

The group would engage with its companies primarily at a board and senior management level, the person added. “Key decisions . . . are happening within the [individual] boards. Previously that was not consistently the case.”

Last year, the company quietly ended its executive trainee programme — once a prized opportunity for young British graduates in Asian languages. Portfolio companies are now responsible for hiring entry-level staff themselves. Staff at the parent are being encouraged to specialise in one business or another.

With the company now explicitly vowing to deliver superior long-term returns for shareholders, and to simplify its structure further, investors are excited about the potential for the share price to trade closer to net asset value. Analysts put the discount at 25 to 40 per cent.

The current changes follow on the heels of an overhaul begun by Ben Keswick in 2021, unwinding a defensive cross-holding structure, and leaving a single Singapore-traded parent entity. Family and management own about 45 per cent of the stock.

“The change in energy and . . . excitement around this is quite evident,” said Tom Naughton, chief investment officer at Prusik Investment Management, which holds a 0.33 per cent stake in the company. “They may or may not be successful . . . [but] when we talk to the companies, you get a sense of how big these changes are.”

Investors have complained that the group’s opacity, family control and complicated capital structure depress its valuation, drawing a contrast with other conglomerates that are more open.

“Whether it’s Berkshire Hathaway or Investor AB in Sweden, you sit with them and you understand what they’re going to do,” said a fund manager invested in the company. “Jardine is a little more mysterious.”

The big question now is over Jardines’ ability to grow, and whether a slimmed-down group can maintain its legendary network of connections and get access to the best new business opportunities in Asia, such as its deal to rescue Astra 25 years ago.

The company and many investors believe its long-term outlook, experience and links across Asia will continue to add value to portfolio companies. But some also question how the company will redeploy capital under the new model.

The fund manager said Jardines had made mostly “small” investments in recent years and had not made a material effort to expand beyond its core markets of mainland China, Hong Kong and south-east Asia.

There “is a point” to Jardines as a committed shareholder of the other companies, the fund manager said. “[But] there’s a real question at the holding company about . . . new capital allocations to new businesses.”

It is unclear exactly what the new model will most resemble — a holding company, a private equity fund or an asset manager — but an executive at one rival said it looked like the relatively slim family offices run by other Hong Kong groups.

Family control, the rival argued, suggests Jardines is here to stay and will not be taken to pieces like other conglomerates: “The important thing is that they’re long-term. I believe Jardine still thinks in generations.”

Jayden Vantarakis, head of Asean equity research at Macquarie, warned that for the time being, the company was exposed to a tough environment in Hong Kong and mainland China. “Their fortunes are going to be tied to how the economy there performs more than anything.”

Read the full article here