The Aster decentralized crypto exchange (DEX) and perpetual futures platform announced on Thursday that its layer-1 blockchain testnet is now live for all users, with a potential rollout of the Aster layer-1 mainnet in Q1 2026.

Several new features are slated for a Q1 launch, including fiat currency on-ramps, the release of the Aster code for builders and the upcoming L1 mainnet, according to the Aster roadmap.

Aster will focus on infrastructure, token utility and building its ecosystem and community in 2026, according to the roadmap.

Aster rebranded as a perpetual futures DEX in March 2025 and is a direct competitor to the Hyperliquid perpetual futures DEX, which also runs on its own application-specific layer-1 blockchain network.

The launch of a dedicated layer-1 chain for Aster reflects the trend of Web3 projects shifting to custom-tailored blockchains to support high-throughput transaction volume, rather than relying on general-purpose chains like Ethereum or Solana, which host mixed traffic.

Related: Perp DEXs will ‘eat’ expensive TradFi in 2026: Delphi Digital

2025 was the year perp DEXs gained momentum

The success of Hyperliquid, a perpetual decentralized exchange (perp DEX), helped spur interest in other perpetual DEXs, such as Aster.

Traditional futures contracts feature an expiry date and must be manually rolled over, whereas a perpetual futures contract has no expiration date.

Instead, traders pay a funding rate to keep their positions open indefinitely, allowing markets to run 24 hours a day, seven days a week.

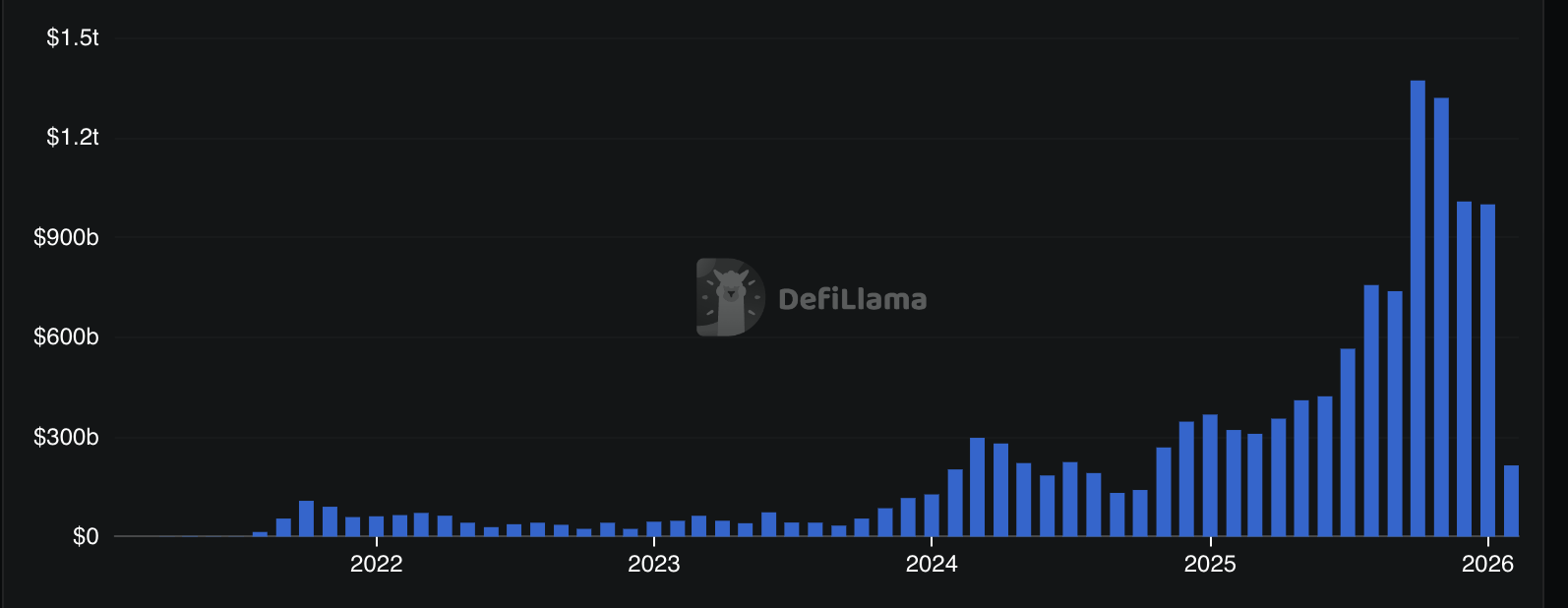

Perp DEX cumulative trading volume nearly tripled in 2025, surging from about $4 trillion to over $12 trillion by the end of the year.

About $7.9 trillion of this cumulative trading volume was generated in 2025, according to DefiLlama data.

Monthly trading volume on perpetual exchanges hit the $1 trillion milestone in October, November and December, data from DefiLlama shows.

The sharp rise in trading volume during 2025 signals growing interest and investor demand for crypto derivatives products and platforms, as more of the world’s financial transactions come onchain.

Magazine: Back to Ethereum: How Synt,hetix, Ronin and Celo saw the light

Read the full article here