Bitcoin (BTC) dropped below $90,000 on Saturday as crypto markets reacted to the US military action in Venezuela.

Key points:

-

Bitcoin attempts to hold recent gains as the US mounts an attack on Venezuela’s capital, Caracas.

-

Traders remain optimistic about the outlook for BTC price action if certain levels hold.

-

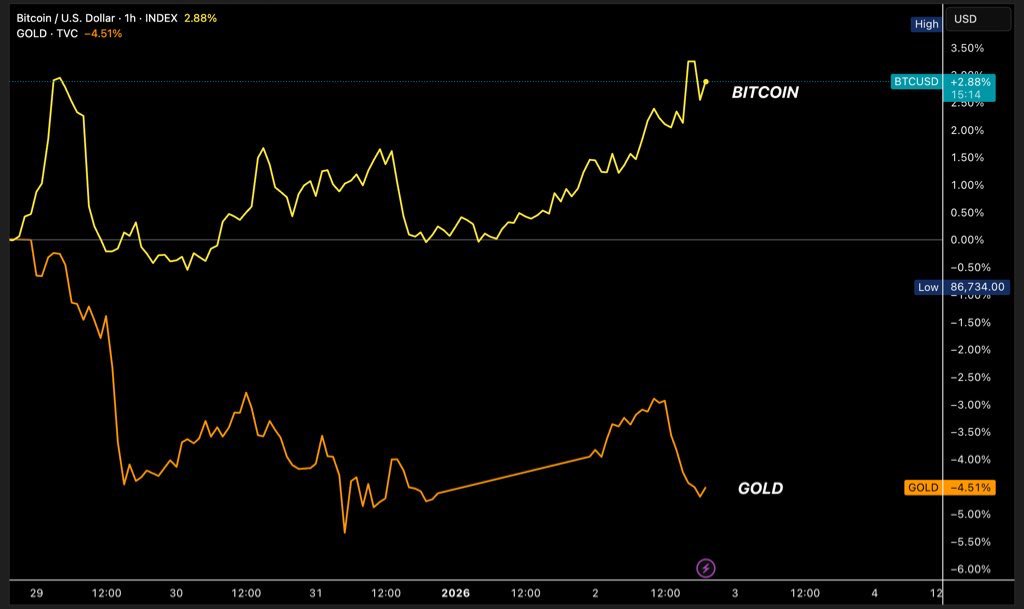

Gold starts to flag on low timeframes as Bitcoin’s gains tap 5% since Christmas.

Bitcoin faces “geopolitical pressure” at $90,000

Data from TradingView showed BTC price action reversing after highs near $90,940 on Bitstamp.

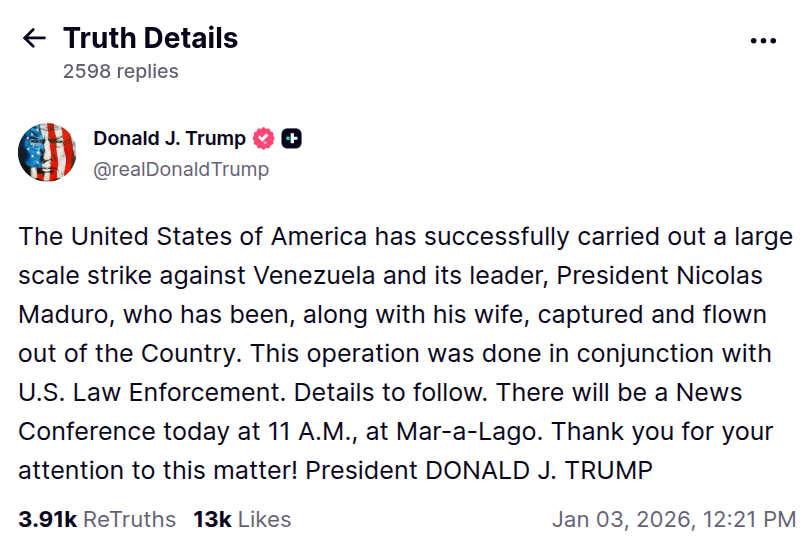

News that the US had launched airstrikes in the Venezuelan capital Caracas were followed by an announcement from President Donald Trump on Truth Social in which he said that Venezuela’s President had been captured and “flown out of the country.”

With traditional markets closed, BTC/USD attempted to preserve some early-year gains ahead of futures returning Sunday.

“We’re seeing some short-term selling pressure due to the ongoing US action against Venezuela, but I remain bullish in the near term,” analytics account @Wealthmanager reacted in a post on X.

“If this situation doesn’t escalate further, I view the move as a temporary pullback, with a recovery likely soon. $96,000–$100,000 remains my target for the coming days/weeks.”

Wealthmanager noted that CME Group’s Bitcoin futures market had closed the week above $90,000, potentially providing a new “gap” and corresponding price target to the upside.

Crypto analyst Lennaert Snyder agreed that much hinged on the return of TradFi next week.

“There’s a lot of geopolitical tension and next week the big players will return. So we’ll probably see more volatility on Bitcoin after the weekend,” he told X followers.

Crypto trader, analyst and entrepreneur Michaël van de Poppe, meanwhile, described Bitcoin’s latest move as a “classic” Venezuela reaction, maintaining a bullish outlook.

“The direction is clear for January: up we go, as long as Bitcoin remains above the 21-Day MA,” he concluded, referring to the 21-day simple moving average at $87,850.

BTC price begins to avenge gold bull run

Bulls also looked to Bitcoin’s relatively strong performance against gold over the New Year period.

Related: Bitfinex whales go long BTC for 2026: 5 things to know in Bitcoin this week

After reaching new all-time highs of $4,551 per ounce on Dec. 26, XAU/USD fell by up to 6% before steadying. At the same time, BTC/USD gained up to 5%.

“An important thing to remember is that the last time Bitcoin started its parabolic rally was after Gold made the top,” trading and analytics resource Bull Theory commented on the topic.

“So if $4550 was the top for Gold, this could be the start of money rotation from Gold to BTC.”

As Cointelegraph reported, gold finished 2025 as the year’s best-performing major asset, with Bitcoin conversely bringing up the rear despite its own all-time highs in October.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here