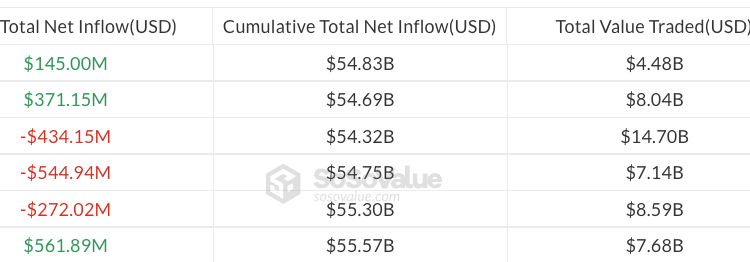

US spot Bitcoin exchange-traded funds (ETFs) extended a tentative rebound after attracting $371 million in net inflows last Friday, adding to signs that institutional demand may be stabilizing following weeks of sustained selling.

Spot Bitcoin (BTC) ETFs attracted a further $145 million in inflows on Monday as BTC hovered around $70,000, according to data from SoSoValue and CoinGecko.

The inflows have yet to offset last week’s $318 million of outflows and $1.9 billion in redemptions year-to-date, but the slowing pace of losses may point to a potential trend reversal for crypto investment products, according to CoinShares.

“Outflows slowed sharply to $187 million despite heavy price pressure, with the deceleration in flows historically signaling a potential inflection point,” CoinShares’ head of research, James Butterfill said in an update on Monday.

Early Bitcoin holders unfazed by institutional inflows, Bitwise says

Bitcoin’s growing institutional presence has not driven early investors out of the market, according to a senior executive at asset manager Bitwise, even as the ETF saw heavy outflows during the latest crypto sell-off that pushed BTC back toward October 2024 price levels.

Analysts at research firm Bernstein described the recent downturn as the “weakest bear case” in Bitcoin’s history, noting the absence of major industry failures typically associated with deeper crypto market stress.

Related: Only 10K Bitcoin at quantum risk and worth attacking, CoinShares claims

With no clear single catalyst behind the decline, some market watchers have linked the volatility to Bitcoin’s increasing institutionalization, including ETFs, and concerns that broader financialization could dilute the asset’s scarcity narrative.

Still, that shift has not meaningfully deterred early adopters, Bitwise chief investment officer Matt Hougan said in comments to Bloomberg ETF analyst Eric Balchunas.

Hougan acknowledged that a “cypherpunk, libertarian OG core” of Bitcoin supporters may be uncomfortable with the growing influence of large asset managers such as BlackRock, but described that group as a “shrinking minority.”

Many early investors are instead taking partial profits after large gains rather than exiting the market altogether, he said, adding that most remain invested even as new institutional buyers enter the space.

“They invested a few thousand dollars and ended up with millions,” Hougan said, adding:

“The vast majority are still in it, and they’re being augmented by new institutional investors. I think the story that most of OG crypto is giving up on the space just doesn’t align with the people that we talk to with the investors that are working with Bitwise.”

In line with a rebound in Bitcoin ETFs, spot altcoin ETFs also posted gains on Monday, with Ether (ETH) and XRP (XRP) seeing inflows of $57 million and $6.3 million, respectively, according to SoSoValue data.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

Read the full article here