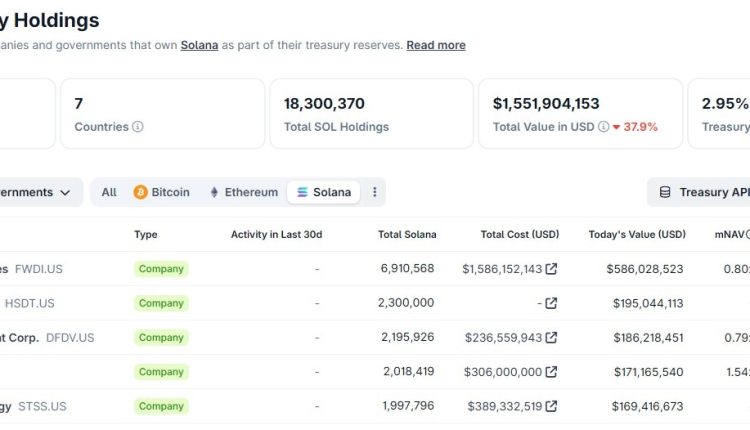

Publicly listed companies that hold Solana as a treasury asset are sitting on more than $1.5 billion in unrealized losses, based on disclosed acquisition costs and current market prices tracked by CoinGecko.

The losses are concentrated among a small group of United States-listed companies that collectively control over 12 million Solana (SOL) tokens, about 2% of the total supply. While losses remain unrealized, equity markets have already repriced the companies, with most trading well below the market value of their tokens.

CoinGecko data shows that Forward Industries, Sharps Technology, DeFi Development Corp and Upexi account for over $1.4 billion in disclosed unrealized losses. The total is likely understated, as Solana Company has not fully disclosed its acquisition costs.

The figures highlight a growing gap between paper losses and liquidity pressure. While none of the companies have been forced to sell their SOL, compressed net asset value (mNAV) multiples and falling share prices have constrained their ability to raise fresh capital.

Accumulation stalls across Solana treasuries

Transaction data compiled by CoinGecko shows that the bulk of SOL accumulation occurred between July and October 2025, when several companies made large, concentrated purchases.

Since then, none of the top five Solana treasury companies have disclosed meaningful new buys, and no onchain sales have been recorded.

Forward Industries, the largest holder, accumulated over 6.9 million SOL at an average cost of about $230. With SOL trading around $84, Forward has unrealized losses of over $1 billion.

Sharps Technology made a single $389 million purchase near the market peak. The company’s SOL is now worth about $169 million, down over 56% from its acquisition cost.

DeFi Development Corp followed a more gradual accumulation strategy and reports smaller losses, but its shares still trade below the value of its SOL holdings.

Solana Company, which built a 2.3 million SOL position over several tranches of purchases, has also paused accumulation since October, according to CoinGecko’s transaction history.

Related: Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Equity markets signal a treasury winter

Equity price data from Google Finance shows that the top five Solana treasury companies have suffered sharp drawdowns in the last six months, significantly underperforming SOL itself.

Forward Industries, DeFi Development Corp, Sharps Technology and Solana Company stock prices are down between 59% and 73% in the six-month charts.

CoinGecko data shows that Upexi has $130 million in unrealized losses on its SOL holdings. However, its shares have fallen more sharply than its peers.

Upexi shares are down more than 80% over the past six months, according to Google Finance. Like other Solana treasury firms, Upexi has paused new accumulation since September.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Read the full article here