Bitcoin (BTC) saw flash volatility around Wednesday’s Wall Street open as US jobs data came in well above expectations.

Key points:

-

Bitcoin attempts to rescue the day’s losses on the back of stronger US nonfarm payrolls data.

-

Mixed signals result in risk assets diverging in their reactions to the numbers.

-

Bitcoin traders stay wary of a deeper BTC price dip to come.

Analysis: Fed interest-rate pause to “continue”

Data from TradingView tracked a BTC price spike to nearly $69,000 which quickly retraced, extending daily losses past 4% at the time of writing.

US nonfarm payrolls outperformed considerably on the day, with 130,000 jobs added in January versus the anticipated 55,000.

Strong labor-market numbers tend to imply less need to lower interest rates — typically a headwind for crypto and risk assets. At the same time, the reduced likelihood of recession creates a nuanced picture for risk-asset performance.

As such, the S&P 500 initially gained 0.5%, while the Nasdaq Composite Index fell 0.6% before both retraced their moves.

Precious metals also saw uncertain price action, with gold hitting new February highs before giving back gains to target $5,000 support.

Reacting, trading resource The Kobeissi Letter additionally referenced cooling unemployment in predicting that the Federal Reserve would hold rates steady at its March meeting.

“The unemployment rate FELL to 4.3%, below expectations of 4.4%. This was a much stronger than expected jobs report, all around the board,” it wrote in a post on X.

“The Fed pause will continue.”

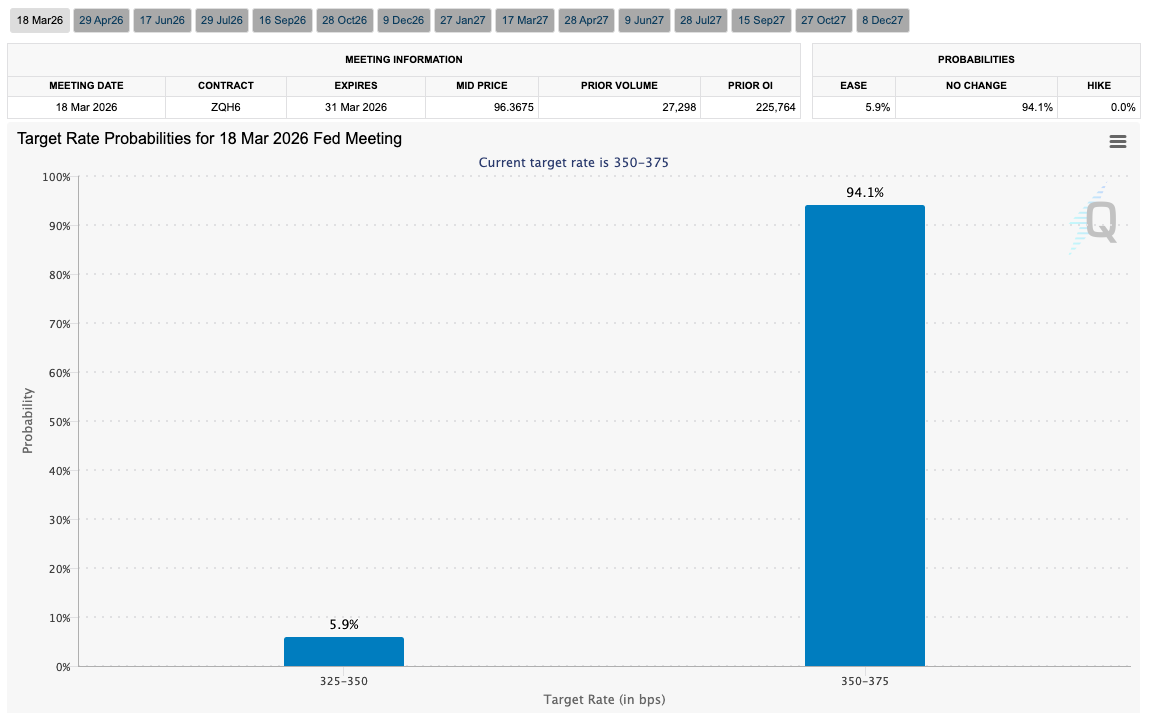

The latest data from CME Group’s FedWatch Tool put the odds of a March rate pause at over 90%.

Attention now focused on Friday’s Consumer Price Index (CPI) print for further cues as to the path of inflation.

Trader eyes BTC price “slow bleed” toward $50,000

Commenting on recent BTC price action, traders remained unimpressed and skewed toward fresh downside.

Related: BTC traders wait for $50K bottom: Five things to know in Bitcoin this week

Daan Crypto Trades brought in Fibonacci retracement levels at $64,569, $62,474 and $59,805 while eyeing the potential for a deeper retracement.

“Pretty weak showing overall after the initial bounce. Bulls failed to push higher past that $72K+ mark and instead saw price break down again,” he summarized.

“Unless ~$68k is retaken, the fib retracement levels are the ones to watch in the short term.”

Earlier, Cointelegraph reported on $69,000 having key long-term significance, with the risk of an extended rangebound environment developing around that level now higher.

$50,000 BTC price bottom targets also persisted, with trader Jelle arguing that BTC/USD was copying 2022 bear market trajectory “closely.”

“Would see a relatively slow bleed towards the low $50ks from here – before bouncing back up; if it keeps playing out the same,” he told X followers.

“Lots of people talk about buying there. I wonder if they will if price gets there.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here