Bitcoin’s (BTC) market structure shifted into a corrective phase after losing a key onchain valuation level in late January.

Glassnode data shows that BTC’s price is compressing within a 2024-era demand zone as liquidity conditions soften. At the same time, BTC’s supply is steadily shifting into long-term, retail-linked wallets while exchange activity has cooled.

This mix of technical and onchain data, along with the current capital rotation, may shape the next steps for Bitcoin price.

Bitcoin lost its active supply cost price, but holders defend $60,000

In its weekly “The Week On-chain” report, Glassnode said that BTC’s recent price dip accelerated due to breaking below its true market mean near $79,000 in January, which is the cost basis of the tracked active supply.

Since then, the price has stabilized inside a dense $60,000 to $69,000 range, which is being defended by medium-term holders. One of the reasons this zone has been a strong support is because of the age of coins within this range for the majority of 2024.

Coins accumulated in that range have aged more than a year, placing a large cohort close to breakeven. This supply has technically tempered further selling pressure.

Market analyst Ardi pointed to a similar dynamic, stating on X,

“We’re trading inside the same $53-73K range that took 245 days to build last year. Think about how much volume went through this zone. This is the most contested zone on BTC’s entire chart right now.”

Glassnode also highlighted that, in past cycles, deeper bear phases have gravitated toward the realized price, which now stands near $54,900. The metric estimates the average acquisition cost of all circulating coins.

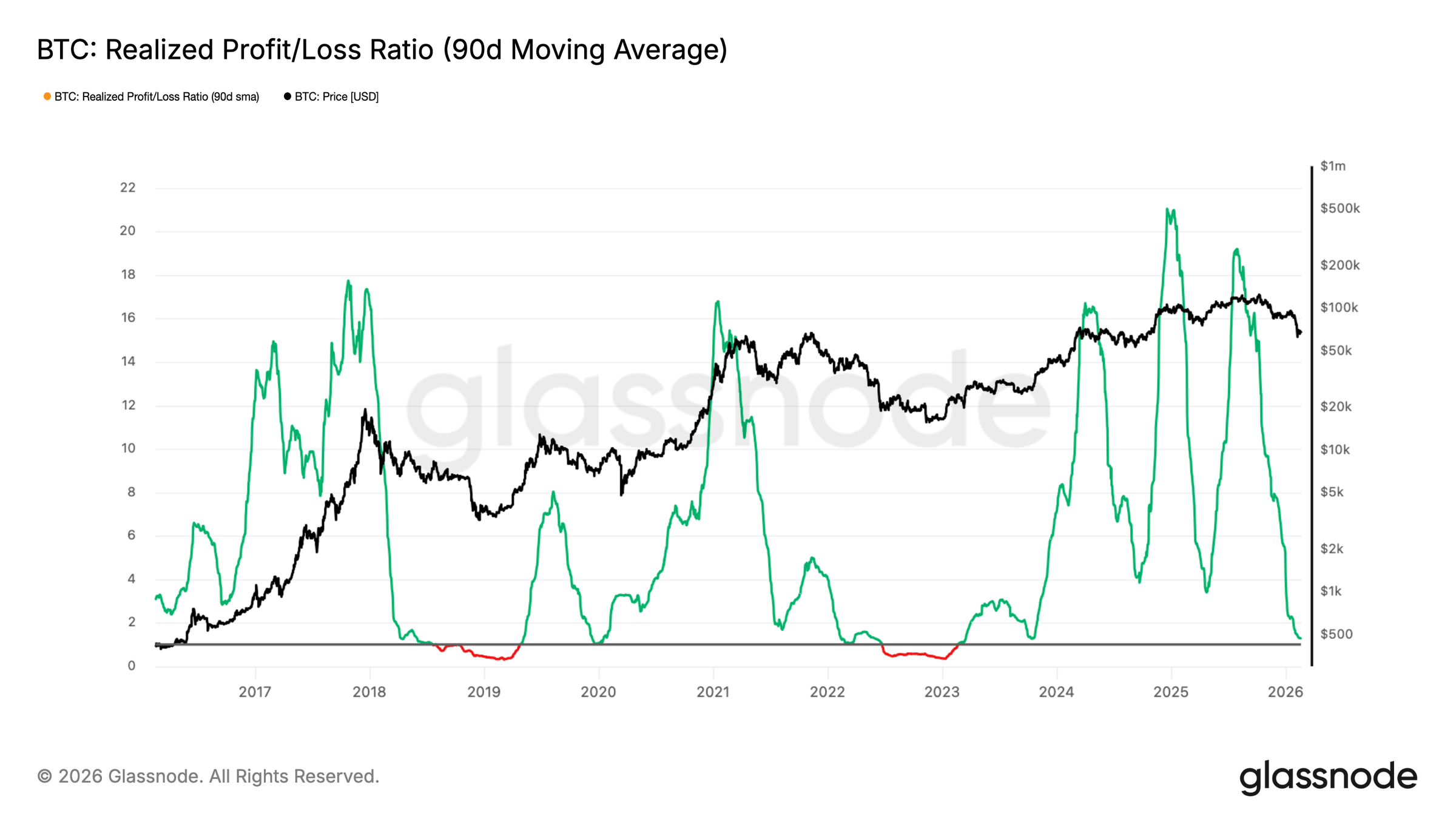

Bitcoin’s liquidity conditions also remain compressed. The 90-day realized profit/loss ratio has declined back into the 1–2 range, a level associated with limited capital rotation. A sustained move below 1 has aligned with stressed bear environments.

Related: Google searches for ‘Bitcoin going to zero’ at highest since 2022

BTC accumulation rises even as activity slows down

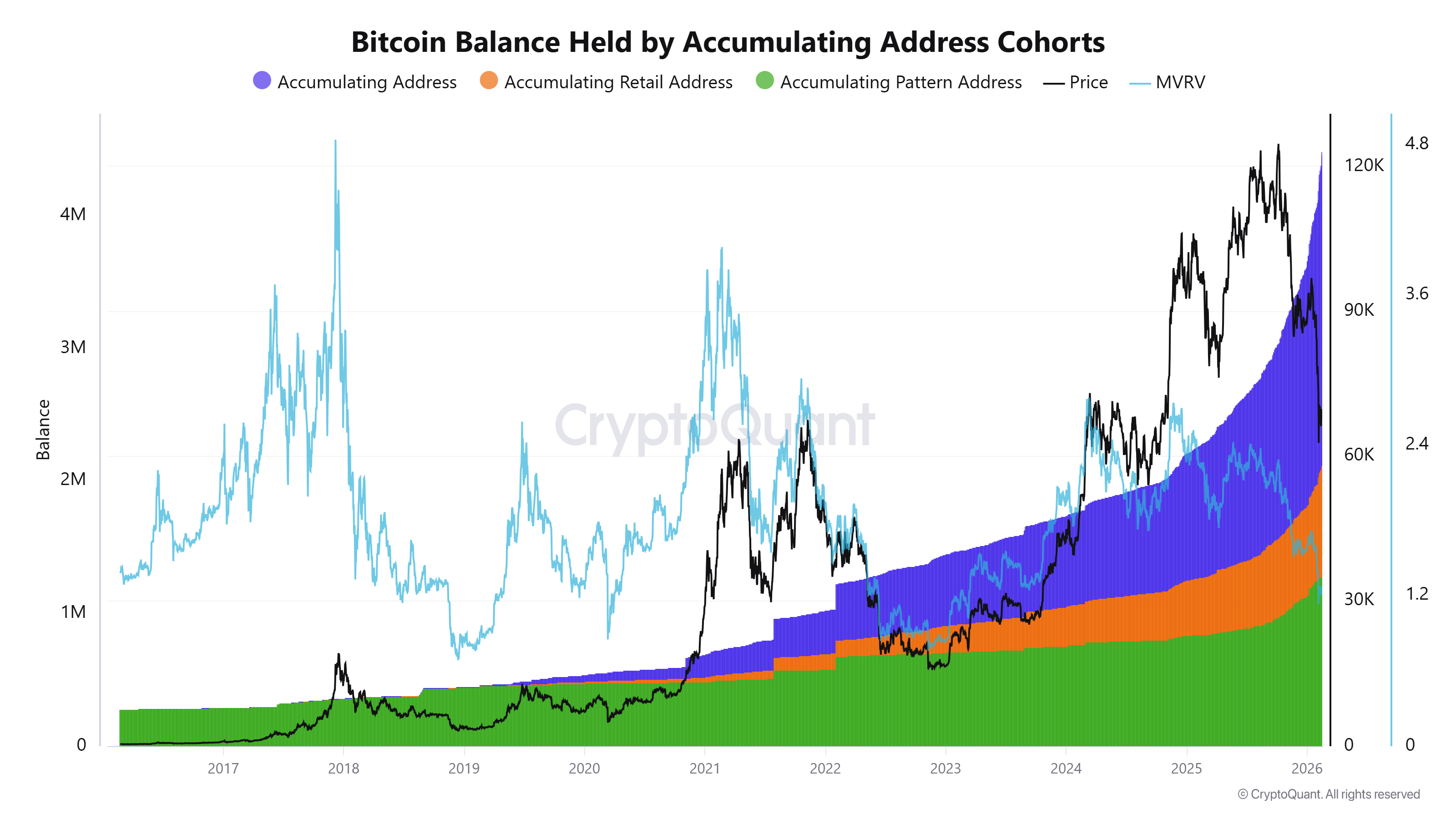

CryptoQuant data shows that the balances held by accumulating address cohorts have continued rising into early 2026. Total BTC held by these cohorts has expanded to over 4 million BTC, up from roughly 2 million BTC in early 2024, which reflects a steady supply absorption.

The retail-linked accumulation addresses have increased their holdings by 850,000 BTC, while the accumulating pattern wallets, addresses that steadily add BTC in recurring intervals with minimal outflows, grew their size to 1.27 million BTC. This expansion occurred even as the price dropped in 2026.

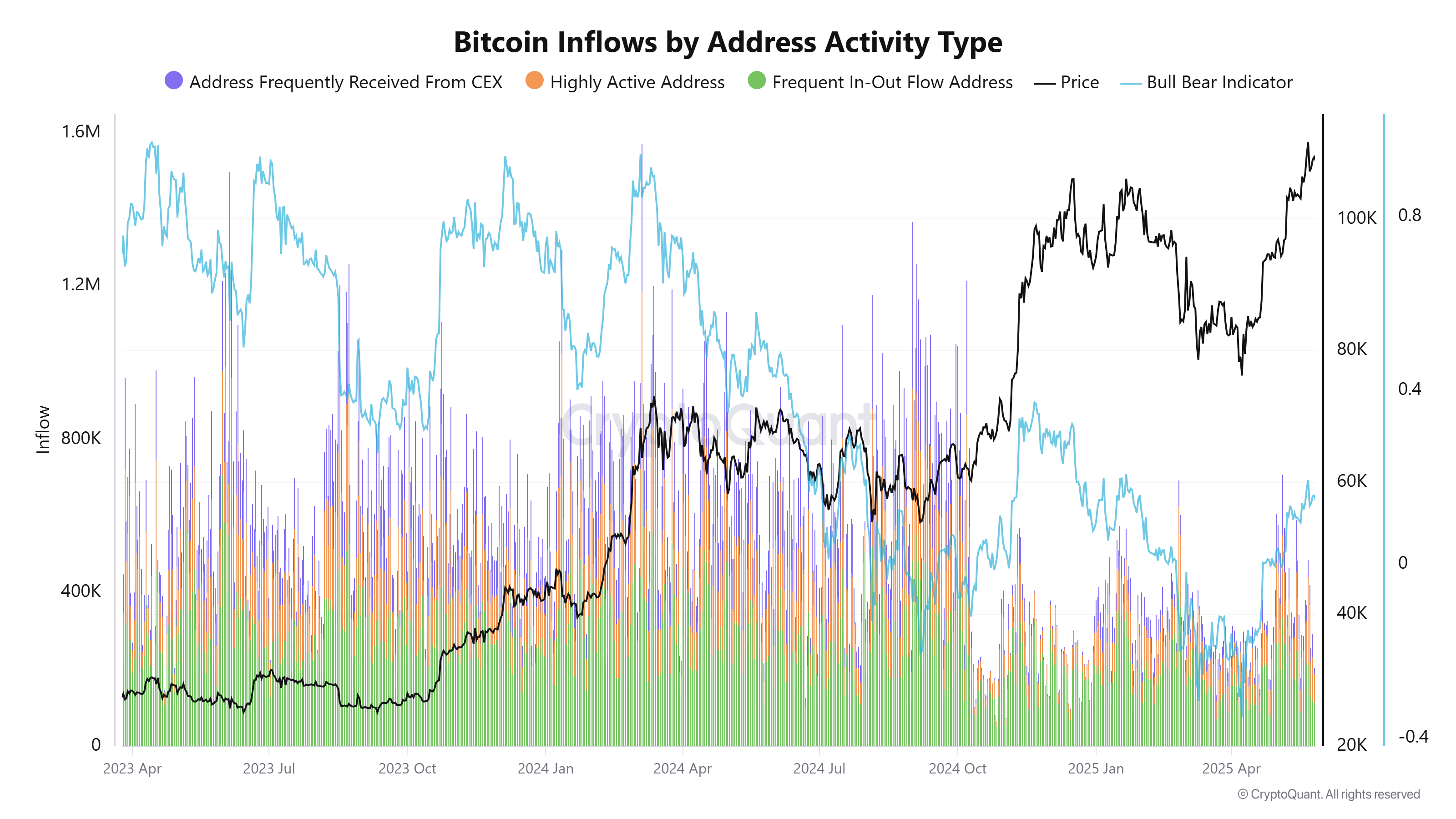

In contrast, the inflows from centralized-exchange addresses and highly active addresses have moderated. Compared with the 2023 to 2024 expansion phases, where inflow spikes frequently exceeded 1.2 to 1.5 million BTC, the recent activity has remained significantly lower, averaging around 300,000 to 400,000 BTC.

The divergence shows that more BTC is being absorbed into long-term wallets while fewer coins are rotating through major exchanges. That reduces the liquid supply and slows down short-term trading activity.

Related: Bitcoin’s consolidation nears ‘turning point’ as $70K comes in focus: Analyst

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here