Bitcoin (BTC) starts the second week of February still on the defensive after last week’s sharp drawdown, with traders increasingly eyeing a deeper retracement toward $60,000 — and even $50,000 — before a durable macro bottom forms.

-

Market forecasts agree that Bitcoin price action has not yet put in a reliable long-term bottom.

-

CPI week comes as markets lose faith in Fed rate cuts in March.

-

US dollar strength begins to fade as analysts eye a potential rerun of 2021 for Bitcoin-dollar correlation.

-

Japan’s election turns heads, with analysis seeing a weaker yen and crypto headwinds to come.

-

Bitcoin miners send large amounts to exchanges as the dust settles on the snap downside.

BTC price expected to attempt $60,000 retest

Bitcoin continues to trade above $70,000 as the week gets underway, but traders are anything but bullish on the short-term BTC price outlook.

Data from TradingView shows a lack of volatility around the weekly close, with BTC/USD staying around 20% higher versus its 15-month lows from last week.

In an X thread covering lower time frames, trader CrypNuevo warned that the current relief may end up as a manipulative move to liquidate late short positions.

“The intention to push price up first would be to hit the short liquidations that exist between $72k-$77k mainly. But this move is just a guess,” he wrote.

“What we’re really anticipating here is the long wick getting filled at least 50% of it in the next weekly candles.”

CrypNuevo implied that the lows could see at least a partial retest in the short term.

“It could be an immediate wick-fill. But in the case of having a move up first, then it could probably take around 5-8 weekly candles to get filled,” he forecast.

At the weekend, Cointelegraph reported on a broad consensus that price would make new macro lows in the future — and that these could take BTC/USD to $50,000 or lower.

Guys this isn’t the bottom. It’s just a bounce.

Historically $BTC drops 80% during its bear market.

That puts us near 40k

— Roman (@Roman_Trading) February 6, 2026

Trader Daan Crypto Trades meanwhile considered less exciting BTC price action to come next.

“After such a volatile few weeks, price will attempt to start ranging at some point. With this recent spike in volatility and big retrace yesterday, there’s a good chance we are hitting that point about now,” he told X followers Sunday.

“Would expect volatility to slowly come off a bit again, a range to be formed and from there on out we can reassess and look for opportunities.”

CPI due as Fed policy nerves emerge

The macro focus is back on US inflation data this week as wild gyrations in precious metals settle.

The January print of the Consumer Price Index (CPI), due Friday, forms the highlight and will follow various US employment data releases.

“Earnings season is also in full swing and macroeconomic uncertainty is elevated,” trading resource The Kobeissi Letter added on the week’s outlook.

Since announcing the new Chair of the Federal Reserve, President Donald Trump has failed to calm market nerves about future financial policy. His pick, Kevin Warsh, is thought to be notionally opposed to easing financial conditions — something that has already weighed on risk-asset performance.

Markets thus have little faith in interest rates going lower at the Fed’s next meeting in mid-March — even if Warsh is only due to take over in May.

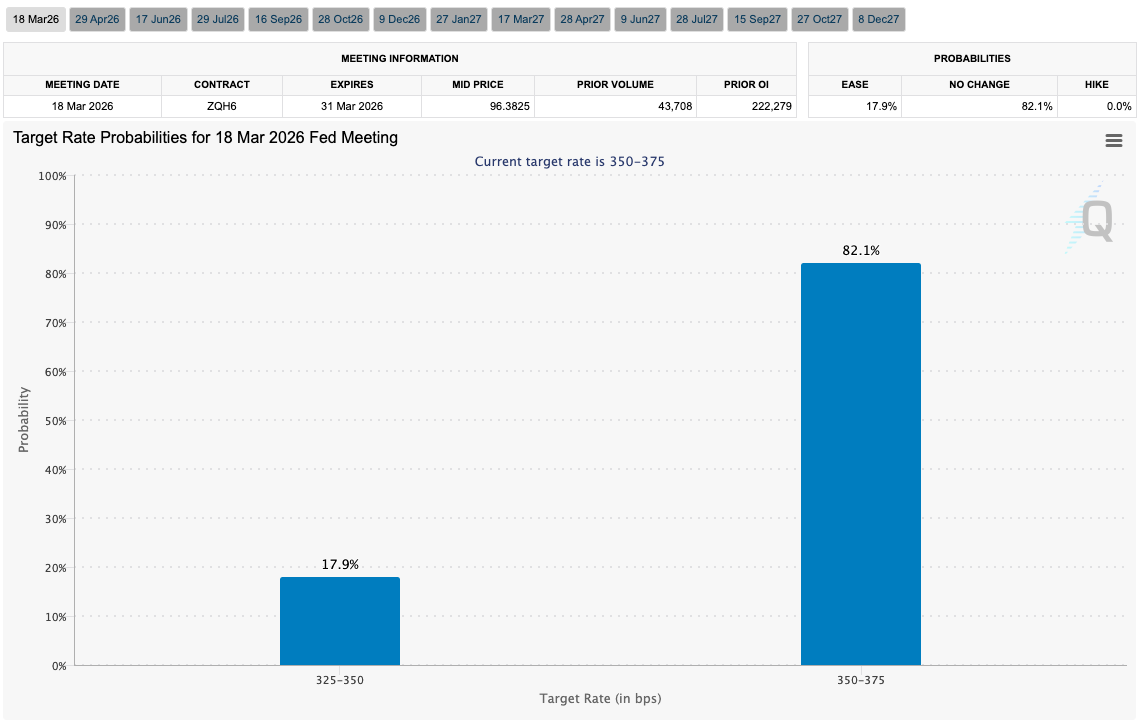

Data from CME Group’s FedWatch Tool currently gives 82% odds of rates staying at current levels.

Commenting, analytics resource Mosaic Asset Company pointed to “stubborn” US inflation statistics as a reason for a more hawkish Fed — and associated market nerves.

“The combination of stronger economic growth and stubbornly high core inflation might starting casting a doubt on the interest rate outlook across the yield curve,” it wrote in the latest edition of its regular newsletter, “The Market Mosaic.”

Mosaic said that difficult conditions for the Fed were a “major catalyst behind the selloff in growth and AI stocks this year.”

“Rising rates makes the present value of future corporate profits worth less in today’s terms, while higher rates presents competition for investor capital as well,” it added.

As the week began, meanwhile, gold returned to the $5,000 mark, while US stocks futures joined Bitcoin in a relief bounce off Friday’s lows.

US dollar at a ten-year crossroads

For both Bitcoin and the broader risk-asset market, US dollar strength is becoming an increasingly important potential volatility catalyst.

The US dollar index (DXY), which enjoyed a relief rally following a trip to multiyear lows near 95.5 in late January, is failing to reclaim levels above 98.

A strong dollar tends to result in pressure for Bitcoin, and while the correlation has undergone many changes in recent years, the long-term trend may provide bulls with a more reliable tailwind.

“Still holding that support. But really critical level for the long-term trend,” analyst Aksel Kibar wrote in recent dollar commentary.

“$DXY can offer a great trade setup soon. Long or short. irrespective of direction.”

Kibar eyed DXY possibly now breaking out of a ten-year trading channel to the downside, but said that more data would be necessary before this was confirmed.

An alternative perspective comes from Henrik Zeberg, chief macro economist at crypto market insight company Swissblock.

In an X post last week, Zeberg likened the current relationship between BTC and DXY to early 2021 — around ten months before BTC/USD saw the blow-off top in its last bull market.

Far from breaking down, DXY could in fact be at the start of its next bull run.

“Strong DXY is BEARISH for BTC – just not in the initial phase of the Bull. Likely because ROTATION into US Assets,” he wrote.

“In 2021 – we had 12 weeks of BTC rally into the new DXY Bull. The rally gained 130% into the TOP for BTC. I see same development again! +100% gain in BTC – into its FINAL TOP.”

An accompanying chart suggested a target for that “final top” at $146,000.

Yen weakness stays on the radar

For the short term, however, Bitcoin faces another macro hurdle: a new fiscal policy era in Japan.

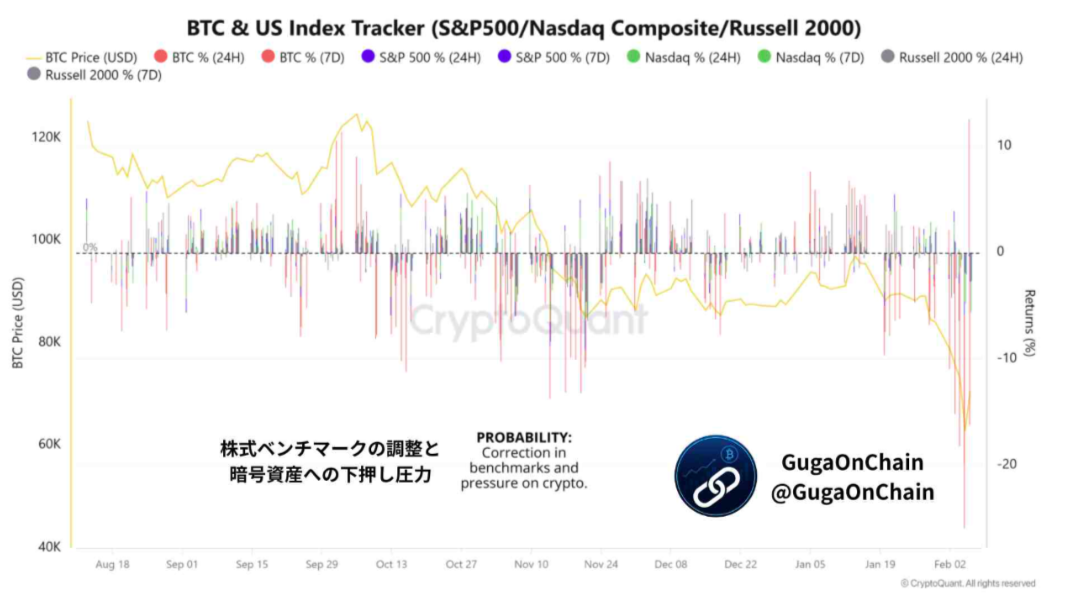

After the reelection of Prime Minister Sanae Takaichi, Japanese stocks surged to record highs — and analysis now sees negative impacts for US investment vehicles and crypto.

“The landslide victory of Sanae Takaichi marks Japan’s shift toward aggressive fiscal stimulus and tolerance for currency depreciation,” analyst XWIN Research Japan wrote in a blog post published on onchain analytics platform CryptoQuant.

“The ‘Takaichi Trade’ has lifted the Nikkei to record highs while reshaping global capital flows.”

XWIN referenced findings warning of “slowing inflows” into US equity exchange-traded funds (ETFs), thanks to a weaker yen increasing the attractiveness of Japanese bonds.

“Against this backdrop, Bitcoin faces short-term downside risk,” it continued.

“In risk-off phases, BTC tends to correlate with U.S. equities, allowing equity-led de-risking to spill into crypto markets. This pressure does not reflect deterioration in Bitcoin’s on-chain fundamentals, but cross-asset risk management.”

As Cointelegraph reported, crypto markets remain highly sensitive to Japan-related news, with one theory even attributing the yen carry trade to last week’s BTC price crash.

Analyzing the yen situation ahead of the election, Robin Brooks, a senior research fellow at Brookings, described its weakness as a “political liability.”

“With the election out of the way, especially if Takaichi does well, the optics of Yen depreciation won’t matter nearly as much,” he predicted.

“So the election is conceivably a catalyst for the next round of Yen weakening.”

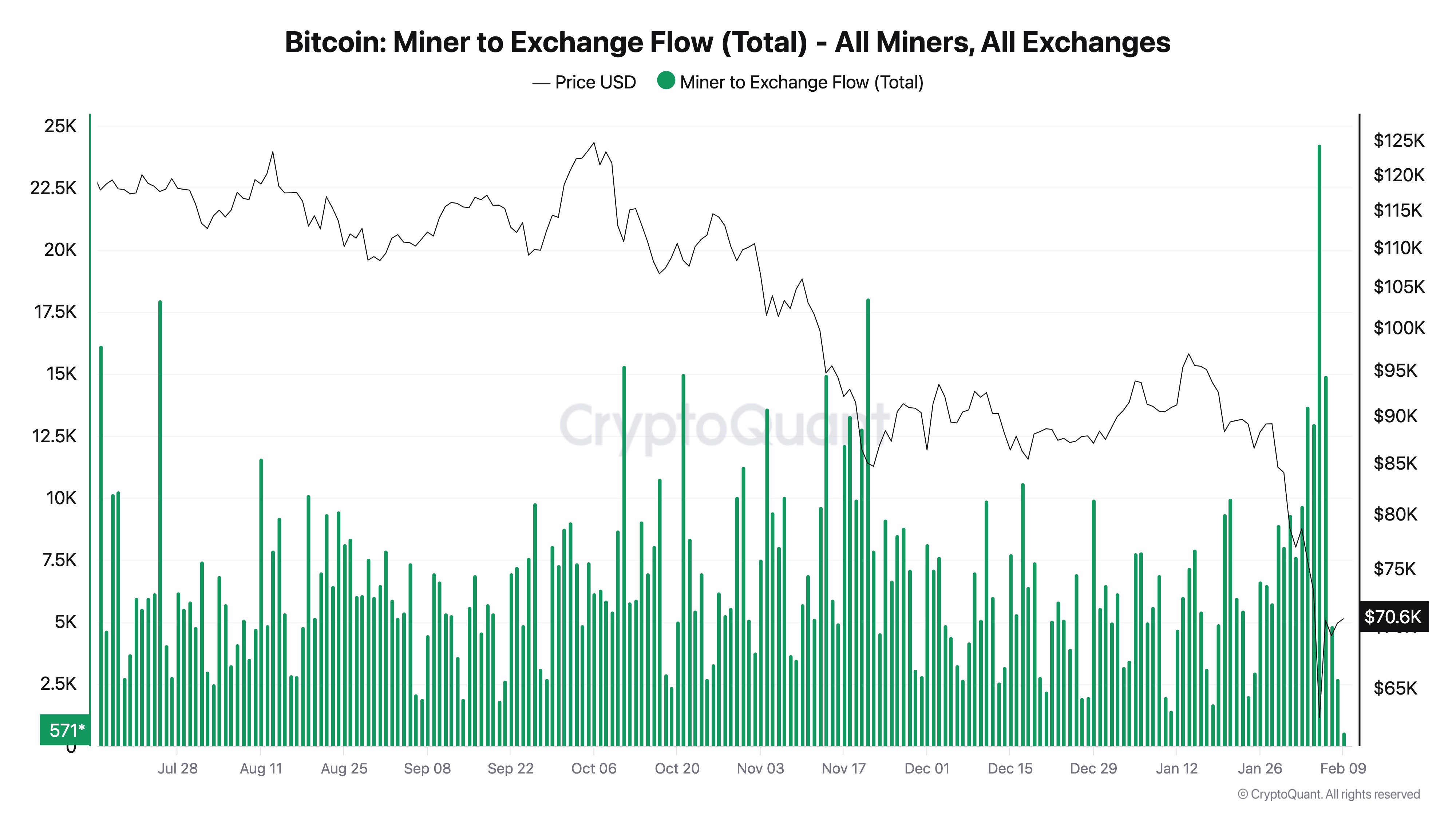

Bitcoin miners see “exceptional” exchange inflows

Bitcoin miners are busy adjusting to current reality after Bitcoin’s 15-month lows — but research warns that a sell-off risk remains.

Related: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

Miner inflows to exchanges reached their highest levels since 2024 in recent days, with Feb. 5 alone seeing total deposits of 24,000 BTC.

Describing that tally as “exceptional,” CryptoQuant contributor Arab Chain said that the market is undergoing a “redistribution phase.”

“Notably, this rise in miner activity comes within a market environment characterized by clear volatility and reduced risk appetite among segments of traders, which could add an extra layer of short-term selling pressure,” a blog post explained.

“However, these inflows do not necessarily indicate the start of a prolonged downtrend, but rather may represent a natural redistribution phase within the market cycle.”

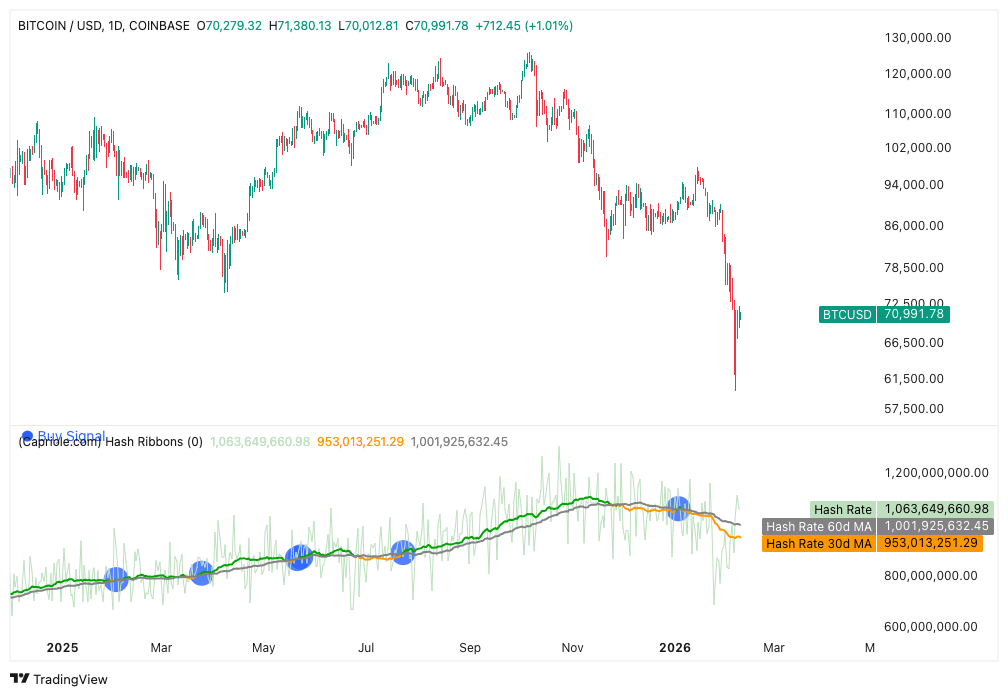

The classic Hash Ribbons indicator, which measures periods of miner stress, likewise continues its reaction to Bitcoin’s flash crash.

The indicator’s two moving averages of hash rate show no sign of forming a classic bullish cross, firmly invalidating its latest “buy” signal from early January.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here