Bitcoin network economist Timothy Peterson maintains his optimistic outlook for BTC (BTC), suggesting that there is a 75% chance that the asset will hit new highs in the next nine months.

In a March 25 X post, Peterson highlighted BTC’s current position near the lower bound of its historical range. The analyst emphasized that Bitcoin’s current path aligns with the bottom 25% threshold, giving it majority odds for a positive rally.

Bitcoin 10-year seasonality chart. Source: X.com

Peterson said,

“Here is a 50% chance it will gain 50%+ in the short term.”

Peterson’s statements follow an earlier study that found that most of Bitcoin’s annual bullish performance occurred in April and October, which have averaged 12.98% and 21.98%, respectively, over the past decade.

Bitcoin monthly returns. Source: CoinGlass

Related: Bitcoin flips ‘macro bullish’ amid first Hash Ribbon buy signal in 8 months

Bitcoin onchain cost basis zone key investors’ levels

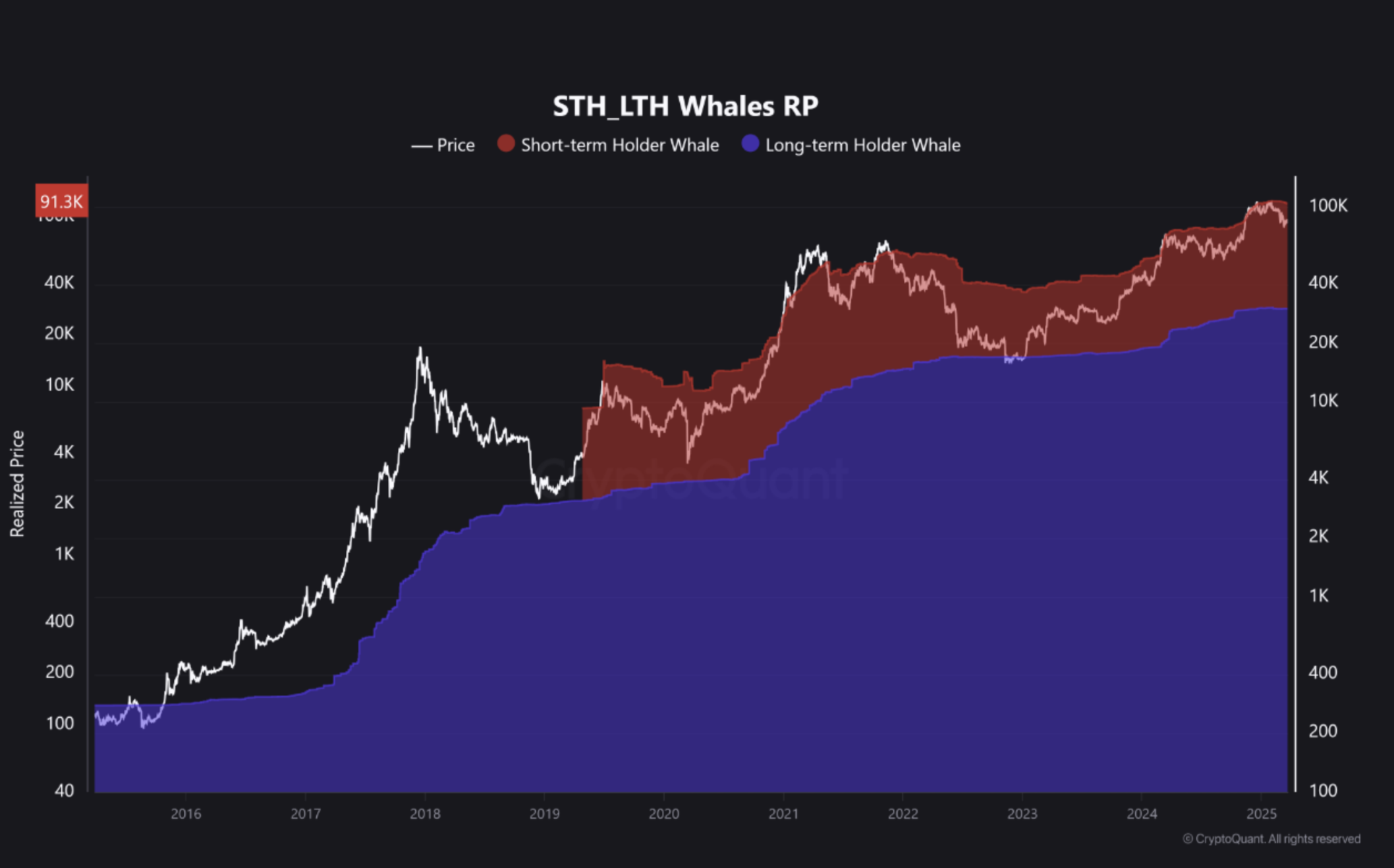

In a recent quicktake post on CryptoQuant, anonymous analyst Crazzyblockk said that the realized price for short-term whales is $91,000, whereas most highly active addresses hold a cost basis between $84,000 and $85,000.

Bitcoin short-term whales position. Source: CryptoQuant

A dip below the cost basis could trigger selling, making the $84,000 to $85,000 range a critical liquidity zone.

The analyst added,

“These onchain cost basis levels represent decision zones where market psychology shifts. Traders and investors should closely monitor price reactions in these areas to gauge trend strength and potential reversals.”

Related: BlackRock launches Bitcoin ETP in Europe

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here