BlackRock’s first tokenized money market fund has paid out $100 million in cumulative dividends since its launch, highlighting the growing real-world use of tokenized securities amid rising institutional adoption.

The milestone for the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) was announced Monday by Securitize, which serves as the fund’s issuer and tokenization partner, overseeing onchain issuance and investor onboarding.

Launched in March 2024, BUIDL was initially issued on the Ethereum blockchain. The fund invests in short-term, US dollar–denominated assets, including US Treasury bills, repurchase agreements and cash equivalents, offering institutional investors a blockchain-based vehicle to earn yield while maintaining liquidity.

Investors purchase BUIDL tokens pegged to the U.S. dollar and receive dividend distributions directly onchain, reflecting income generated from the underlying assets.

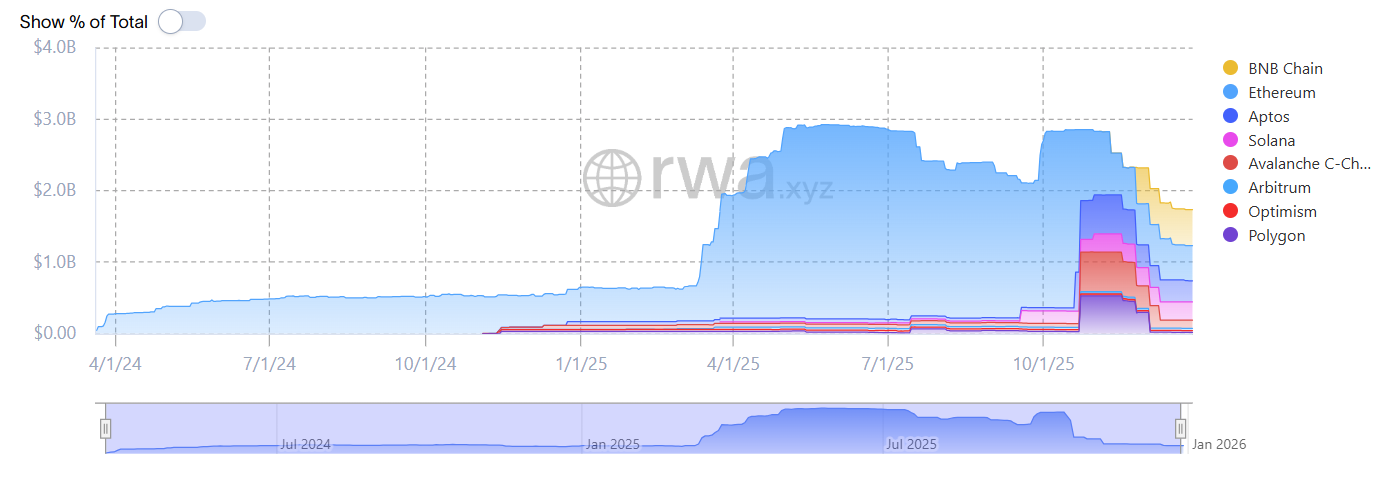

Since its debut on Ethereum, BUIDL has expanded to six additional blockchains, including Solana, Aptos, Avalanche and Optimism.

The $100 million milestone is notable because it represents lifetime payouts derived from actual Treasury yields distributed to holders of onchain fund tokens. It demonstrates that tokenized securities can operate at scale while mirroring the core functions of traditional financial products.

The development also underscores the operational efficiencies enabled by blockchain technology, including faster settlement, transparent ownership records and programmable distributions, features that are increasingly drawing interest from large asset managers and institutional investors exploring tokenized real-world assets.

BUIDL, in particular, has seen strong adoption, with the value of the tokenized fund surpassing $2 billion earlier this year.

Related: Fragmentation drains up to $1.3B a year from tokenized assets: Report

Tokenized money market funds gain traction and scrutiny

Tokenized money market funds have quickly emerged as one of the fastest-growing segments of the onchain RWA market, and for good reason. Their appeal lies in their ability to deliver money market–style returns with greater operational efficiency, a dynamic that has begun to draw attention from traditional financial institutions.

Some market participants view these products as a potential counterweight to the anticipated growth of stablecoins.

In July, J.P. Morgan strategist Teresa Ho said tokenized money market funds preserve the longstanding appeal of “cash as an asset,” even as regulatory developments such as the approval of the GENIUS Act were expected to accelerate stablecoin adoption and potentially erode the role of cash-like instruments.

Despite their rapid growth, tokenized money market funds have also attracted industry scrutiny. The Bank for International Settlements recently warned that such products could introduce operational and liquidity risks, particularly as they become an increasingly important source of collateral within the digital asset ecosystem.

Related: Real-world assets top DEXs to become 5th-largest category in DeFi by TVL

Read the full article here