Bank of America CEO Brian Moynihan warned that interest-bearing stablecoins could pull as much as $6 trillion out of the US banking system, arguing that large-scale deposit migration would reduce lending capacity and push borrowing costs higher.

The comments surfaced after a crypto investor shared a screenshot from Bank of America’s earnings call transcript on X.

During the call, Moynihan pointed to Treasury-cited studies showing that a significant share of bank deposits could shift into stablecoins if issuers are allowed to pay interest. He said such products would function more like “a money market mutual fund concept,” with funds held in cash, central bank reserves or short-term Treasurys rather than deployed for lending.

Moynihan said such a shift would move deposits off bank balance sheets, shrinking credit availability, particularly for small and mid-sized businesses that rely more heavily on bank loans than capital markets.

The comments come amid stalled progress in crypto legislations in the United States. On Wednesday, the US Senate Banking Committee postponed a markup of the crypto market structure bill that had been scheduled for Thursday, with committee Chair Tim Scott saying the delay was needed to allow for further bipartisan negotiations. Scott did not provide a new date for the markup.

The postponement followed a similar move by the Senate Agriculture Committee, which earlier this week pushed its own markup of the crypto bill to Jan. 27.

Related: Coinbase could pull CLARITY Act support over stablecoin rewards ban

The debate over stablecoin yield

Whether stablecoin issuers or the exchanges and third parties that distribute their tokens should be allowed to offer yield has emerged as a key point of contention in negotiations across Congress.

Banking groups have said yield-bearing stablecoin products function similarly to unregulated investment products and have been vocal about closing any loopholes that allows yield to be passed to tokenholders.

On Jan. 7, the Community Bankers Council wrote a letter to lawmakers that echoed concerns raised by Moynihan, warning that as much as $6.6 trillion in bank deposits could be at risk if restrictions are not enforced. They wrote:

If billions are displaced from community bank lending, small businesses, farmers, students, and home buyers in towns like ours will suffer. Crypto exchanges and the constellation of stablecoin-affiliated companies are not designed to fill the lending gap, nor will they be able to offer FDIC-insured products.

Crypto industry leaders are divided on the current state of the CLARITY Act, a bill aimed at clarifying the regulatory framework for digital assets that has passed in the House of Representatives and is awaiting Senate consideration.

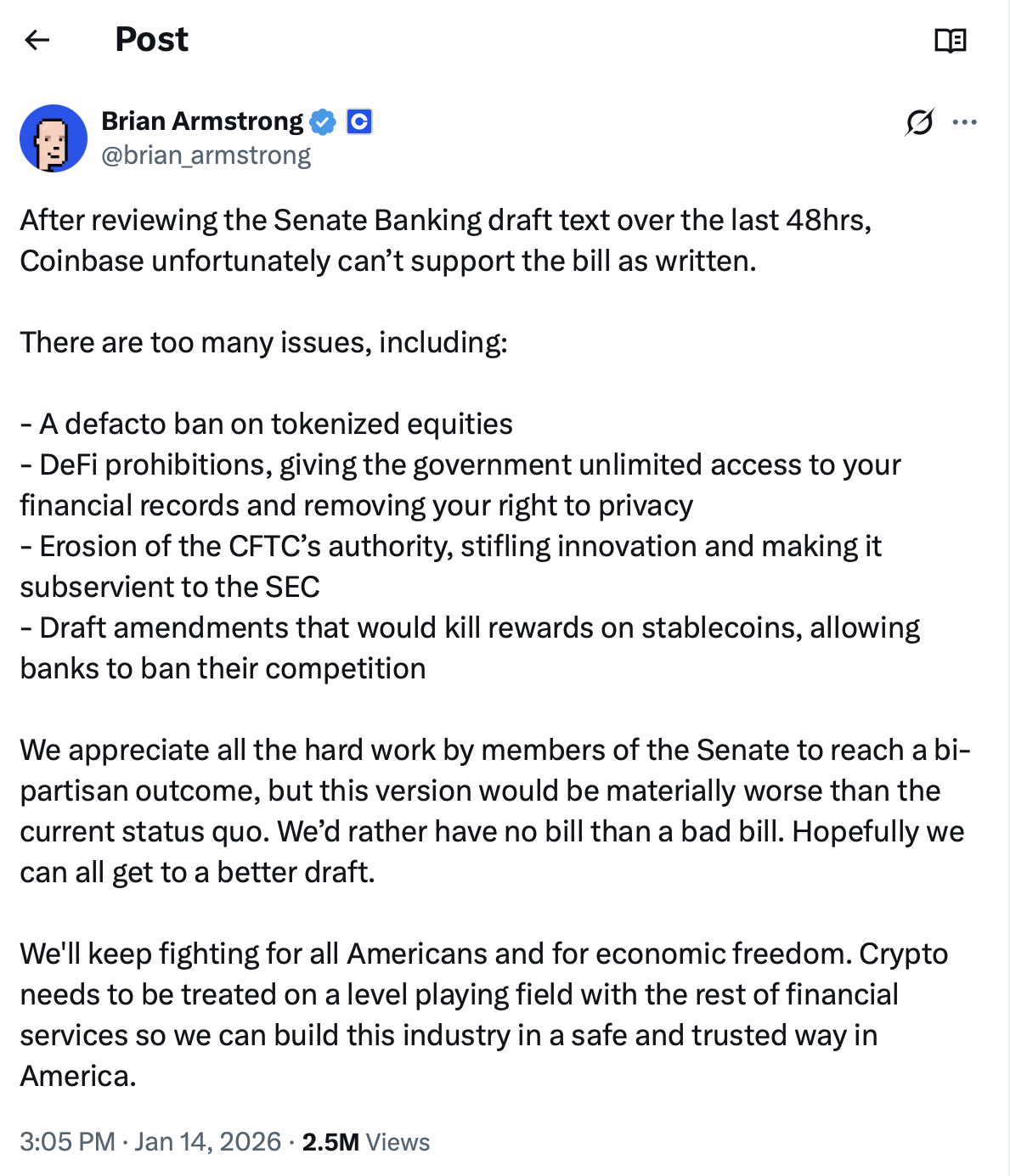

On Wednesday, Coinbase CEO Brian Armstrong said the company could not support the Senate Banking Committee’s draft of the bill because, among other things, it would “draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition.”

He added that Coinbase would “rather have no bill than a bad bill” if the legislation advances in its current form.

Other industry leaders have taken a more optimistic view. On Thursday, a16z Crypto managing partner Chris Dixon said that while the bill is “not perfect” and still requires changes, advancing the CLARITY Act is necessary if the US wants to remain a leading hub for crypto innovation.

Magazine: ‘China’s Ethereum’ in civil war, Japan to embrace Bitcoin ETFs: Asia Express

Read the full article here