Bitcoin (BTC) traded as high as $76,900 on Wednesday, up 4.5% above its 15-month low of $72,860, reached on Tuesday. However, there are increasing signs that Bitcoin’s price could experience a deeper correction over the following weeks or months.

Key takeaways:

-

Bitcoin confirms bearish technical patterns on multiple time frames, risking a deeper correction toward $60,000.

-

Bitcoin’s Puell Multiple could stay in the discount zone longer, indicating a continuation of the downtrend.

-

A surge in BTC inflows to Binance could provide bears with fuel for a deeper pullback.

Bitcoin’s chart technicals target sub-$60,000

The BTC/USD pair had confirmed a head-and-shoulders (H&S) pattern on its weekly chart, warning of a deeper correction ahead.

The price broke below the neckline of the H&S pattern at $82,000 on Saturday, to continue the downward trend with a measured target of $52,650.

Related: Next Bitcoin accumulation phase may hinge on credit stress timing: Data

Such a move would bring the total losses to 31% from the current level and the drawdown from the $126,000 all-time high to 58%.

Crypto analyst BitcoinHabebe said that Bitcoin’s drop toward the H&S pattern’s target at $60,000 was “obvious,” due to a myriad of macroeconomic headwinds.

Others, meanwhile, put forth even lower targets. The H&S setup is a “very scary picture,” said analyst 0xLanister in a Wednesday post on X, adding:

“Bitcoin price will drop to $40,000.”

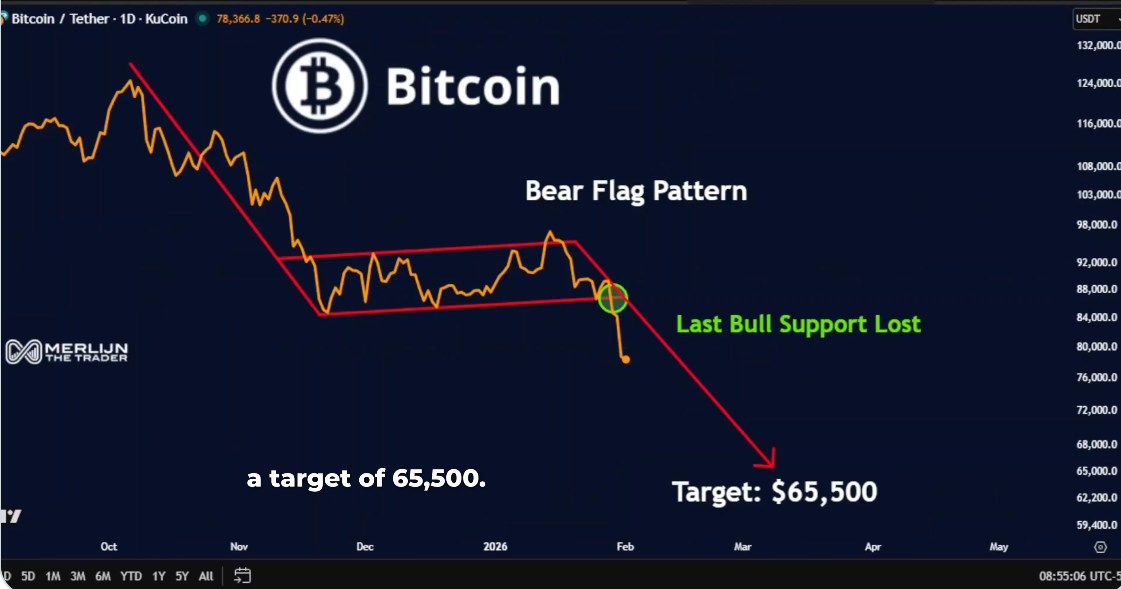

Traders also spotted the confirmation of a bear flag pattern on the daily price chart after key support levels were lost.

“Bear flag confirmed on Bitcoin,” once the last support at $78,000 failed to hold, said analyst Merlijn Trader in a recent X post, adding:

“Next liquidity magnet is $65,500.”

As Cointelegraph reported, Bitcoin could continue its downtrend to as low as $58,000 as there are few catalysts for now to reverse the trend.

Bitcoin metric indicates “continuation of bearish trend”

Bitcoin appears to be in “accumulation” territory, according to the Puell Multiple, which tracks miners’ daily revenue against the annual average. It has extended its decline into the discount zone, following Bitcoin’s latest drop to 15-month lows below $73,000.

“The indicator has been in this range for at least three months, since November 2025,” said CryptoQuant analyst Gaah in a QuickTake analysis on Tuesday.

The average period the indicator remains in the discount zone is about 200 days, Gaah said, adding:

“We are halfway through the period, indicating a continuation of the bearish trend in price BTC.”

Lower prices also mean that Bitcoin miners remain under pressure with lower revenues. This could be the “perfect fuel for small entrepreneurs in the sector to shut down machines and capitulate to cover expenses,” Gaah added.

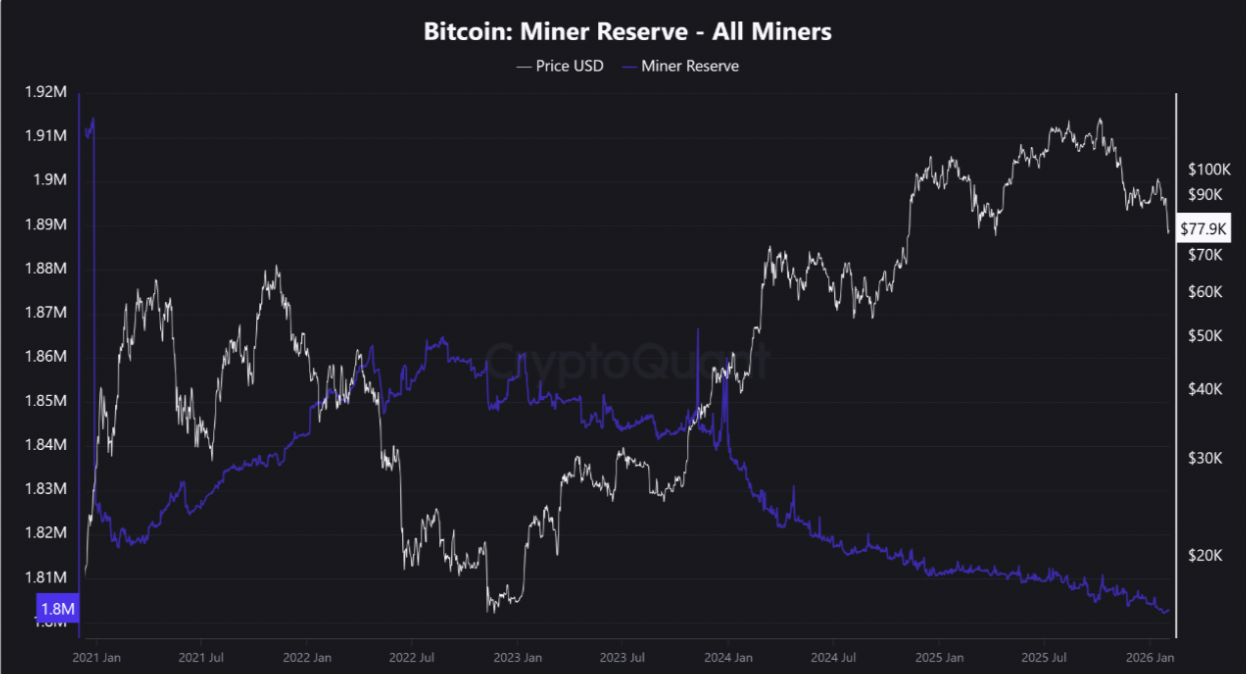

This is evidenced by decreasing miner reserves, which have been declining over the last four years to 1.8 million BTC at the time of writing.

“If price continues to decline, this effect intensifies, increasing pressure to sell miners’ reserves.”

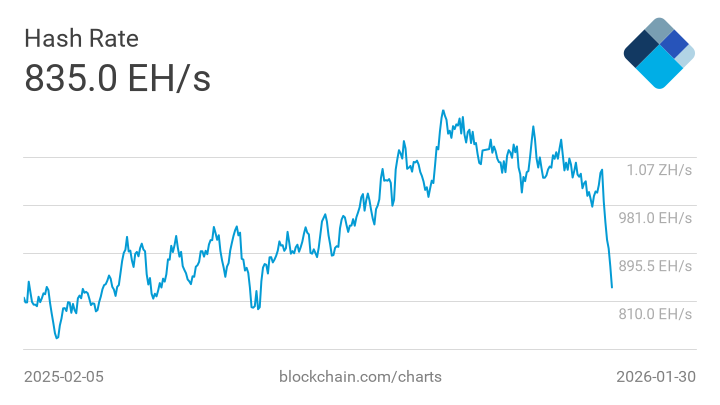

Additionally, Bitcoin’s total network hash rate has dropped 12% since the November 2025 highs, the largest decline since 2021, which suggests possible miner capitulation underway at current prices.

Large BTC inflows to Binance raise alarm

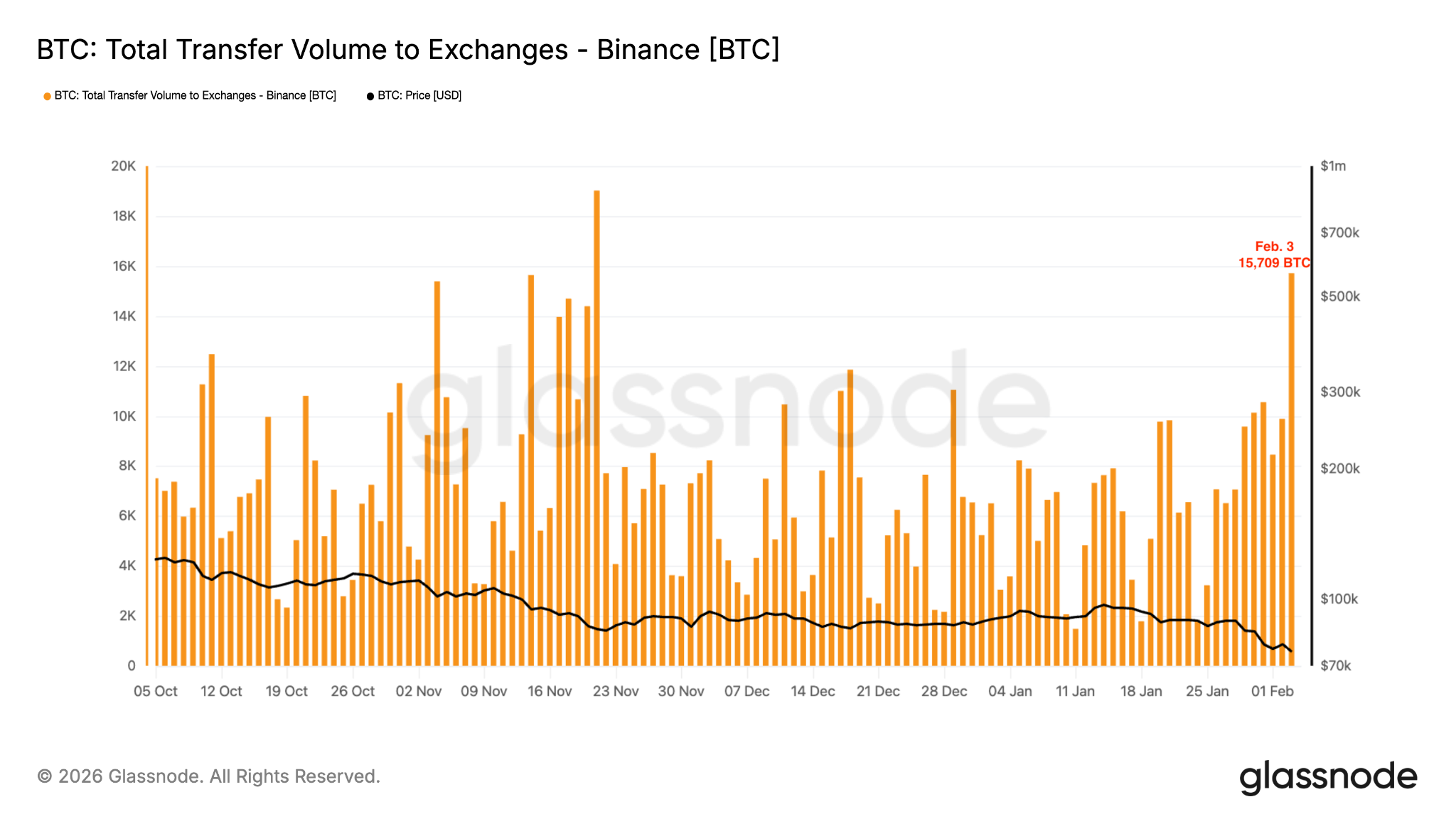

Daily BTC inflows to Binance reached 15,709 on Tuesday, the highest reading since Nov. 21, 2025, based on onchain data. Historically, similar inflow peaks, such as the one recorded in November, have been followed by sharp downward moves in price.

This surge suggested that holders are actively preparing to de-risk, or capitulate, following its drop below key support levels.

“BTC inflows trigger FUD as selling pressure builds on Binance,” said CryptoQuant analyst Darkfost in a Wednesday post on X, referring to high volume Bitcoin transfers to the exchange on Monday and Tuesday.

“Over those two days, between 56,000 and 59,000 BTC were sent to Binance, representing a real selling pressure on the spot market,” Darkfost said, adding:

“This suggests that we are entering a phase of capitulation and panic as BTC becomes oversold, a context that has historically often allowed for the formation of a bottom, both in the short term and over longer horizons.”

With the market attempting to secure support above $74,000, Binance’s growing inventory should worry the bulls. Until the excess supply is absorbed, the recovery could be short-lived.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here