The amount of Ether (ETH) in the queue to be staked has surpassed that waiting to be unstaked, an occurrence that has previously preceded massive ETH price rallies.

Key takeaways:

-

Ethereum staking queue surpasses the exit queue, historically an occurrence that has led to major ETH price rallies.

-

ETH appears bullish above $2,750, with charts hinting at a $5,000 target.

Ethereum validator entry queue surpasses exit queue

Ethereum’s entry queue increased to 745,619 ETH worth $2.2 billion at current prices, with a 13-day wait time. This has surpassed the exit queue for the first time since June, currently at 360,528 ETH ($1.06 billion).

This marks the highest amount of Ether set for staking by the network’s validators since November 30.

Related: Ethereum’s TVL could skyrocket ’10X’ in 2026: Sharplink CEO

Data from ValidatorQueue notes that the current number of active validators is above 983,371 million, with 29.3% of the total ETH supply staked, or around 35.5 million ETH.

“Ethereum validator entry queue just flipped exit queue,” DefiIgnas said in a Saturday X post, adding:

“The Pectra upgrade improved staking UX and raised maximum validator limits, making restaking easier for large balances.”

This means that most validators are looking to hold on to their ETH, reducing the sell-side pressure.

“ETH validator entry queue is now bigger than the exit queue, for the first time in six months,” head of defi Monad, Abdul, said in an X post on Sunday, adding:

“The last time this happened in June, ETH doubled in price shortly after.”

Data from TradingView reveals that the last two times the number of ETH waiting to be staked surpassed that to be unstaked were in March and June, preceding 90% and 126% Ether price rallies, respectively.

If history repeats itself, ETH price could climb to as high as $5,000 in 2026, on the back of increased staking, higher network activity and lower transaction fees.

Ether’s 2024 fractal setup targets $5,000 ETH price

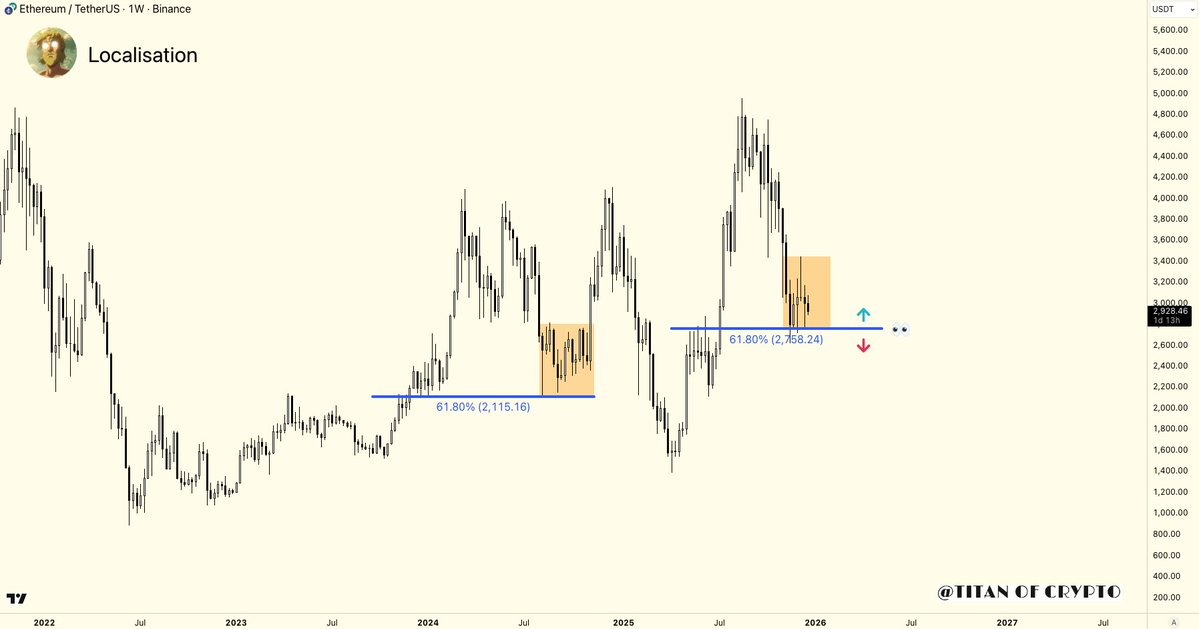

Ether’s current technical structure closely mirrors the setup that sparked its Q4/2024 price rally.

The chart below suggests that the current horizontal price action within the $2,750-$3,200 range is behaving much like the whipsaw within $2,260 and $2,750 between July and October 2024.

Once the price broke above the high range at $2,750, it went on to rise 74.5% to $4,100 in December 2024.

With prices holding above $2,750, the ETH/USD pair has the potential to rise 75% from the current levels toward $5,120, echoing the rally that followed a similar technical setup in 2024.

Investor and trader Titan of Crypto said that “ETH has already retraced 61.8% from its last impulsive move,” adding that it is currently at a level where the price often reacts, as seen in mid-2024.

He added:

“$2,750 is the key level to watch over the coming weeks.”

As Cointelegraph reported, Ether’s rise to new all-time highs in 2026 could be in question or even a “bull trap,” according to some prominent industry figures.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here