Key takeaways:

-

Bitcoin fell to $74,680 after futures market liquidations, yet derivatives data show no signs of panic or extreme bearishness.

-

Spot Bitcoin ETF outflows reached $3.2 billion, but represent less than 3% of assets under management.

Bitcoin (BTC) price plunged to $74,680 on Monday after a total of $1.8 billion in bullish leveraged positions were liquidated since the market downturn on Thursday. Traders moved into cash and short-term government bonds, especially after silver prices fell 41% over three days. Concerns over stretched valuations in the tech sector pushed investors into a more risk-averse stance.

Traders fear that further downside for Bitcoin remains possible as gold has been selected as a clear store of value, and saw its market capitalization reach $33 trillion, an 18% rise over the past 3 months. Despite the price downside, four indicators suggest that Bitcoin may hold above $75,000 through 2026, as macroeconomic risks have eased and traders overstate the scale of outflows and the impact of BTC derivatives.

Yields on the US 2-year Treasury stood at 3.54% on Monday, unchanged from three weeks earlier. A surge in demand for US government-backed assets would likely have pushed yields below 3.45%, similar to October 2025, when the US entered a prolonged government funding shutdown, and nonfarm payroll data weakened.

Likewise, the S&P 500 index traded just 0.4% below its all-time high on Monday, signaling confidence in a swift resolution to the latest US government partial shutdown, which began on Saturday. US House Speaker Mike Johnson told Fox News that an agreement is expected by Tuesday, despite limited support from House Democrats.

Bitcoin derivatives show resilience despite 40.8% price drop

Concerns around the artificial intelligence sector gradually eased after tech giant Oracle (ORCL US) announced plans to raise up to $50 billion in debt and equity during 2026 to meet contracted demand from its cloud customers. Investors had been unsettled by Oracle’s aggressive artificial intelligence expansion, which previously led to a 50% drop in the company’s share price, according to CNBC.

Resilience in Bitcoin derivatives suggests that professional traders have refused to turn bearish despite the 40.8% price decline from the $126,220 all-time high reached in October 2025. Periods of excessive demand for bearish positions typically trigger an inversion in Bitcoin futures, meaning those contracts trade below spot market prices.

The Bitcoin futures annualized premium (basis rate) stood at 3% on Monday, signaling weak demand for leveraged bullish positions. Under neutral conditions, the indicator usually ranges between 5% and 10% to compensate for the longer settlement period. Even so, there are no signs of stress in BTC derivatives markets, as aggregate futures open interest remains healthy at $40 billion, down 10% over the past 30 days.

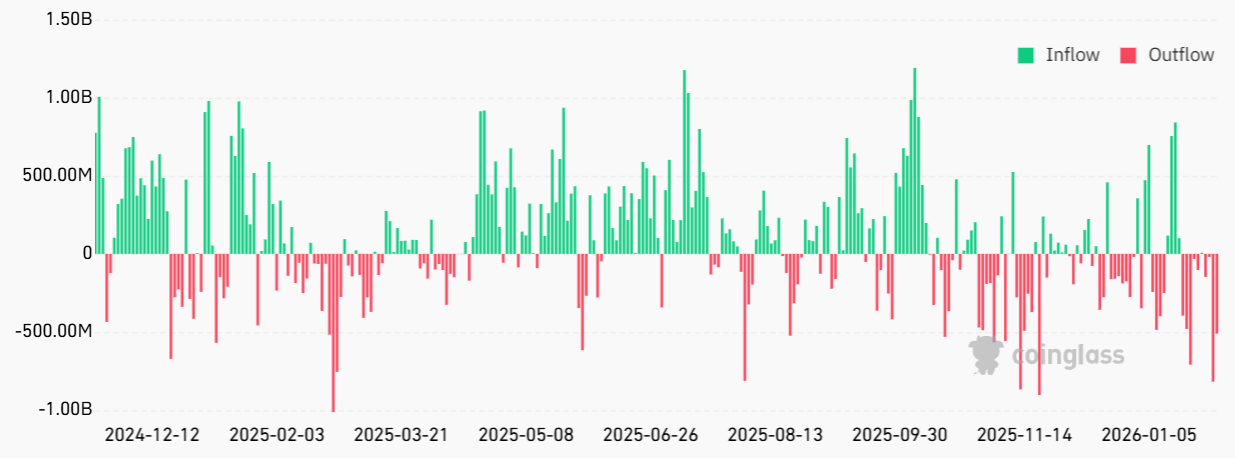

Traders grew increasingly concerned after spot Bitcoin exchange-traded funds (ETFs) recorded $3.2 billion in net outflows since Jan. 16. Even so, the figure represents less than 3% of the products’ assets under management. Strategy (MSTR US) also fell victim to unfounded speculation after its shares traded below net asset value, fueling fears that the company would sell some of its Bitcoin.

Related: Saylor’s Strategy buys $75.3M in BTC as prices briefly dip below $75K

Beyond the absence of covenants that would force liquidation below a specific Bitcoin price, Strategy announced $1.44 billion in cash reserves in December 2025 to cover dividend and interest obligations. Bitcoin’s price may remain under pressure as traders try to pinpoint the drivers behind the recent sell-off, but there are strong indications that the $75,000 support level may hold.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here