The Netherlands’ House of Representatives advanced a legislative proposal on Thursday to introduce a 36% capital gains tax on savings and most liquid investments, including cryptocurrencies.

The legislation reached the 75-vote threshold required to advance, with 93 lawmakers voting in favor of it, according to the House tally.

Under the proposal, savings accounts, cryptocurrencies, most equity investments and gains made from interest-bearing financial instruments are subject to the tax, whether or not the assets are sold.

Critics say the bill will drive capital out of the Netherlands and into jurisdictions with more favorable tax laws, as investors seek a flight to safety from confiscatory taxation.

The Dutch Senate must also pass the bill before it is signed into law, which will take effect in the 2028 tax year, if it is passed, but many investors in the crypto community are already sounding the alarm and predicting capital flight from the country.

Related: European Commission calls on 12 countries to implement crypto tax rules

Investors say the tax is out of touch and will backfire

“France did this in 1997 and saw a massive exodus of entrepreneurs leaving the country,” Denis Payre, co-founder of logistics company Kiala said.

Crypto market analyst Michaël van de Poppe said the proposal is “the dumbest thing I’ve seen in a long time.”

“The number of people willing to flee the country is going to be bananas,” he added, echoing the calls of other industry analysts and executives.

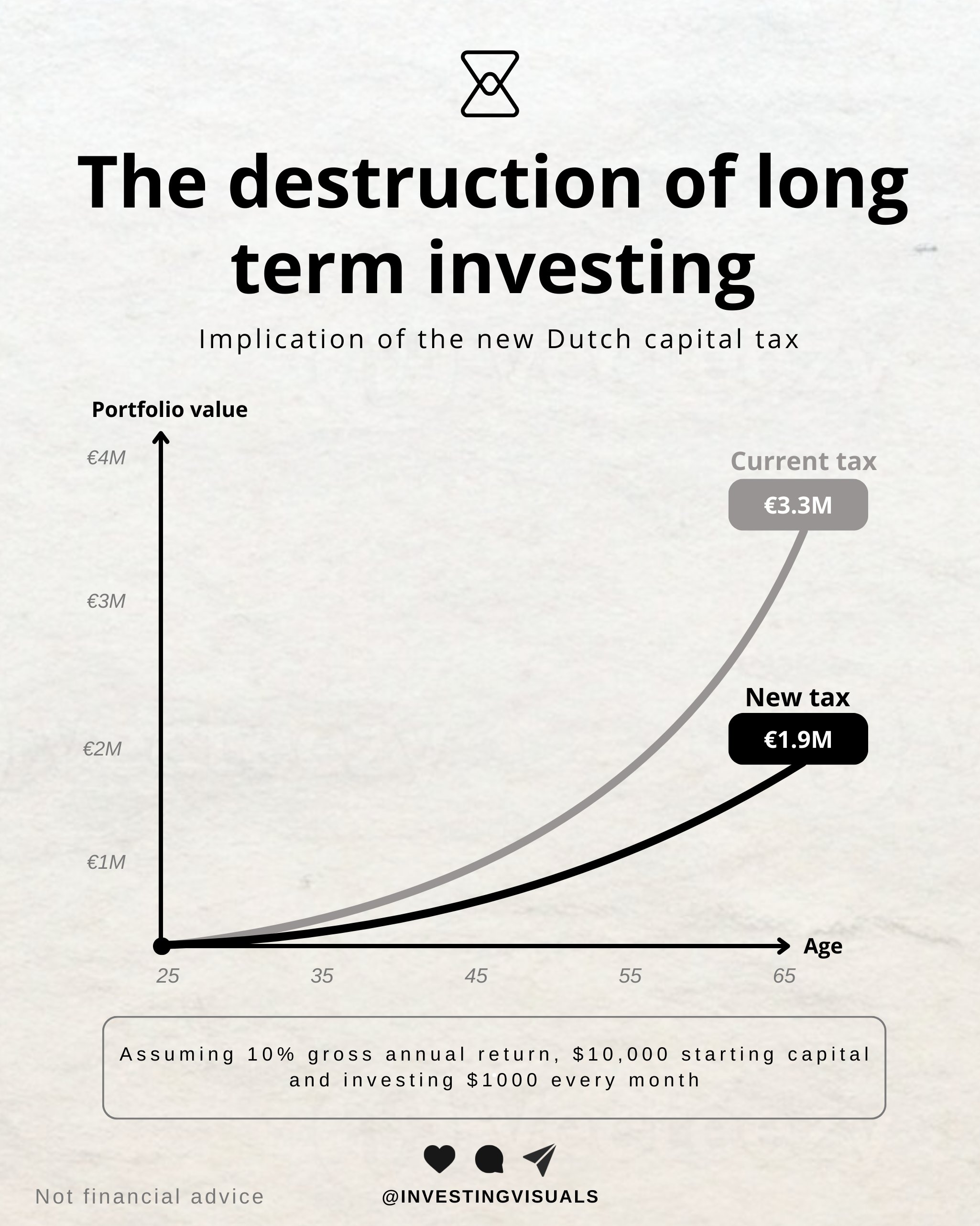

An investor starting with 10,000 euros ($11,871) who contributes 1,000 euros per month over 40 years would end up with about 3,320,000 euros by the end of the 40 years, according to Investing Visuals.

However, the new 36% tax reduces the total amount after 40 years to about 1,885,000 euros, a difference of 1,435,000 euros, Investing Visuals said.

Crypto industry and tech executives in the United States voiced similar concerns about California’s proposed wealth tax on billionaires.

The proposal outlined a 5% tax on an individual’s net worth above the $1 billion threshold, igniting a torrent of backlash and tech entrepreneurs announcing that they were leaving the state of California.

Magazine: Best and worst countries for crypto taxes — plus crypto tax tips

Read the full article here