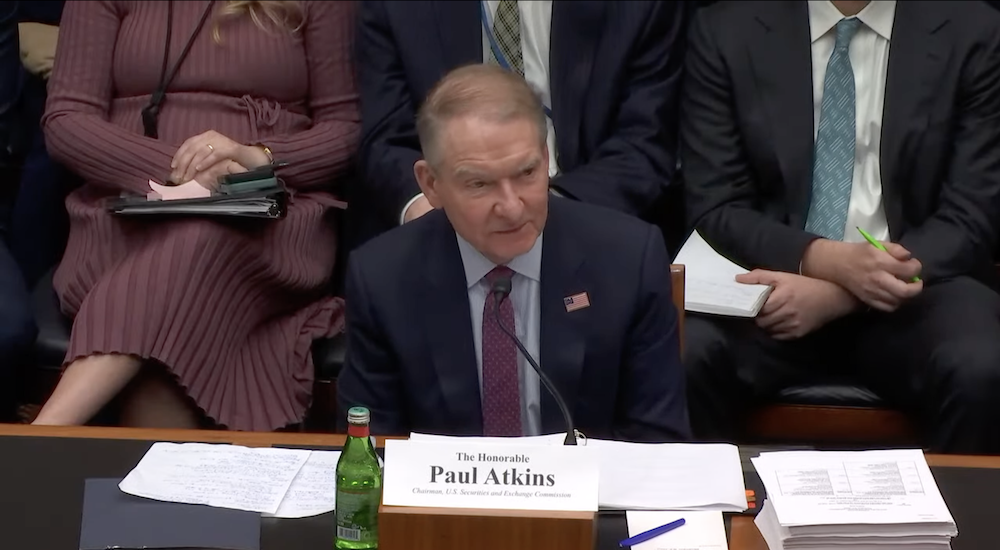

US lawmakers questioned Securities and Exchange Commission (SEC) Chair Paul Atkins at a hearing on Wednesday about the agency’s enforcement actions against the crypto industry and why several cases were dismissed since the leadership change.

Enforcement actions since US President Donald Trump assumed office, and appointed Atkins as SEC chair, are down by 60%, Representative Stephen Lynch said.

The Massachusetts Democrat cited the dismissal of several SEC lawsuits against the crypto industry, including the SEC’s motion to dismiss the Binance case in May 2025, as examples of the dropped enforcement cases.

Lynch also said that foreign investments in World Liberty Financial (WLFI), a decentralized finance platform linked to the Trump family, and memecoins launched by the family, were also causes for concern.

Recent reports indicate that Aryam Investment 1, an Abu Dhabi investment vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, the national security adviser of the United Arab Emirates (UAE), purchased 49% of the startup company behind WLFI. Lynch said:

“This is hurting the crypto industry, all these scams. Look at crypto today. I think it’s down 25% in the last month. People are losing trust, and it’s not good for crypto. It’s certainly not good for consumers, and it’s awful the reputational damage that the SEC is suffering.”

“We have a very robust enforcement effort, and we are bringing cases,” Atkins responded. The comments rehashed previous concerns voiced by Democratic lawmakers about the Trump family’s involvement in crypto and how it could effect US national security.

The comments come during a US midterm election year and could signal resistance toward crypto from Democrats, which could stall market structure legislation if the Democratic Party takes back control of at least one chamber of Congress.

Related: Trump-linked WLFI faces probe over $500M UAE crypto deal

Rep. Maxine Waters claims crypto industry pardons, dropped lawsuits are politically motivated

“These cases were dismissed, despite the fact that the SEC was winning in court, proving that the SEC’s crypto enforcement program was well-grounded in the law,” California Representative Maxine Waters said.

The crypto industry executives who benefited from the pardons and the dropped regulatory lawsuits gave “millions of dollars” to Trump and his family, Waters continued.

Waters, who is a vocal critic of both Trump and the crypto industry, has repeatedly called for probes into the president’s family’s crypto activities, characterizing the projects as a potential backdoor for foreign entities to influence Executive Branch policy through bribery.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Read the full article here