Spot XRP (XRP) exchange-traded funds (ETFs) have continued to attract investor interest, recording inflows every day of last week as transactions surged to a six-month high.

Unfortunately, these positive fundamentals didn’t help the bulls hold the price above the psychological $2 support level. How low can XRP price go?

Key takeaways:

-

XRP fell below $2 in a 6-day correction as trade war fears from Trump’s Greenland tariff threats triggered market-wide sell-offs.

-

Strong fundamentals, such as $1.28 billion cumulative ETF inflows and a surge in XRP Ledger transactions to a six-month high, failed to lift investor sentiment.

XRP price under exchange reserves surge

XRP extended its correction on Monday, dropping below the $2 psychological level, marking six consecutive days of declines.

The sell-off extends across the crypto market, with Bitcoin (BTC) falling to $92,000 and Ether (ETH) pressing down on support at $3,000, triggered by US President Trump’s weekend threat of new tariffs on European countries (over buying Greenland), sparking fears of renewed trade wars.

Related: Ripple targets MiCA passporting in EU with Luxembourg e-money nod

More than $788.9 million in long positions were liquidated, with Bitcoin accounting for $224 million of that total. XRP saw $39.5 million in long liquidations, the highest since Nov. 22, 2025.

Across the board, a total of $875 million was wiped out of the market in short and long positions, affecting around 250,000 traders, as shown in the figure below.

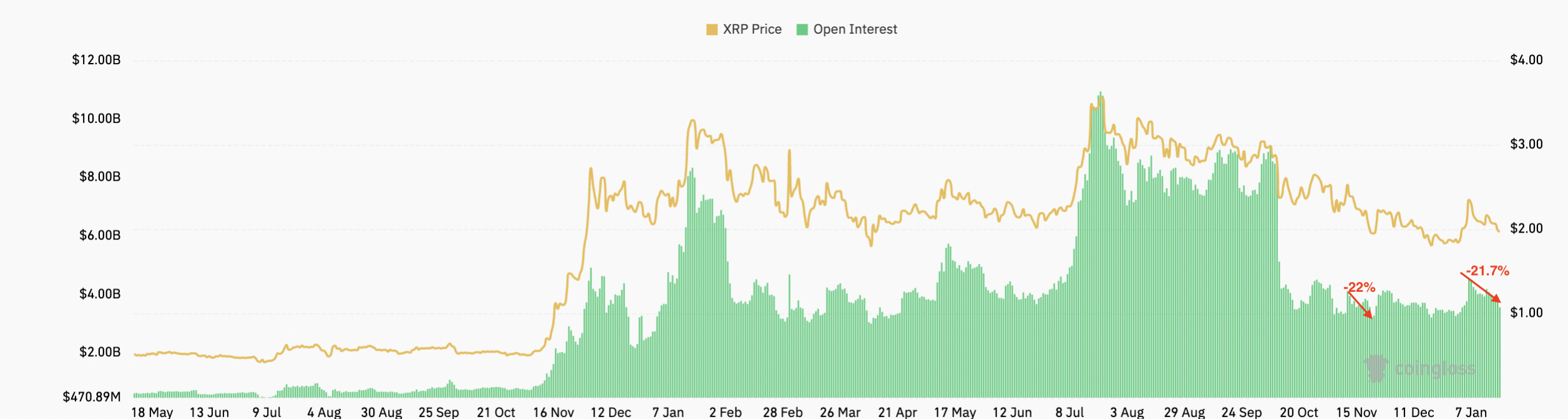

Meanwhile, demand for XRP derivatives has remained weak, falling to $3.56 billion on Monday from its yearly high of $4.55 on Jan.6, representing a 21.7% decline.

Further decline in the OI could accompany prices lower, as seen in October 2025.

XRP price ignores ETF demand, onchain activity

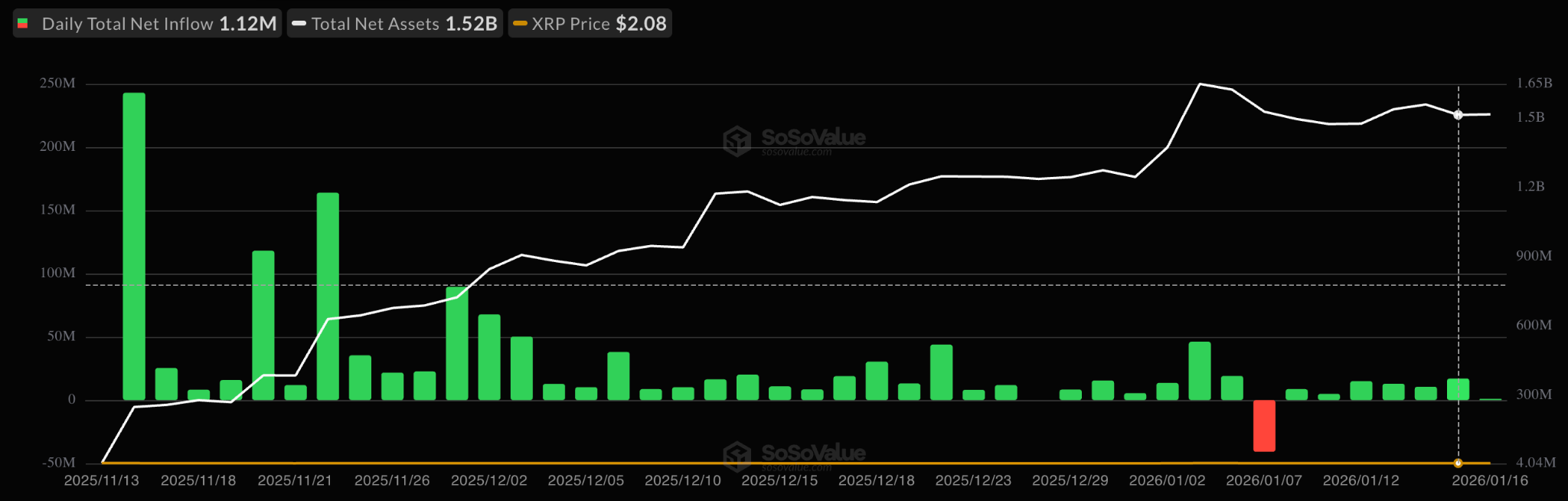

The six-day price correction comes even as institutional sentiment remains relatively positive, as reflected in steady inflows into US-based XRP spot ETFs.

According to data from SoSoValue, XRP ETFs added $1.12 million on Friday, bringing cumulative inflows to $1.28 billion and total assets to over $1.52 billion. The Franklin XRP ETF (XRPZ) was the only XRP ETF with inflows on Friday, bringing its net assets to $287.75 million.

As Cointelegraph reported, global XRP investment products also attracted $69.5 million in inflows during the week ending Jan. 16, signaling steady demand from institutions.

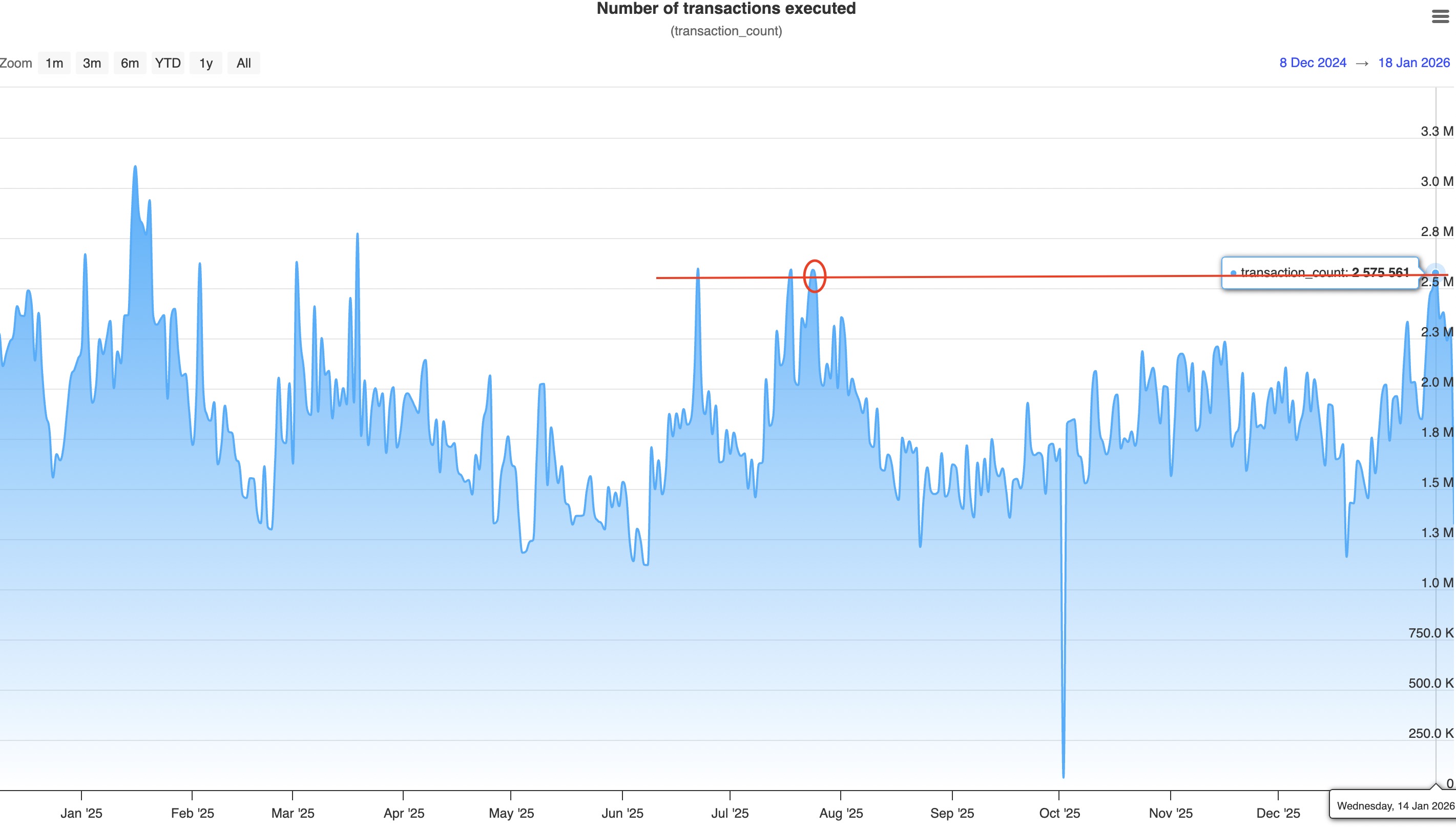

XRP has also seen an increase in onchain demand, evidenced by the surge in transactions to a six-month high last week.

Data from XRPScan shows that the number of transactions executed on the XRP Ledger soared to 2,575,561 on Wednesday, levels last seen in July 2025.

Despite this robust network usage and persistent ETF demand, XRP price has underperformed, dropping 18.5% from its eight-week high of $2.41 reached on Jan. 6.

As Cointelegraph reported, stronger technical validation and high volumes across spot and derivatives markets would be needed to confirm a breakout to higher levels.

XRP price must hold $1.80

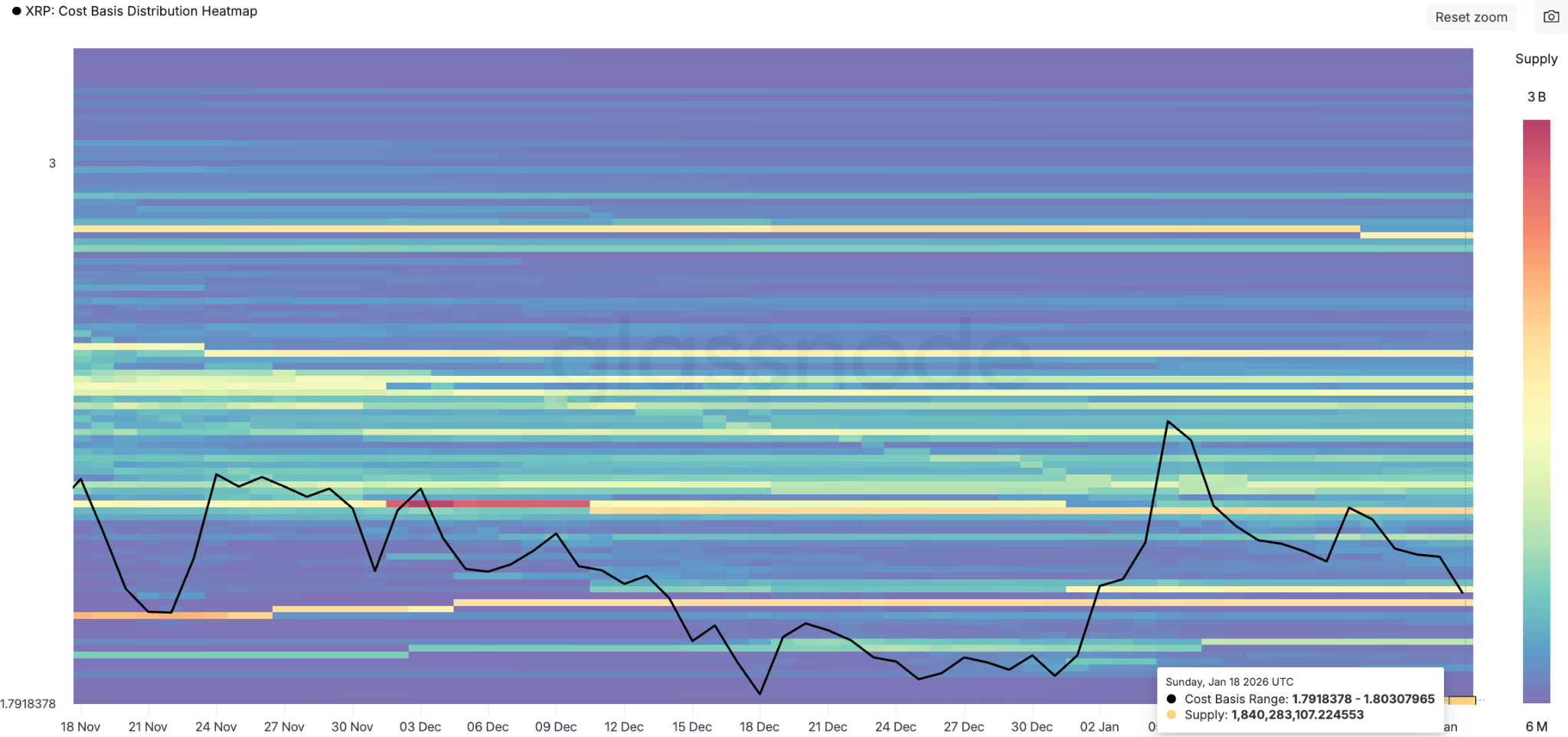

The XRP/USDT pair is currently testing a daily order block around $1.96, a level with strong support, according to data from Glassnode.

The cost basis distribution heatmap reveals that more than 1.78 billion XRP were bought around this level over the last six months. The next significant support sits at $1.78 and $1.80, where investors acquired approximately 1.84 billion XRP.

Note that the XRP/USD pair has not closed a daily candlestick below this level since April 2025, and bulls must defend it to avoid a deeper correction.

If the price breaks below this level, it could drop toward the green zone shown below, supported by the $1.61 local low and the 200-week exponential moving average (EMA), which is about $1.41 and represents the last line of defense for the XRP price.

Unfortunately for the bulls, XRP’s downside momentum is increasing based on the relative strength index, or RSI, which has hit its lowest level in 2026.

As Cointelegraph reported, a break below the support line of a descending channel at $2 will see the XRP/USDT pair extend the decline to $1.75 and subsequently to the Oct. 10 low of $1.61.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here