The Biden administration on Wednesday proposed a rule that would dial back overdraft fees charged by the country’s biggest banks.

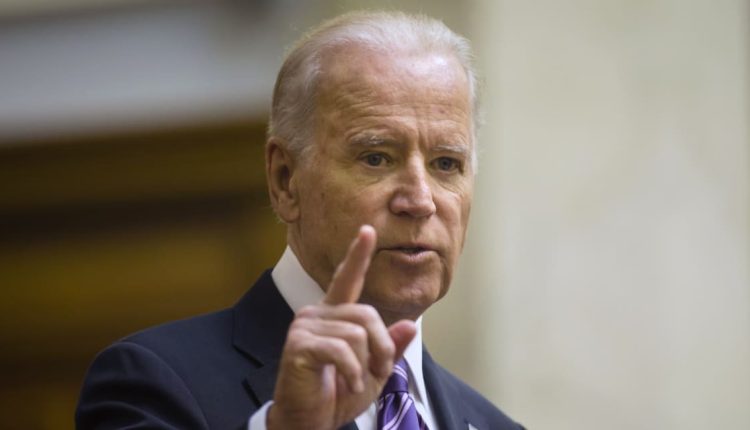

“For too long, some banks have charged exorbitant overdraft fees—sometimes $30 or more—that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines,” President Joe Biden said in a statement. “Banks call it a service—I call it exploitation.”

The proposal—from the Consumer Financial Protection Bureau—would shutter a legal loophole that has exempted overdraft lending services from consumer financial protection laws, including the Truth in Lending Act, the agency said in a statement. It would apply to insured financial institutions with more than $10 billon in assets.

“Under the proposal, large banks would be free to extend overdraft loans if they complied with longstanding lending laws, including disclosing any applicable interest rate,” the CFPB said. “Alternatively, banks could charge a fee to recoup their costs at an established benchmark—as low as $3, or at a cost they calculate, if they show their cost data.” The agency has suggested benchmarks of $3, $6, $7, or $14, and it expects the rule will go into effect Oct. 1, 2025, if adopted.

It isn’t the first time the Biden administration has weighed in on junk fees, the hidden and often excessive fees that boost the cost of travel, tickets, banking, and other consumer services. Last year, the Federal Trade Commission proposed comprehensive rules to address those fees, Barron’s previously reported.

The American Bankers Association pushed back on the proposal.

“In an effort to score political points, the CFPB is seeking to eliminate a valuable service and push consumers who need overdraft protection into the hands of less-regulated, more-costly alternatives,” said ABA President and CEO Rob Nichols. “We will review this proposal with our members and craft an appropriate response that identifies the flaws in the Bureau’s approach.”

Bankrate Chief Financial Analyst Greg McBride said it was “far too early for consumers to let their guard down regarding overdrafts,” noting that the new rules had yet to be completed.

“In the meantime, remain vigilant against incurring overdrafts by setting up a link between your checking and savings accounts, signing up for email or text alerts when your balance gets below a certain threshold, and checking your available balance via smartphone app prior to initiating any transactions,” he added.

Write to Emily Dattilo at [email protected]

Read the full article here