A commission advising Congress on risks related to China said Tuesday that U.S.-China relations have hit a new normal of “long-term strategic and systemic competition” and recommended ways to act on potential risks.

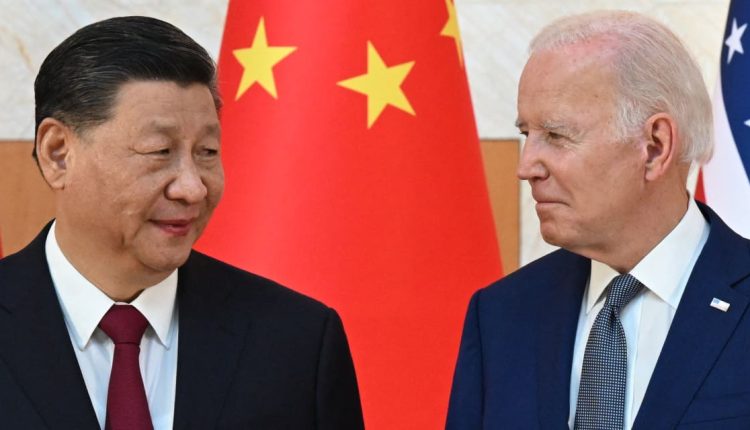

The annual report by the U.S.-China Economic and Security Review Commission underscores a growing view the relationship between the two countries has fundamentally changed. It is also an indication that a meeting on Wednesday between Chinese President Xi Jinping and President Joe Biden on the sidelines of the Asia-Pacific Economic Cooperation summit is unlikely to shift that trajectory.

On the foreign policy front, the commission writes that Beijing continues on an aggressive path, including providing nonlethal military assistance to Moscow and conducting joint patrols in the Arctic, as well as pouring more money into an “unprecedented military buildup.”

China has also sought to present itself internationally as an alternative security partner to the U.S. For example, the commission notes China’s participation in peacekeeping operations in African countries where it has invested heftily in energy and critical minerals.

Economically, the country is struggling amid a property slump the commission says is creating broader instability in the financial system. At the same time, the Communist Party is opening the financial sector to foreign investments. That raises risks for those investing in China through pensions and wealth management products, according to the commission.

The country’s economic malaise has weighed on the

iShares MSCI China exchange-traded fund

(ticker: MCHI), which is still down almost 10% this year.

Though many U.S. companies still see access to China’s market as critical to growth, the commission found more firms trying to limit their exposure and find alternative strategies. Indeed, foreign direct investment into China in the third quarter turned negative.

Some companies have started to shift to suppliers elsewhere in Asia in a bid to diversify. But the commission noted that many of these alternate suppliers are owned by Chinese entities, leaving U.S. companies vulnerable.

The commission, formed in 2000 to assess national security implications of the economic relationship with China, outlined 30 suggestions for Congress. Many focus on increasing disclosure to identify potential vulnerabilities.

For example, it recommended Congress consider legislation for a framework for corporate disclosures about company risks to China, including the percentage of total assets in China, joint ventures with Chinese companies, the nature of research and development in China, and the influence of any personnel with Communist Party ties in decision-making.

Similarly, it called on Congress to establish a framework to evaluate national security threats posed by electronic products imported from China and notes that Congress should use all tools to eliminate such risks, including tariffs.

The report also suggested establishing an interagency group to build a database to help companies, universities, and others to conduct due diligence on potential Chinese partners.

It also recommended allowing the Committee on Foreign Investment in the U.S. to review investments in U.S. companies that could help China acquire technological capabilities that would advance its aims at becoming self-sufficient, especially in areas Beijing has prioritized through industrial policy.

And it encouraged Congress to direct the administration to engage with allies in planning and preparing for sanctions on China in the event of a confrontation over Taiwan or other issues.

For investors, one persistent concern beyond China’s economic recovery is assessing their vulnerability to actions out of Congress—both related to investments in China but also in investments in global companies that have China exposure.

The commission’s report is the latest confirmation that this is a concern that isn’t likely to abate soon.

Write to Reshma Kapadia at [email protected]

Read the full article here