Several chip stocks are set to have a good year, benefiting from the rising demand for artificial-intelligence semiconductors, says Wells Fargo.

On Wednesday, analyst Aaron Rakers reiterated his Overweight ratings for

Nvidia,

Micron,

Arm Holdings,

and

Synopsys.

The analyst reaffirmed his price targets of $675 for Nvidia, $95 for Micron, and $630 for Synopsys. He raised his forecast for Arm to $85 from $70.

“We’re positive on the fundamental semi setup in 2024/2025” given the ”secular expansion of Gen AI,” he wrote. The analyst is especially optimistic about demand for AI servers, which he estimates will lead to sales growth of more than 30% this year.

In Wednesday trading, Nvidia stock was down 1% to $477, while Micron fell 0.5% to $82. Arm Holdings and Synopsus dropped by 2.3% to $67.36 and declined by 1.3% to $492.70, respectively. The

Nasdaq Composite

had fallen 0.8%.

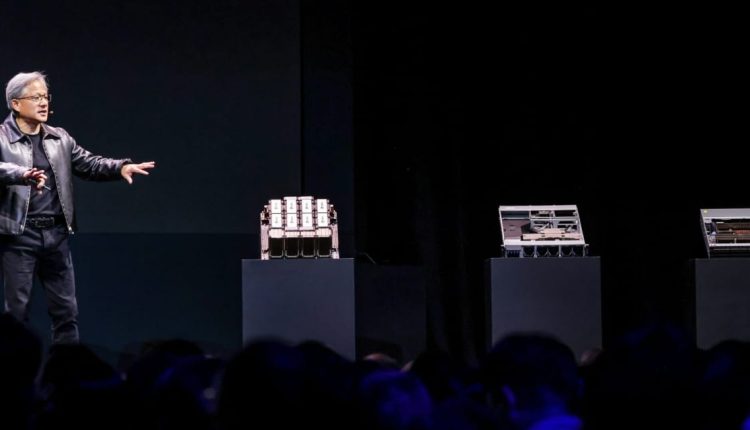

Rakers said Nvidia is his top pick for AI based on the technological leadership of its data-center graphics processing units and its ability to sell complete AI systems spanning software, hardware, and networking. “We see our full stack / platform thesis in Nvidia remaining a significant competitive advantage,” he wrote.

Start-ups and corporations have preferred Nvidia’s products because of its robust programming platform, CUDA, which provides AI-related tools that make it easier to develop applications.

On Micron, Rakers said, he is growing more confident about the chip maker’s ability to generate substantial revenue from its advanced HBM3E memory chips later this year. The semiconductors will be used in advanced AI servers.

Micron is a leading maker of both dynamic random-access memory, which is used in computers, and flash memory, found in smartphones and solid-state hard drives.

Synopsys and Arm, meanwhile, are “core long-term holdings” as electronic design automation software and other intellectual property related to chip design account for a bigger share of the semiconductor industry’s spending on research and development. “The EDA/IP market benefits from the some the most influential secular tailwinds in the semiconductor industry,” he wrote.

Write to Tae Kim at [email protected]

Read the full article here