One thing to start: Happy new year and welcome back to FT Asset Management. I hope you had a great break. Here are Ruchir Sharma’s top 10 trends for 2025. Projections about the coming year assume market shifts will be dictated by Donald Trump. But the global economy is unlikely to revolve around the US, Sharma predicts.

In today’s newsletter:

-

BlackRock’s latest green climbdown

-

Who is right about ‘Maganomics’: bearish economists or bullish investors?

-

Dolce & Gabbana turns the Grand Palais into a pleasure palace

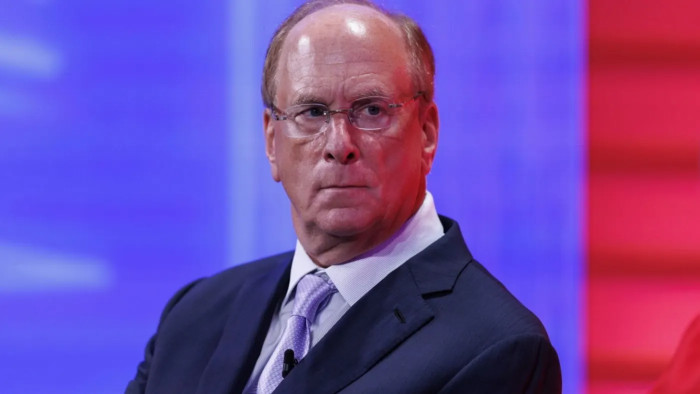

BlackRock quits climate change group

In the weeks since Donald Trump retook the US presidency, American financial firms have been rushing to distance themselves from climate and diversity programmes and anything that smells of what conservatives criticise as “woke capitalism”.

Last week, BlackRock, the money manager that did more than any other to put sustainability at the top of investors’ minds earlier this decade, joined the mass exodus, writes Brooke Masters in New York.

The $11.5tn money manager told institutional clients in a letter on Thursday that it had quit Net Zero Asset Managers, a voluntary global group that describes itself as committed to “the goal of net zero greenhouse gas emissions by 2050 or sooner”.

BlackRock’s vice-chair, Philipp Hildebrand, wrote that the group was specifically motivated by heightened regulatory pressure. Belonging to NZAM has “caused confusion regarding BlackRock’s practices and subjected us to legal inquiries from various public officials”, he wrote.

Texas and other Republican states have sued BlackRock, Vanguard and State Street, claiming that they conspired to constrain coal supplies and further a “destructive, politicised environmental agenda”. The money manager is also the subject of boycott laws in a number of states for allegedly being “hostile” to fossil fuel.

Meanwhile BlackRock is engaged in a tussle with the Federal Deposit Insurance Corporation over regulations that require big shareholders in banks to act as passive investors. The FDIC wants BlackRock to sign “passivity agreements” that would subject it to compliance audits to insure that it is not using its large stakes to pressure management on issues such as sustainability. Vanguard reached a deal with the FDIC in December after months of negotiations, but BlackRock and the watchdog hit an impasse ahead of last Friday’s deadline.

BlackRock last week wrote to the FDIC asking for an extension. “We are not aware of any imminent or ongoing issues that would warrant hastening the finalisation of a completely new regulatory framework in a two-week period,” Ben Tecmire, head of US regulatory affairs at BlackRock, said in the letter. The FDIC agreed to give the money manager until February 10, when the Trump administration will be in power.

Vanguard left NZAM more than a year ago, and the largest Wall Street banks have quit a similar group for banks, the Net-Zero Banking Alliance, in recent weeks.

Chart of the week

Stock investors are brushing aside economists’ gloomy predictions about US president-elect Donald Trump’s economic policies, betting instead that his plans will boost corporate earnings and power the market higher.

Wall Street’s S&P 500 benchmark soared to record highs last year and, although there has been a recent pullback, equity strategists have predicted gains of about 10 per cent for the index this year on the back of strong earnings growth.

That bullish tone contrasts sharply with recent warnings from economists about the likely damage from Trump’s protectionist policies, which, they say, could hit economic growth, raise inflation and limit the Federal Reserve’s ability to cut interest rates.

Some put that sharp divide down to differing views about the extent to which Trump will implement his plans, doubts about the impact of GDP growth on the profits of the Big Tech groups driving the market’s rally, and differing timescales on which to gauge the effects of the new president’s policies.

“I suspect economists are taking a lot of what Trump says he will do as likely to play out,” said Evan Brown, portfolio manager and head of multi-asset strategy at UBS Asset Management. “Investors, rightly or wrongly, are betting that Trump won’t follow through to nearly the same extent.”

Recent polls by the Financial Times found more that than half of the 47 economists surveyed on the US economy forecast “some negative impact” from Trump’s policies, with a further tenth expecting a “large negative impact” and only one-fifth predicting a positive effect.

Many focused on the risks from two high-profile Trump policies: trade tariffs and curbs on US immigration.

“If I were to channel an economist and look at this new era as a glass half empty, those would be exhibits A and B that I would point to,” said Jurrien Timmer, director of global macro at Fidelity. “But the market is looking at earnings.”

10 stories you may have missed over the break

Is the US stock market in bubble territory? Valuations might be frothy but they don’t seem nutty, argues Oaktree Capital Management co-founder Howard Marks.

Multi-manager hedge funds Citadel and Millennium Management were among the winners in what was overall a strong year for the global hedge fund industry.

A profound funding shift might contribute to huge investment needed for data centres, energy and reshoring of industry, writes Oliver Wyman vice-chair Huw van Steenis, signalling a big new role for private credit.

The private equity industry is preparing to lobby the incoming Donald Trump administration to give it access to savers’ retirement funds, in a move that could unlock trillions of dollars for firms such as Blackstone, Apollo Global and KKR.

Investors pulled a record $450bn out of actively managed stock funds last year, according to data from EPFR, as a shift into cheaper index-tracking investments reshapes the asset management industry.

Boaz Weinstein, founder of New York-based hedge fund Saba Capital, has said he wants to be a “white knight” for UK investors and the London stock market by buying into the £266bn investment trust sector.

Should the UK really look to Canada’s pension system as its model? Chancellor Rachel Reeves wants to learn lessons from the ‘Maple 8’ — but they have their own problems.

Veteran investment manager Terry Smith has dumped his underperforming £22.5bn fund’s stake in Diageo after almost 15 years, reflecting a threat to demand posed by weight-loss drugs.

A leading BlackRock private equity fund has lost more than $600mn on an investment in Alacrity, an insurance outsourcing company, after the business struggled with its debt load.

The simple secret behind Kensington and Chelsea, the UK’s best performing council pension fund — and why its chair fears the chancellor’s ‘megafunds’.

And finally

Paris is grey, the light wan, but no matter: in the newly reopened Grand Palais, la dolce vita reigns, writes our chief visual arts critic Jackie Wullschläger. A black dress fashioned like the Eiffel Tower waves you in, and Paris begins 2025 with as sumptuous, seductive and intelligently enjoyable an exhibition as it has hosted this century: Dolce & Gabbana’s Du Cœur à la Main (From the Heart to the Hands). See you on the Eurostar.

Read the full article here