© Reuters.

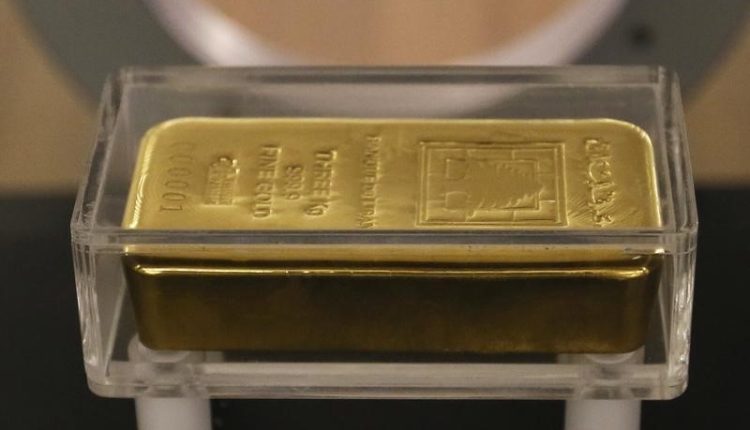

Investing.com– Gold prices moved little on Thursday, coming under pressure from strength in the dollar and Treasury yields as signs of sticky inflation pushed up concerns that the Federal Reserve will maintain its hawkish rhetoric.

Data also showed some resilience in the U.S. economy, further sapping safe haven demand for the yellow metal amid growing bets that the country will avoid a recession this year.

But U.S. interest rates remained a key point of concern for gold markets, with a string of Federal Reserve speakers due before an later in the month.

rose 0.1% to $1,919.32 an ounce, while expiring in December fell 0.1% to $1,943.30 an ounce by 00:58 ET (04:58 GMT). Both instruments were trading just above their lowest level in 10 days.

U.S. rate concerns rise after strong service sector data

Data on Wednesday showed that grew more than expected in August. But a particular point of contention for markets was data showing an uptick in , which is likely to factor into stickier inflation readings in the coming months.

The reading, coupled with a recent spike in oil prices, fueled renewed concerns that U.S. inflation will remain sticky this year, eliciting a hawkish response from the Federal Reserve.

The Fed is widely expected to keep rates on hold in September. But the central bank is also set to .

The prospect of higher rates bodes poorly for gold, given that they push up the opportunity cost of investing in bullion. A stronger also diminishes the per-ounce value of the yellow metal.

This notion had battered gold over the past year, and presents a cloudy outlook for the yellow metal.

Copper slips on weak China trade data

Among industrial metals, copper prices fell on Thursday as Chinese trade data pointed to continued economic weakness in the world’s largest copper importer.

fell 0.4% to $3.7757 a pound- a two-week low.

Chinese data showed that while and shrank at a slower-than-expected pace in August, they still remained close to historic lows. China’s copper imports also dropped about 5% from last year, indicating sluggish appetite for the red metal amid deteriorating economic conditions.

China’s copper imports have slowed in recent months as the country grapples with a manufacturing slowdown, as well as a severe cash crunch in its massive property market.

Read the full article here