Stay informed with free updates

Simply sign up to the War in Ukraine myFT Digest — delivered directly to your inbox.

EU shipyards are repairing Russian ice-class tankers and offering them dry dock facilities, enabling Moscow to continue moving gas through the Arctic despite western sanctions on its energy sector.

Without the maintenance work — provided by Damen shipyard in Brest, France, and Fayard A/S in Denmark — Russia’s Yamal LNG plant would struggle to access crucial markets through winter when northern hemisphere gas prices are at their highest.

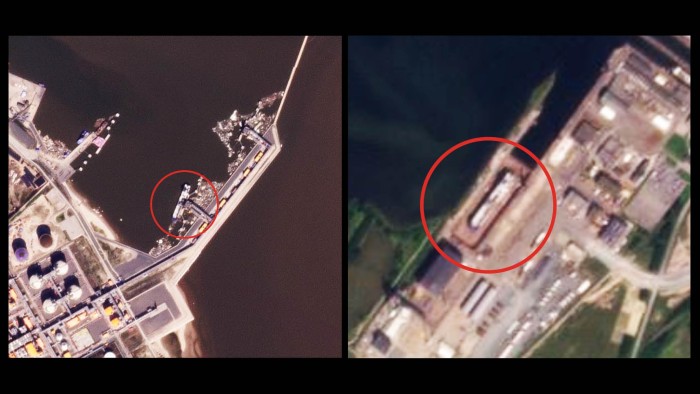

The two yards have serviced 14 out of the 15-strong fleet of specialised Arc7 tankers that ship from Yamal LNG on Russia’s far northern coast, according to satellite imagery and port-call tracking data from Kpler, a data and analytics company. Some ships called multiple times.

“If those two shipyards were off-limits, it would put the whole logistics operations in doubt,” said Malte Humpert, an Arctic shipping specialist at High North News who has tracked the vessels’ movements. “They could get the service somewhere else but that would mean going well off their route.”

Eight of the tankers have called into Damen, while Fayard has serviced nine since Russia’s full-scale invasion of Ukraine in February 2022. Most of the ships are owned by energy and shipping companies including Greece’s Dynagas and Canada’s Teekay.

Damen confirmed it had repaired “several vessels involved in the transport of Russian LNG” but added that this “strictly adhered to European sanctions legislation” and that it was “not involved in the cargo choices made by the shipping companies operating these vessels”.

“No further repairs of these LNG ships are planned for the coming period,” it said.

Fayard did not respond to a request for comment.

Phasing out Russian gas is a central policy aim of the European Commission. However, its target to reduce the EU’s use of Russian fossil fuels to zero by 2027 has been thrown off course by an increase in imports of Russian LNG, most supplied from Yamal.

The activities of the ships and yards are not sanctioned because of carve-outs for energy transportation and because they are not Russian-flagged, and the specialised tankers would not be able to distribute their cargo without the technical expertise and maintenance from the European yards.

The only one of the fleet not to have called at either of the two yards is the Christophe de Margerie, which is owned by the sanctioned Russian shipping company Sovcomflot.

The EU agreed to sanction the ship itself — the first move from the bloc to put any sanctions on Yamal’s operations — on December 16. The US has already hit the Yamal project with waves of sanctions.

The Christophe de Margerie’s inability to access the repair yards in Europe has put the vessel out of service for six months, demonstrating the Arc7’s reliance on European knowhow and parts, Humpert said.

From Yamal, the ships can either sail towards Europe or take the much longer and more hazardous Northern Sea Route to China. The eastbound route can only be sailed during the warmer months, despite Novatek — owner of Yamal LNG — experimenting with a longer shipment window.

The Arc7 LNG carriers were built in South Korea at a cost of around $333mn per ship, according to research by the Oxford Institute for Energy Studies.

They are more than 200m long and can carry about 170,000 cubic metres of natural gas with a specifically designed ‘Azipod’ propulsion system to navigate thick ice.

One European shipbroker said the French and Danish yards, which have dry docks big enough for the outsized tankers, are the “only ones both capable of handling Arc7s and at the same time located in the right place”.

While Russian crude oil and coal have been sanctioned, gas has remained outside of the bloc’s sanctions regime amid concerns over security of supply.

In a first step towards phasing out imports of the shipped gas, EU countries agreed in June to ban from March the trans-shipment of Russian LNG. This will stop EU ports being used to move gas from ice-class tankers to less expensive regular vessels for shipping to other countries.

Yamal LNG exported 20.9bn cubic metres to Europe in 2023, according to OIES, of which around a quarter was sent on to destinations outside the bloc. Supplies from Yamal made up around 85 to 90 per cent of the EU’s Russian LNG imports, according to think-tank Bond Beter Leefmilieu.

Additional reporting by Shotaro Tani in London

Read the full article here