Canadian Dollar tests higher ground against the US Dollar after Canadian CPI print beats expecations

- The CAD caught a Tuesday jolt after Canadian CPI inflation came in above expectations.

- Economic calendar data sees limited impact as markets gear up for holidays.

- Canadian Retail Sales & GDP to round out the trading week.

The Canadian Dollar (CAD) is catching a limited bid on Tuesday following a better-than-expected Canadian Consumer Price Index (CPI) inflation print, dragging the CAD into the green against the US Dollar (USD), but limited data impact sees the CAD still down against the majority of major currency peers for the day.

CPI inflation in Canada printed at 3.1% for the year through November, beating expectations and giving the Canadian Dollar a slight boost. The rest of the week sees a steady trickle of Canadian data heading into the holiday shutdown, with the Bank of Canada’s (BoC) latest Summary of Opinions on Wednesday, followed by Canadian Retail Sales for October on Thursday, and the week rounds out with the final Canadian Gross Domestic Product (GDP) print for 2023.

Daily Digest Market Movers: Canadian Dollar mixed on the day, but catching some lift against the Greenback

- The Canadian Dollar is up four-tenths of one percent against the US Dollar on Tuesday, and up over a full percent against the Japanese Yen (JPY).

- The Loonie is losing noticeable ground against the Antipodeans, down nearly half a percent against both the Australian Dollar (AUD) and the New Zealand Dollar (NZD).

- Canada’s Consumer Price Index (CPI) came in at 3.1% for the year through November, holding steady with the previous print and beating the forecast decline to 2.9%.

- MoM CPI for November also beat expectations, holding steady at 0.1% versus the forecast -0.2%.

- The Bank of Canada’s November CPI Core ticked upwards in the annualized figure from 2.7% to 2.8%, while the MoM number printed at 0.1% versus the previous 0.3%.

- Next up: the BoC’s Summary of Deliberations, the Canadian central bank’s last scheduled meeting’s minutes, which could provide further insight into how hawkish or dovish the BoC is leaning.

- Canadian Retail Sales on Thursday as well as Canadian GDP on Friday.

- US data could overshadow Canadian calendar releases.

- US Gross Domestic Product on Thursday, US Core Personal Consumption Expenditure (PCE) Price Index figures on Friday.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.50% | -0.73% | -0.40% | -0.90% | 0.69% | -0.88% | -0.71% | |

| EUR | 0.49% | -0.23% | 0.08% | -0.39% | 1.16% | -0.38% | -0.20% | |

| GBP | 0.73% | 0.22% | 0.32% | -0.17% | 1.41% | -0.16% | 0.02% | |

| CAD | 0.42% | -0.10% | -0.30% | -0.48% | 1.09% | -0.46% | -0.29% | |

| AUD | 0.88% | 0.39% | 0.16% | 0.49% | 1.56% | 0.01% | 0.18% | |

| JPY | -0.69% | -1.17% | -1.43% | -1.11% | -1.60% | -1.59% | -1.40% | |

| NZD | 0.87% | 0.38% | 0.16% | 0.45% | -0.03% | 1.55% | 0.16% | |

| CHF | 0.70% | 0.20% | -0.02% | 0.29% | -0.20% | 1.38% | -0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

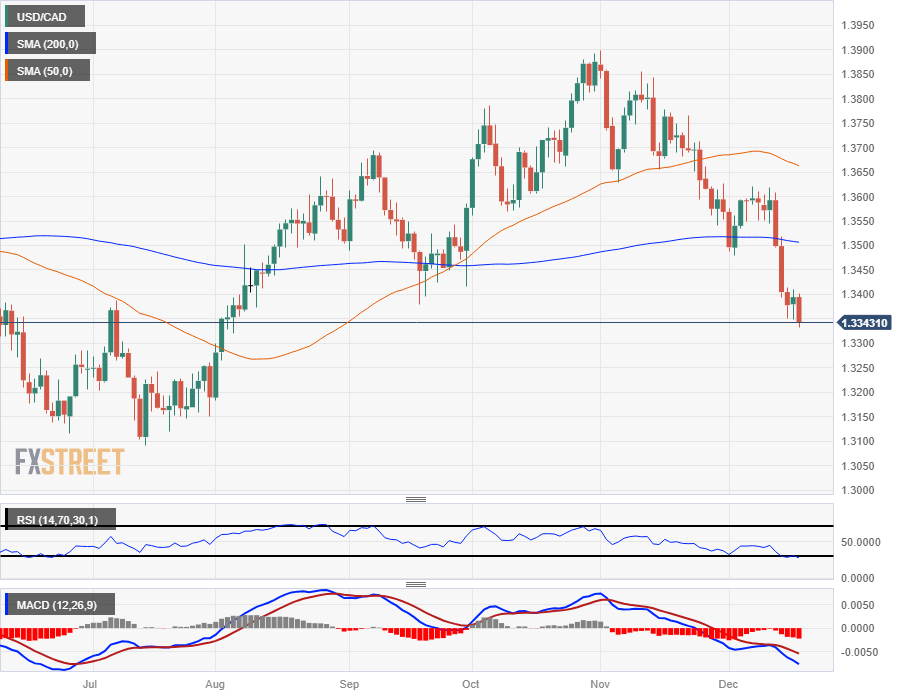

Technical Analysis: Canadian Dollar looks to extend against Greenback, USD/CAD looking for 1.3300

The Canadian Dollar climbed to a fresh 19-week high against the US Dollar on Tuesday, testing 1.3333 and setting the USD/CAD on pace to close down for six of the last eight trading weeks.

The USD/CAD is down over 4% from November’s early peak just shy of 1.3900, and the pair is extending further beyond the 200-day Simple Moving Average (SMA) near the 1.3500 handle after breaking through the key moving average last week.

The US Dollar has resumed its backslide against the CAD, and Tuesday will mark the fourth red candle out of the last five consecutive trading days.

The nearest major support sits at July’s low bids near the 1.3100 handle, and a technical resistance zone is pricing in at common turnaround points between 1.3400 and 1.3500, in conjunction with the 200-day SMA.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Read the full article here