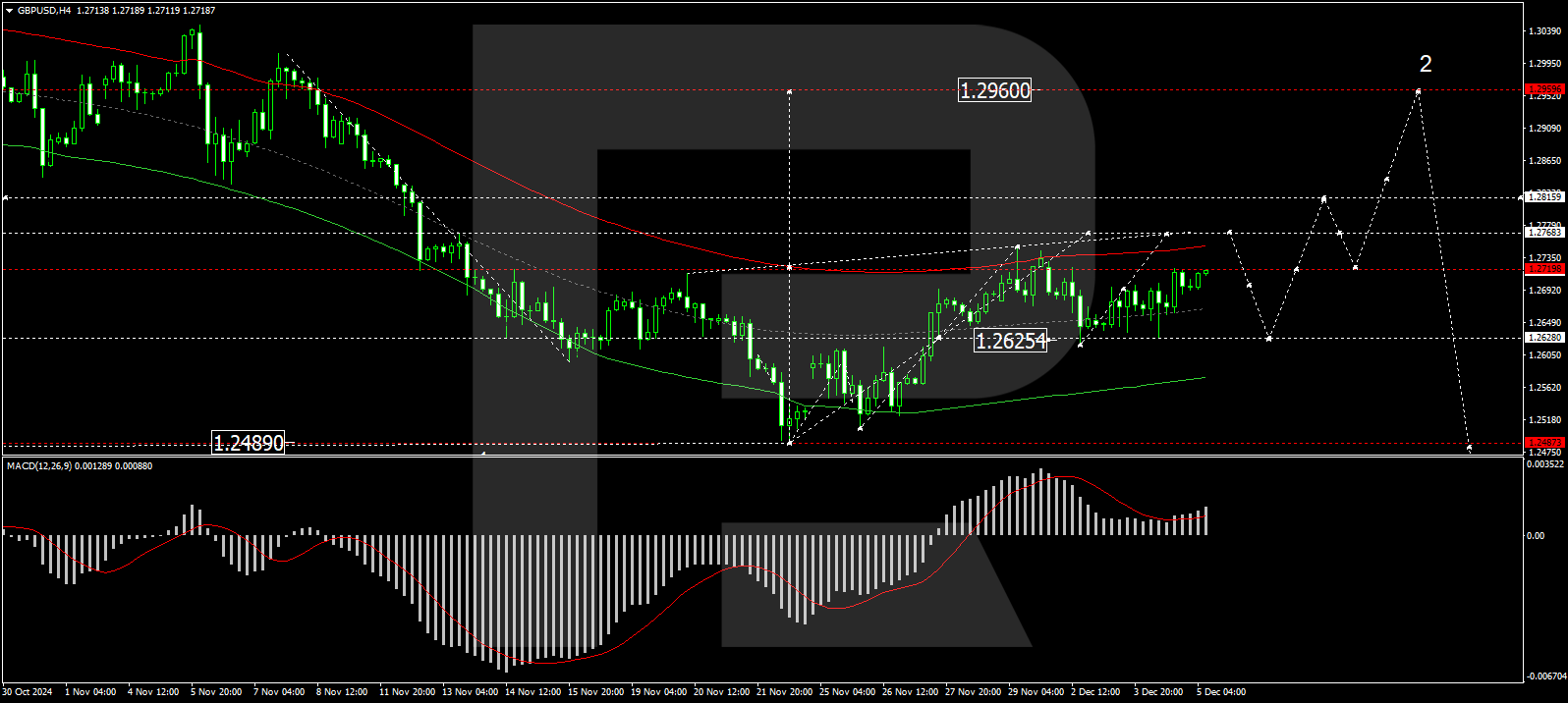

GBP/USD Forecast: Pound Sterling could face next resistance at 1.2750

GBP/USD registered small gains for the second consecutive day on Wednesday and continued to edge higher early Thursday. The technical outlook suggests that the bullish bias remains intact in the near term.

Falling US Treasury bond yields and disappointing macroeconomic data releases from the US made it difficult for the US Dollar (USD) to stay resilient against its major rivals on Wednesday. The ISM Services PMI declined to 52.1 in November from 56 in October and missed the market expectation of 55.5. Additionally, the ADP Employment Change came in at 146,000 in November, compared to analysts’ estimate of 150,000. Read more…

GBP/USD continues its rally: Third day of buying

The GBP/USD pair has risen to 1.2711, marking the third day of sustained buyer activity. This upward movement comes from comments from Bank of England Governor Andrew Bailey, who hinted at potential interest rate cuts in 2025 if the consumer price index (CPI) continues its downward trajectory.

In a recent interview, Governor Bailey discussed the possibility of a decisive easing in monetary policy, suggesting a total reduction of 100 basis points in 2025, which could bring the interest rate down to as low as 3.75% per annum. While this outlook is seen as positive, investors are currently more focused on the short term, with expectations set for the BoE’s rate to remain unchanged in December 2024. Any substantial rate adjustments are anticipated to be implemented next year. Read more…

Read the full article here