Pound Sterling falls back as higher UK gilt yields keep downside bias unabated

The Pound Sterling (GBP) resumes its downside journey in Tuesday’s European session due to rising yields on the United Kingdom (UK) gilts. The 30-year UK gilt yields have risen to near 5.47%, the highest since 1998, due to multiple tailwinds, such as higher uncertainty about incoming trade policies under the administration of United States (US) President-elect Donald Trump, persistent inflationary pressures and slower growth expectations in Britain.

A healthy rise in UK gilt yields has resulted in a discomforting situation for UK Chancellor of the Exchequer Rachel Reeves, who was already facing backlash from employers for raising their contribution to National Insurance (NI) and leaving little fiscal headroom if the situation turns upside down. Read more…

GBP/USD shows recovery signs

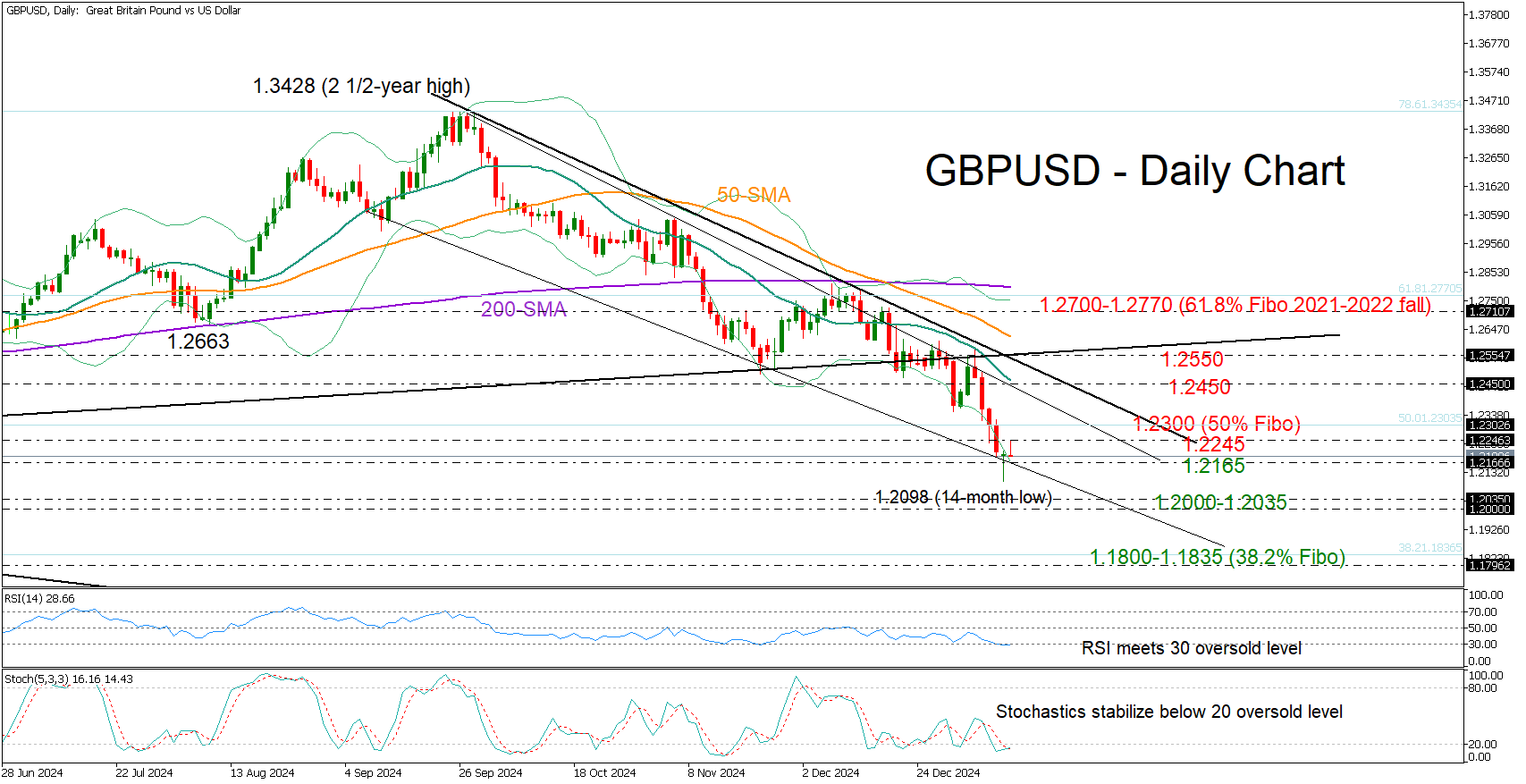

GBP/USD slumped to a 14-month low of 1.2098 on Monday following five devastating weeks, but a hopeful green doji candlestick emerged at the close of the day, signaling that the bears might be losing their grip.

The RSI and the stochastic oscillator are both flatlining near their oversold levels, and the price itself has dipped below the lower Bollinger band. These signs suggest that the recent bearish cycle might have hit a bottom, though traders will likely want confirmation before committing to buying positions. Read more…

Read the full article here