Pound Sterling gains against US Dollar in light volume conditions before New Year

The Pound Sterling (GBP) rises to near 1.2600 against the US Dollar (USD) at the start of the week. However, low volatility is expected from the GBP/USD pair due to thin trading volume conditions before New Year celebrations. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, drops below 108.00 but is set to end the year with almost 6.7% gains.

The USD performed strongly this year even though the Federal Reserve (Fed) reduced its key borrowing rates by 100 basis points (bps) to 4.25%-4.50%. The Greenback has gained significantly in the last three months after Republican Donald Trump’s victory in the United States (US) Presidential election as policies such as immigration control, higher import tariffs, and lower taxes are expected to be inflationary and pro-growth. Read more…

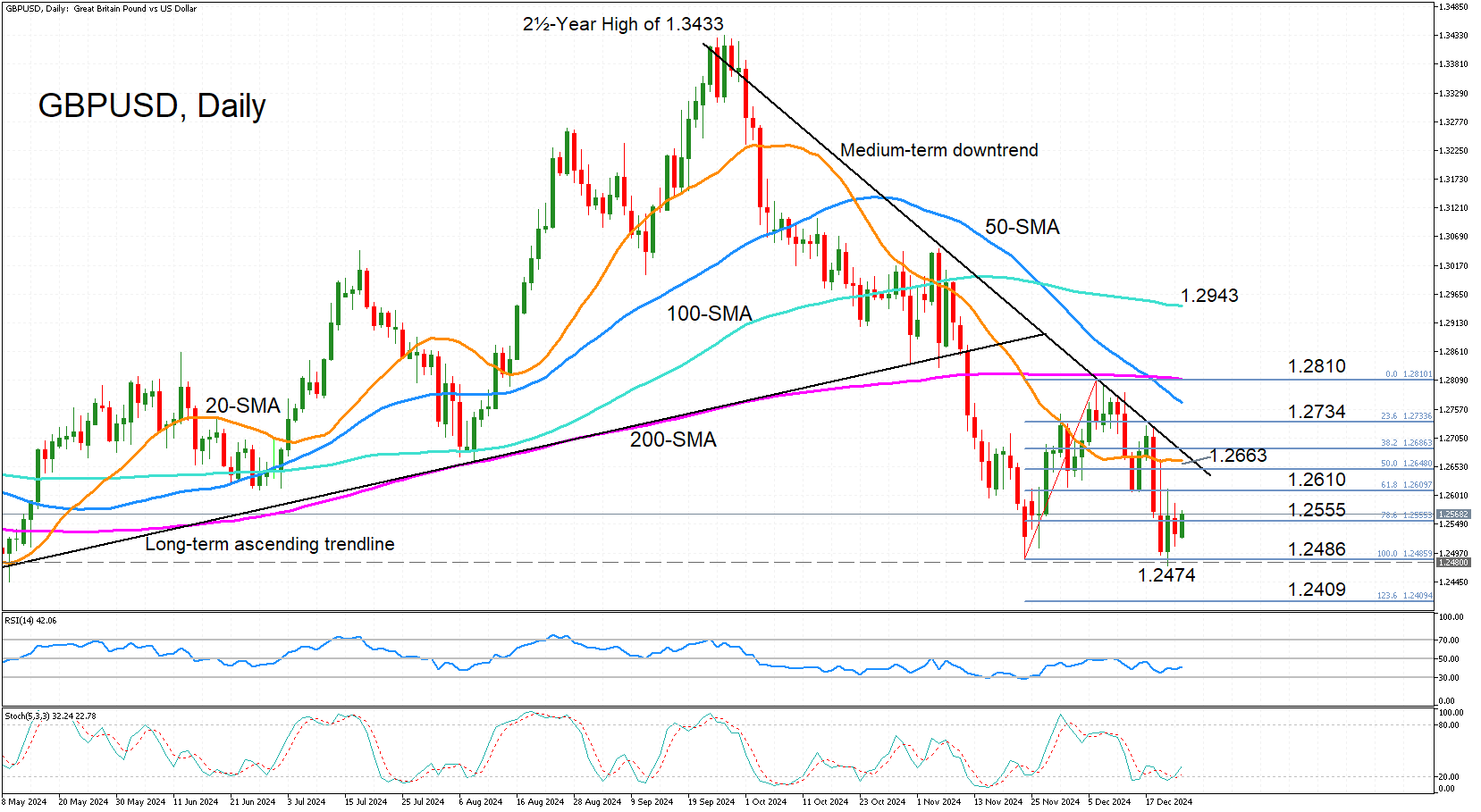

Technical analysis: GBP/USD holds above 1.25 but weak bullish bias

GBP/USD has managed to hold above the 1.2500 mark this week following last week’s post-Fed tumble that pulled the pair to the lowest since May, hitting 1.2474. The slide reinforced the medium-term downtrend line as a strong resistance wall, but now the bulls face additional barriers.

Any recovery attempt would first need to overcome the 61.8% Fibonacci retracement of the November-December upleg at 1.2610 and then battle the 20-day simple moving average (SMA) at 1.2663 before cracking the descending trendline. Read more…

Read the full article here