- Indian Rupee loses traction on the modest rebound of the US Dollar.

- Finance Ministry said India’s economy is expected to surpass the government’s growth estimate of 6.5% in FY24.

- The US labor data, including US Nonfarm Payrolls (NFP), will be in the spotlight this week.

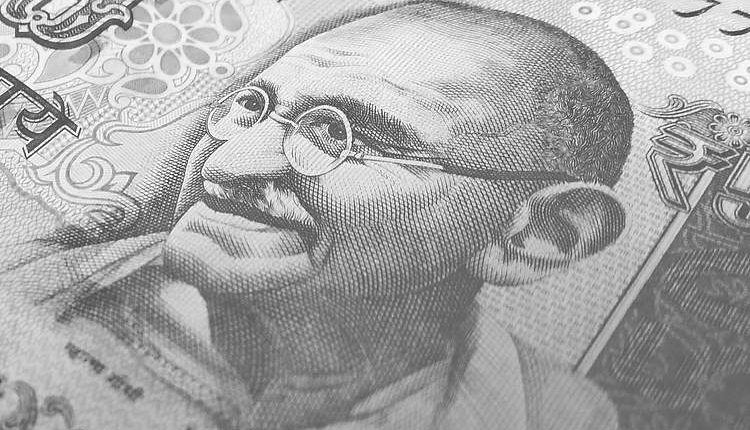

Indian Rupee (INR) trades on a soft note on the first trading day of 2024 on Tuesday. India’s Finance Ministry said in its half-yearly economic review report on Friday that India’s economy is projected to surpass the government’s growth estimate of 6.5% in FY24. The ministry further stated that the growth in consumption demand is also expected to continue. Additionally, the relatively steady Indian Rupee with substantial foreign currency reserves encourages confidence in the country’s external sector.

The INR is likely to be influenced by the US Dollar (USD) dynamic this week while traders keep an eye on the US labor data, including US Nonfarm Payrolls (NFP), Unemployment Rate, and Average Hourly Earnings, due later on Friday.

Daily Digest Market Movers: Indian Rupee remains strong amid global factors and uncertainties

- The Reserve Bank of India (RBI) has constantly intervened in foreign currency markets on both sides in recent weeks, keeping the USD/INR pair in a narrow range, according to traders.

- The International Monetary Fund (IMF) stated in its annual report that India had intervened in selling dollars more than it deemed necessary.

- Indian Finance Ministry mentioned that the real GDP grew by 7.7% in H1 of FY24, following a 7.6% growth in Q2.

- India’s current account deficit narrowed to $8.3 billion in the second quarter of 2023–24.

- The US Chicago Purchasing Managers’ Index (PMI) arrived at 46.9 in December from the previous reading of 55.8, weaker than the expectation of 51.0.

- According to the CME Group’s FedWatch tool, the markets are pricing in 88% odds of rate cuts in March.

Technical Analysis: Indian Rupee extends the longer-term range theme

Indian Rupee trades weaker on the day. The USD/INR pair has traded within a multi-month-old trading band of 82.80–83.40. According to the daily chart, buyers look to retain control as the pair holds above the key 100-period Exponential Moving Average (EMA). Furthermore, the 14-day Relative Strength Index (RSI) bounces back above the 50.0 midpoint, suggesting that further upside looks favorable.

The first support level will emerge at 83.00. A break below 83.00 will see a drop to the confluence of the lower limit of the trading range and a low of September 12 at 82.80. Further south, the next contention is located near a low of August 11 at 82.60. On the other hand, the immediate resistance level is near the upper boundary of the trading range at 83.40. The additional upside filter to watch is the year-to-date (YTD) high of 83.47, followed by the 84.00 psychological mark.

US Dollar price in the last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies in the last 7 days. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.01% | -0.08% | 0.02% | -0.20% | -0.48% | -0.01% | -1.31% | |

| EUR | -0.03% | -0.09% | 0.01% | -0.22% | -0.51% | -0.01% | -1.33% | |

| GBP | 0.06% | 0.08% | 0.10% | -0.14% | -0.42% | 0.06% | -1.25% | |

| CAD | -0.03% | -0.01% | -0.10% | -0.25% | -0.52% | -0.02% | -1.34% | |

| AUD | 0.20% | 0.20% | 0.13% | 0.24% | -0.28% | 0.20% | -1.12% | |

| JPY | 0.49% | 0.50% | 0.43% | 0.51% | 0.28% | 0.53% | -0.83% | |

| NZD | -0.01% | -0.01% | -0.09% | 0.02% | -0.21% | -0.49% | -1.32% | |

| CHF | 1.29% | 1.30% | 1.22% | 1.31% | 1.09% | 0.80% | 1.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Read the full article here