In a day when stocks are dumping, having finally noticed the surge in yields, one would have expected today’s 20Y reopening auction (of 19Y, 10M Cusip UD8) to be solid. It wasn’t.

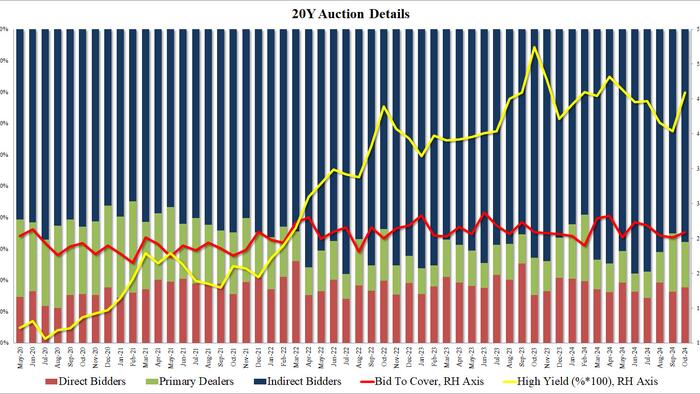

Stopping at a high yield of 4.590%, this was 55bps higher than last month’s 4.039%, the highest yield since May and also tailed the When Issued 4.574% by 1.6bps, the second consecutive tail in a row (if not as bad as last month’s 2.0bps tail).

The bid to cover was a solid 2.59, above last month’s 2.51 and the highest since July 2.78, if below the six-auction average of 2.64.

The internals were also ok, with Indirects taking down 67.9%, up from 65.1% but below the recent average of 72.8%. And with Directs awarded 17.6%, Dealers were left holding 14.5% of the final allotiment.

Overall, this was a mediocre auction, with respectable if hardly stellar internals, and which did nothing to help the relentless selling observed in recent days across the curve as the market finally starts retrading “Trumpflation” now not just a Trump administration, but a Red sweep appear increasingly likely.

Loading…

Read the full article here