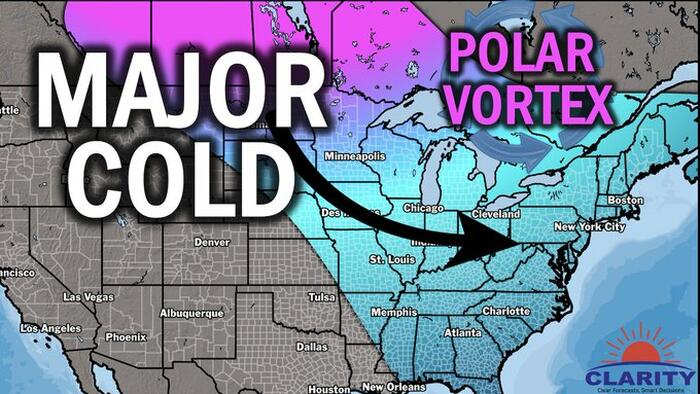

New forecasts from private weather forecaster BAMWX show an Arctic blast, or “polar vortex,” is set to pour into the eastern half of the United States during the second week of January or by mid-month. US natural gas markets responded early Friday, jumping nearly 5% on expectations of a colder start to the new year and increased heating fuel demand.

“BIG overnight colder trends on the EPS. The key here is the tropospheric polar vortex sitting over the Hudson Bay. The ability for storms/fronts to pull in cold air will be amplified and this run highlights that. Stages set for a few memorable cold snaps in January of 2025,” BAMWX wrote on X.

BIG overnight colder trends on the EPS.

The key here is the tropospheric polar vortex sitting over the Hudson Bay. The ability for storms/fronts to pull in cold air will be amplified and this run highlights that.

Stages set for a few memorable cold snaps in January of 2025. pic.twitter.com/bbe9rF9gep

— BAM Weather (BAMWX) (@bamwxcom) December 27, 2024

BAMWX noted, “In addition to the Tropospheric Polar Vortex – one key to keeping the cold around for an extended time is to then move the Stratospheric Polar Vortex towards North America to ensure a consistent supply of cold air down the road,” adding, “Both the ECMWF and GEFS are showing that now.”

In addition to the Tropospheric Polar Vortex – one key to keeping the cold around for an extended time is to then move the Stratospheric Polar Vortex towards North America to ensure a consistent supply of cold air down the road.

Both the ECMWF and GEFS are showing that now. pic.twitter.com/Bm0tGFcKg1

— BAM Weather (BAMWX) (@bamwxcom) December 27, 2024

BAMWX’s Kirk Hinz commented on the new weather models, pointing to a very serious cold start to the year for the eastern half of the US. He said, “All systems “go” on Arctic air dumping into the US early to mid-Jan.”

All systems “go” on #Arctic air dumping into the US early to mid-Jan.

We have been mentioning for weeks now to look for this period for our next cold air outbreak + increased #winter storm potential.#PolarVortex position is prime for “durable” cold as well.#natgas #energy pic.twitter.com/eKoiiPTlrW

— Kirk 🇺🇸 Hinz | BAM ⚡️Weather (@Met_khinz) December 27, 2024

Here’s BAMWX’s long-range analysis for January:

The cold sets the stage for possible snowy conditions across the Ohio Valley, Mid-Atlantic, and Northeast.

A look at January patterns with a declining AAM, suggests theres plenty of snow chances on the horizon in January.

Im about to record my latest video to talk more about this be sure to check it out! pic.twitter.com/zIWNGaNNXk

— BAM Weather (BAMWX) (@bamwxcom) December 27, 2024

BAMWX’s January Forecast in video format:

NatGas futures for January delivery jumped nearly 5%, reaching about $3.89/MMBtu.

Notably, prices have breached the $3 resistance level after consolidating for two years, potentially signaling a major trend reversal.

In early December, warmer Lower 48 temperatures turned the “widowmaker” (March-April 2025) spread negative at the earliest point in the season in nine years. This signaled that the market abandoned expectations for higher prices across the Lower 48 this winter. However, the spread has flatlined around 0 and turned up.

All it takes is one polar vortex split to unleash cold Arctic air into the Lower 48, potentially reversing the bearish outlook—and that’s likely what may happen here.

Loading…

Read the full article here